Question

Olympian Inc. is preparing its 2020 financial statements; its annual accounting period ends December 31. The following items a through i related to cash, are

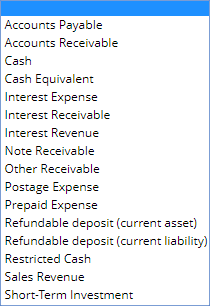

Olympian Inc. is preparing its 2020 financial statements; its annual accounting period ends December 31. The following items a through i related to cash, are under consideration. Indicate how each item should be reported on a balance sheet as of December 31, 2020.

a. A $900 check received from a customer, dated February 1, 2021, is held by Olympian.

b. A customers check was included in the December 20 deposit. It was returned by the bank stamped NSF (non-sufficient funds). No entry has yet been made by Olympian Inc. to reflect the return.

c. A 6-month, $20,000 CD (certificate of deposit) on which $1,000 of interest accrued to December 31 has just been recorded by debiting interest receivable and crediting interest revenue.

d. Postage stamps that cost $30 are in the cash drawer.

e. Postage stamps that cost $30 are in the cash drawer.

f. Three checks, dated December 31, 2020, totaling $465, payable to vendors who have sold merchandise to Olympian Inc. on account, were not mailed by December 31, 2020. They have not been entered as payments in the check register and ledger.

g. Olympian Inc. has a note receivable that matures December 31, 2020. The note is for $20,000 and bears interest at 9%, having been outstanding for three months. The company plans to include the full amount due of $20,000 plus interest in its cash balance even though payment was not received until January 1, 2021. 1. Value of the note ($20,000) 1. Value of the note ($20,000)

h. The company has invested in a U.S. Treasury bill, originating December 15, 2020, and maturing February 1, 2021, for $2,500.

i. The company is legally required to maintain $25,000 at its bank as a compensating balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started