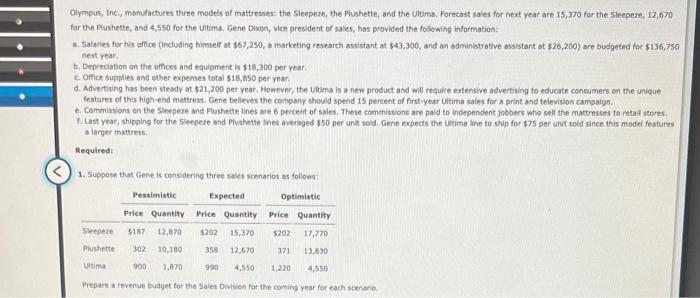

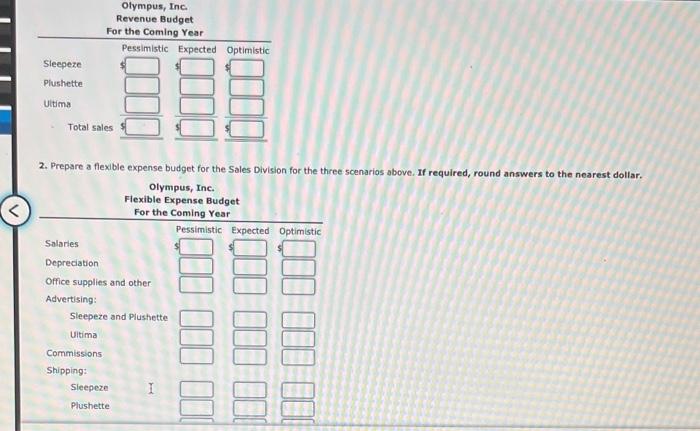

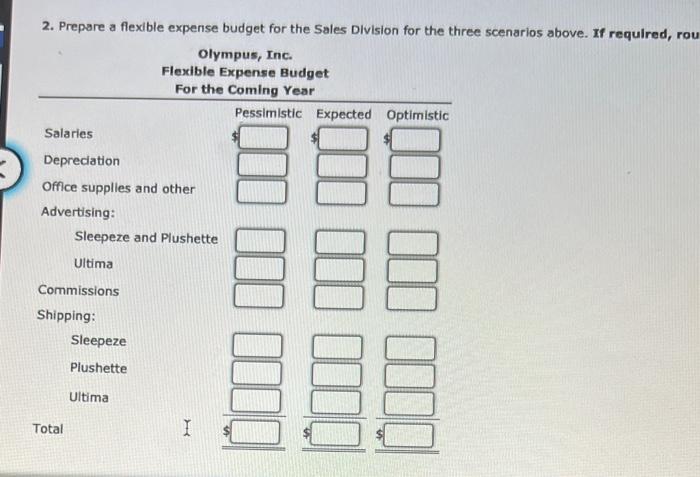

Olympus, Inci, manulactures three models of mattresses: the Sleepere, the Plushette, and the Ultims. Forecast sales for next year are 15,370 for the Sleepere, 12.670 for the Plashette, and 4,550 for the Uitima. Gene Dixon, vice president of sales, has provided the following information: a. Salaries for his off ce (including himseif at $67,250, a marketing resestch assistant at $43,300, and an administrative assistant at $26,200 ) are budgeted for $136,750 next year. b. Depreciation on the offices and equipment is $18,300 per year, c. Office supplies and other expenses total $18,850 per year. d. Advertising has been stesdy at $21,200 per year. Howriver, the Uitama is a new product and will require extensive advertising to educate consumers on the unique features of this high-end mattrest. Gene believes the compary should spend 15 percent of first-yesr ultima sales for a print and television campaign. 6. Commistions on the Sleepere and Plushette lines are 6 perceet of sales. Theie commissions are paid to independent jobbers who sell the mattresses to retai steres. f. Last year, stipping for the 5 teepeze and Plushette lines avereged $50 per unit sold. Gene expects the Uitima line to ship for $75 per unit sold since this model features a larger mattress, Required: 1. Suppose that Gene is considering three sales scenarios as follows: Prepare a revenue budget for the Sales Dividion for the coming year for each scenario. 2. Prepare a flexible expense budget for the Sales Division for the three scenarios above. If required, round answers to the nearest dollar. 2. Prepare a flexible expense budget for the Sales Division for the three scenarios above. If required, ro Olympus, Inci, manulactures three models of mattresses: the Sleepere, the Plushette, and the Ultims. Forecast sales for next year are 15,370 for the Sleepere, 12.670 for the Plashette, and 4,550 for the Uitima. Gene Dixon, vice president of sales, has provided the following information: a. Salaries for his off ce (including himseif at $67,250, a marketing resestch assistant at $43,300, and an administrative assistant at $26,200 ) are budgeted for $136,750 next year. b. Depreciation on the offices and equipment is $18,300 per year, c. Office supplies and other expenses total $18,850 per year. d. Advertising has been stesdy at $21,200 per year. Howriver, the Uitama is a new product and will require extensive advertising to educate consumers on the unique features of this high-end mattrest. Gene believes the compary should spend 15 percent of first-yesr ultima sales for a print and television campaign. 6. Commistions on the Sleepere and Plushette lines are 6 perceet of sales. Theie commissions are paid to independent jobbers who sell the mattresses to retai steres. f. Last year, stipping for the 5 teepeze and Plushette lines avereged $50 per unit sold. Gene expects the Uitima line to ship for $75 per unit sold since this model features a larger mattress, Required: 1. Suppose that Gene is considering three sales scenarios as follows: Prepare a revenue budget for the Sales Dividion for the coming year for each scenario. 2. Prepare a flexible expense budget for the Sales Division for the three scenarios above. If required, round answers to the nearest dollar. 2. Prepare a flexible expense budget for the Sales Division for the three scenarios above. If required, ro