Question

Omas pay period is for two weeks ending August 12th and August 26th. Oma pays two sales clerks for the store and one assistant for

Omas pay period is for two weeks ending August 12th and August 26th. Oma pays two sales clerks for the store and one assistant for the office. Each clerk works a normal eight-hour day, 40 hours per week. (No overtime) The clerks earn $12/hour. The assistant is paid $3,600 per month, or $1,800 per paid period. Assume that these calculations include all the necessary and required deductions for taxes and withholdings.

For example, the pay period ending August 26 is for the work completed during the weeks August 1 5 and August 8 12. Assume that all a normal work week was completed.

Office Equipment Depreciation

The office equipment was purchased price was $6,320 and has an estimated life of 5 years with a total salvage value of $1,000. Round to nearest dollar. Operating Equipment Depreciation The operating equipment was purchased price was $18,780 and has an estimated life of 12 years with a total scrap value estimated at $1,200. Round to nearest dollar.

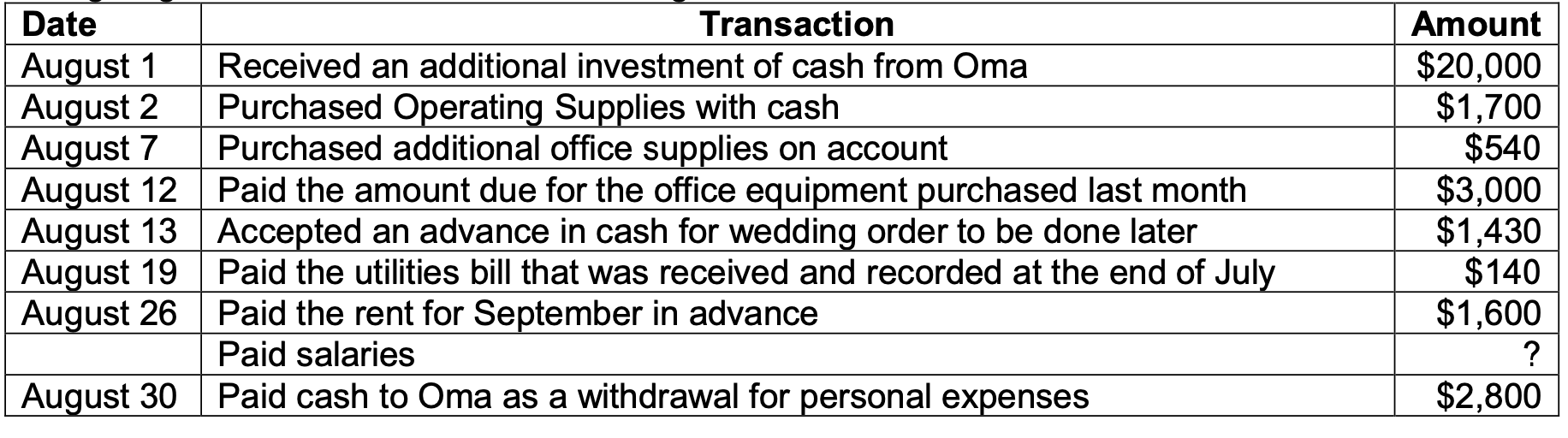

During August, Omas B&B had the following transactions.

-

(5 points) Record the transactions for August in journal form in a proper format.

-

(10 points) Post the August transactions to the ledger accounts in a proper format

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started