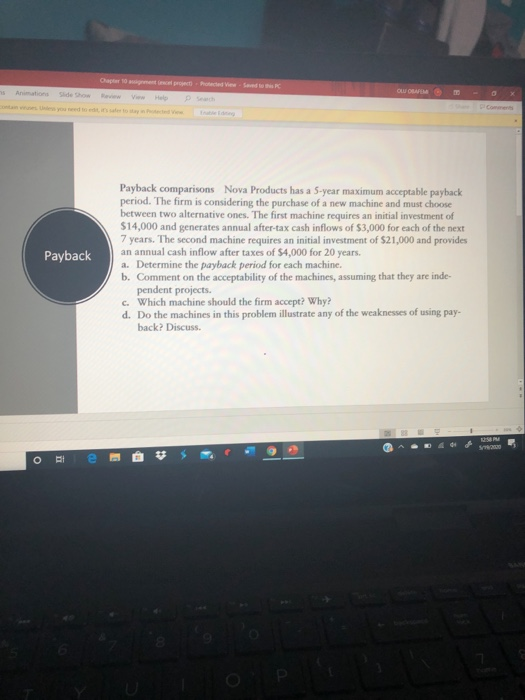

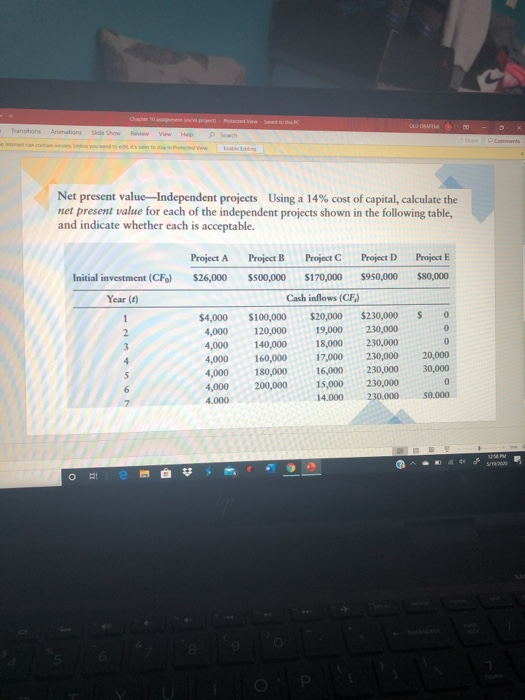

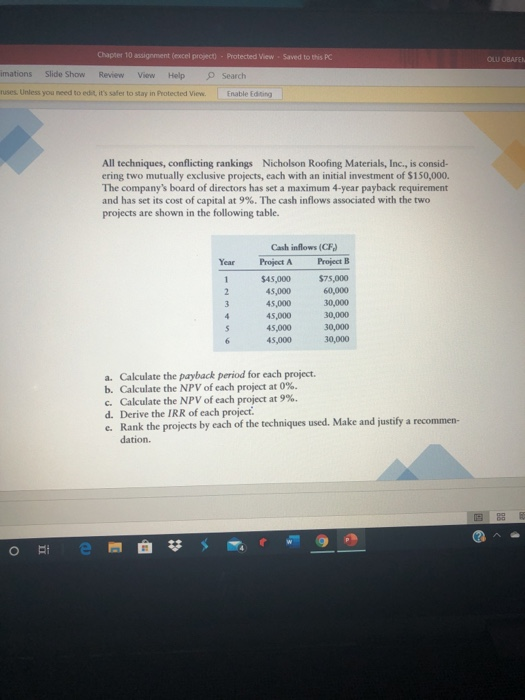

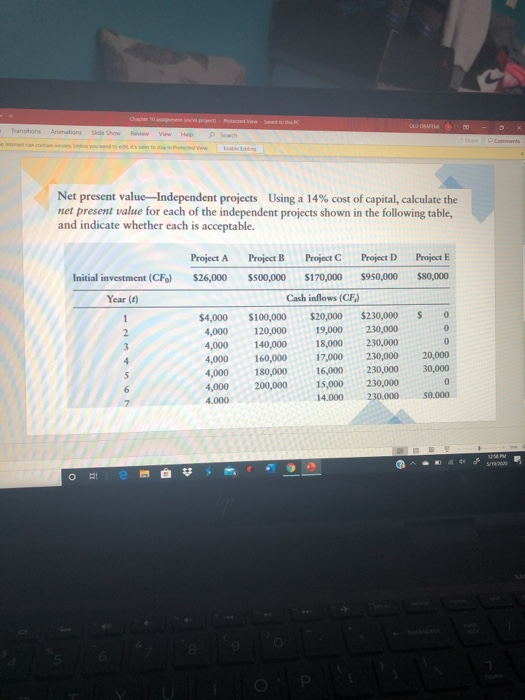

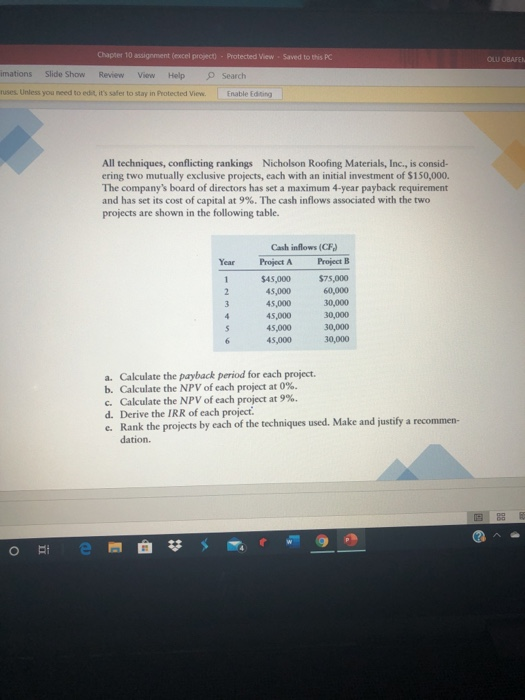

OLUM Hele Payback Payback comparisons Nova Products has a 5-year maximum acceptable payback period. The firm is considering the purchase of a new machine and must choose between two alternative ones. The first machine requires an initial investment of $14,000 and generates annual after-tax cash inflows of $3,000 for each of the next 7 years. The second machine requires an initial investment of $21,000 and provides an annual cash inflow after taxes of $4,000 for 20 years. a. Determine the payback period for each machine. b. Comment on the acceptability of the machines, assuming that they are inde- pendent projects. c. Which machine should the firm accept? Why? d. Do the machines in this problem illustrate any of the weaknesses of using pay- back? Discuss. S200 . $ e o E ii COM Transitions Ananations Show Review Net present value-Independent projects Using a 14% cost of capital, calculate the net present value for each of the independent projects shown in the following table, and indicate whether each is acceptable. Project A $26,000 Project E $80,000 Initial investment (CF) Year (1) Project B Project C Project D $500,000 $170,000 $950,000 Cash inflows (CF) $100,000 $20,000 $230,000 120,000 19,000 230,000 140,000 18,000 230,000 160,000 17,000 230,000 180,000 16,000 230,000 200,000 15,000 230,000 14.000 230.000 $4,000 4,000 4,000 4,000 4,000 4,000 4.000 2 3 4 $ 0 0 0 20,000 30,000 0 50.000 5 GA S70 e E OLU OBAFEN Chapter 10 assignment (excel project) - Protected ViewSaved to this PC Review View Help O Search imations Slide Show ruses. Unless you need to edit it's safer to stay in Protected View Enable Editing All techniques, conflicting rankings Nicholson Roofing Materials, Inc., is consid- ering two mutually exclusive projects, each with an initial investment of $150,000. The company's board of directors has set a maximum 4-year payback requirement and has set its cost of capital at 9%. The cash inflows associated with the two projects are shown in the following table. Year 2 3 4 Cash inflows (CF) Project A Project B $45,000 $75,000 45,000 60,000 45,000 30,000 45,000 30,000 45,000 30,000 45,000 30,000 a. Calculate the payback period for each project. b. Calculate the NPV of each project at 0%. c. Calculate the NPV of each project at 9%. d. Derive the IRR of each project: e. Rank the projects by each of the techniques used. Make and justify a recommen- dation. IS Da 2 E o i e