Answered step by step

Verified Expert Solution

Question

1 Approved Answer

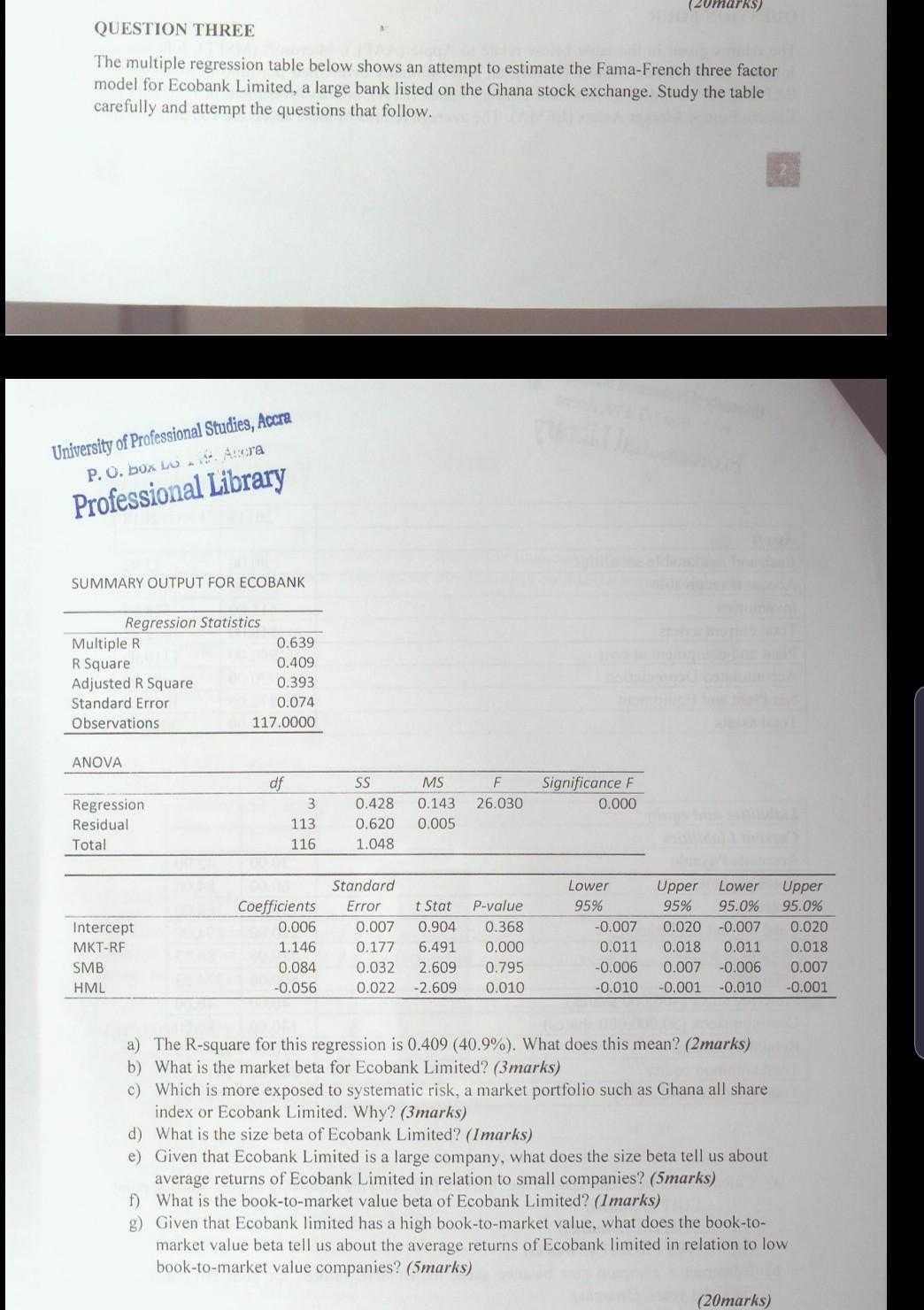

omarks) QUESTION THREE The multiple regression table below shows an attempt to estimate the Fama-French three factor model for Ecobank Limited, a large bank listed

omarks) QUESTION THREE The multiple regression table below shows an attempt to estimate the Fama-French three factor model for Ecobank Limited, a large bank listed on the Ghana stock exchange. Study the table carefully and attempt the questions that follow. University of Professional Studies, Accra P. O. box wara Professional Library SUMMARY OUTPUT FOR ECOBANK Regression Statistics Multiple R 0.639 R Square 0.409 Adjusted R Square 0.393 Standard Error 0.074 Observations 117.0000 ANOVA F 26.030 Significance F 0.000 Regression Residual Total df 3 113 116 MS 0.143 0.005 SS 0.428 0.620 1.048 Intercept MKT-RF SMB HML Coefficients 0.006 1.146 0.084 -0.056 Standard Error 0.007 0.177 0.032 0.022 t Stat 0.904 6.491 2.609 -2.609 P-value 0.368 0.000 0.795 0.010 Lower 95% -0.007 0.011 -0.006 -0.010 Upper 95% 0.020 0.018 0.007 -0.001 Lower 95.0% -0.007 0.011 -0.006 -0.010 Upper 95.0% 0.020 0.018 0.007 -0.001 a) The R-square for this regression is 0.409 (40.9%). What does this mean? (2 marks) b) What is the market beta for Ecobank Limited? (3 marks) c) Which is more exposed to systematic risk, a market portfolio such as Ghana all share index or Ecobank Limited. Why? (3marks) d) What is the size beta of Ecobank Limited? (Imarks) e) Given that Ecobank Limited is a large company, what does the size beta tell us about average returns of Ecobank Limited in relation to small companies? (5marks) f) What is the book-to-market value beta of Ecobank Limited? (1 marks) g) Given that Ecobank limited has a high book-to-market value, what does the book-to- market value beta tell us about the average returns of Ecobank limited in relation to low book-to-market value companies? (5marks) (20marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started