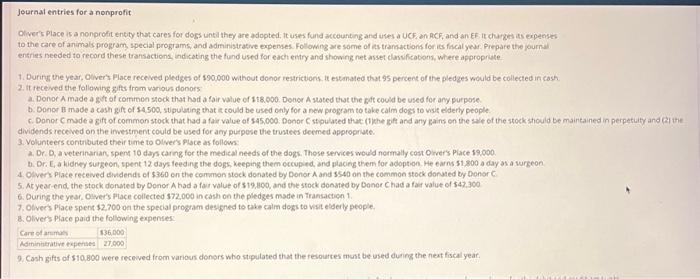

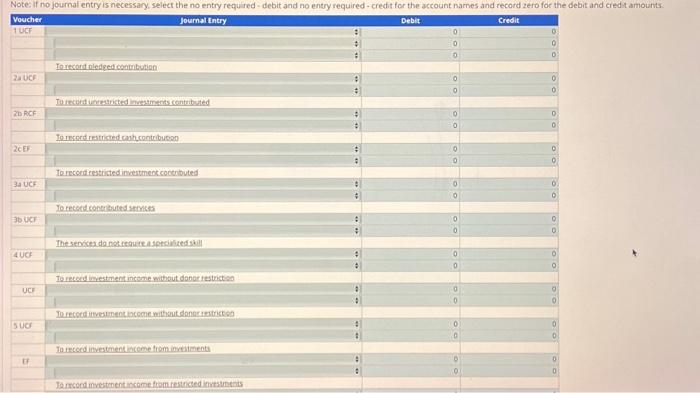

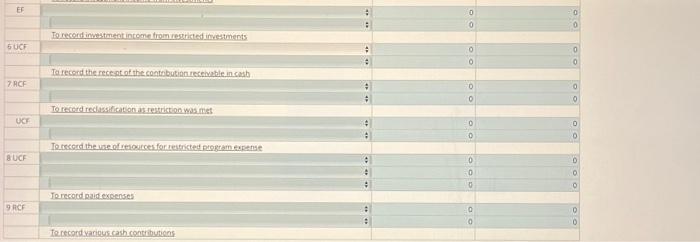

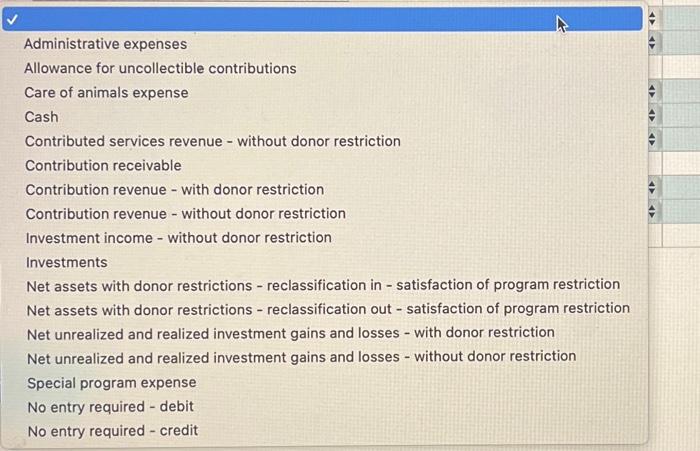

Olver's place is a nonprofit entity that cares for dogs untal they are adopted, It uses fund accounting and uses a UCF, an ACF, and an EF it durges is expenses to the care of animals program, special programs, and administratve expenses. Followng ave some of as trantactions forits fachalyear. Prepare the journd entries needed to record these transactions, indicating the fund used for each eetry and showing net anset clanvicabons, where approprate. 1. Durity the year, Olivers Place received pledges of $90,000 without donor reatrictions it estanated that 95 pertent of the pledges would be collected in cash 2. it receved the following geft from various donors a. Donor A made a git of commen stock that had a fair value of 118.000 . Donce A rated that the gith could be used for ary purpose. b. Donor in made a cash git of 54,500, supuluing that it could be used only for a new program to take caim dogs to vist elderly people. c. Donor C mude e sift of comman stock that had a fair value of 545,000 . Donor C stpulased that (1)the gft and ary gains on the sale of the stock stiould be maintained in perpetuify and Ce the dividends receved on the investment could be used for any purpese the trustees deemed approprite. 3. Volunteers contributed their time to Olvers plsce as follows: a. Dr. D, a veterimarary spent 10 days carng for the medical needs of the dogs. Those services would normally cost Owers place 19000 . b. Dr. L, a kidney surgeon, spent 12 days feeding the dogs, keeping them eccupid, and placing them for adoption. He earns 51800 a day as a wirgeon. 4. Olvers Plake receved divdends of $360 en the common stock donated by Donor A and 3540 on the common stock dorused by Donor C 5. At yea-end the stock donated by Denor A had a far value of 519.800 , and the stock donsted by Donor Chad a far value of 542.300 6. Ouring the year. Olver's fiace collected 372,000 in cash on the pledges made in Transaction 1. 7. Olver's place spent $2,700 on the special program desgred to take calm dogs to vast etderly peopic. 8. Olver's place paid the following expenses: 9. Cosh gifts of $10.800 were receved from various donors who stipulated that the resourtes munt be used during the neat fiscal year: Note: if no journai entry is necessary, select the no entry required - debit and no entry required - credit for the account names and record zero for the debit and credit amounts To record inmestment intome trom resticted investments To recend the recent of the controution recemable in wash 7. ACF To record redassificaton as reatiction wos mat Io recerd the yase of resources for reitricted poggram topense Iorecoidipaidexpenses Te recond yarious cash contributiens Administrative expenses Allowance for uncollectible contributions Care of animals expense Cash Contributed services revenue - without donor restriction Contribution receivable Contribution revenue - with donor restriction Contribution revenue - without donor restriction Investment income - without donor restriction Investments Net assets with donor restrictions - reclassification in - satisfaction of program restriction Net assets with donor restrictions - reclassification out - satisfaction of program restriction Net unrealized and realized investment gains and losses - with donor restriction Net unrealized and realized investment gains and losses - without donor restriction Special program expense No entry required - debit No entry required - credit