Answered step by step

Verified Expert Solution

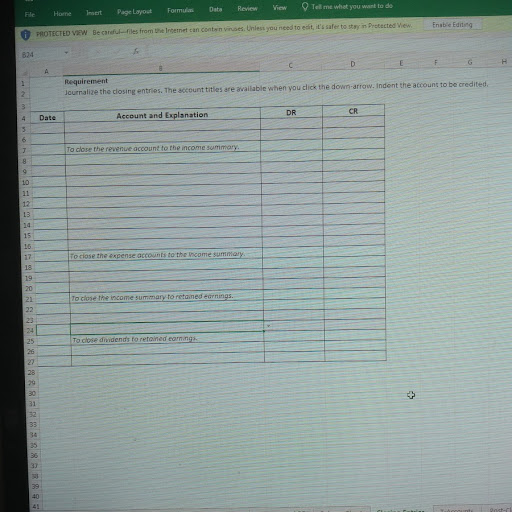

Question

1 Approved Answer

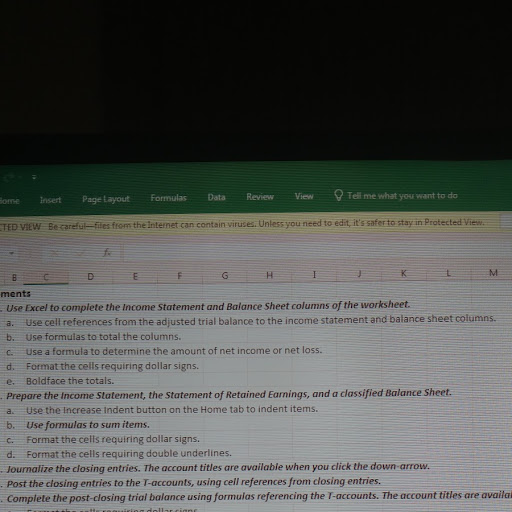

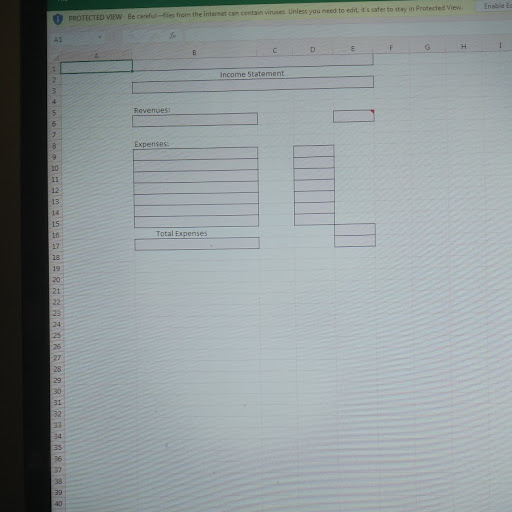

ome Insert Page Layout Fomulas Data Review View Tell me what you want to do TED VIEW Be careful files from the Internet can contain

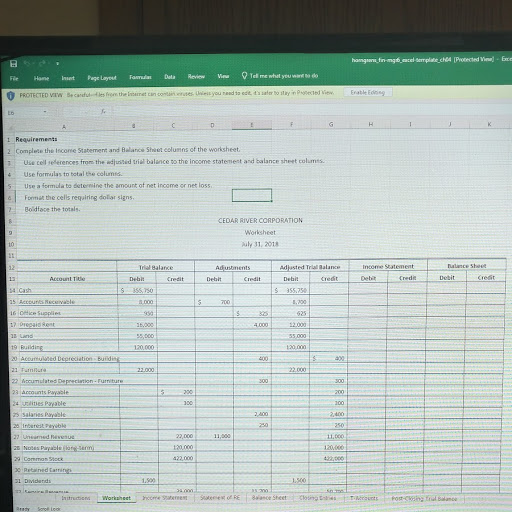

Step by Step Solution

There are 3 Steps involved in it

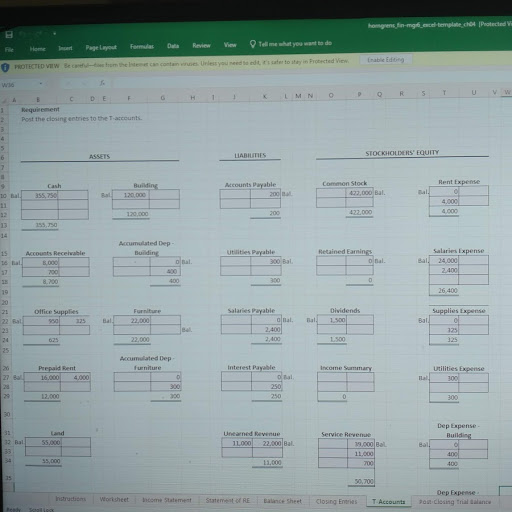

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

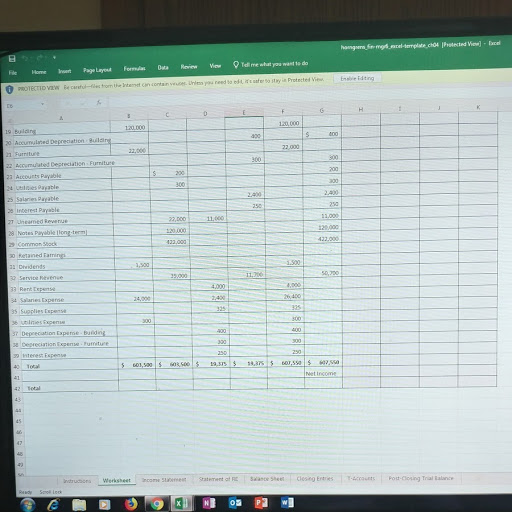

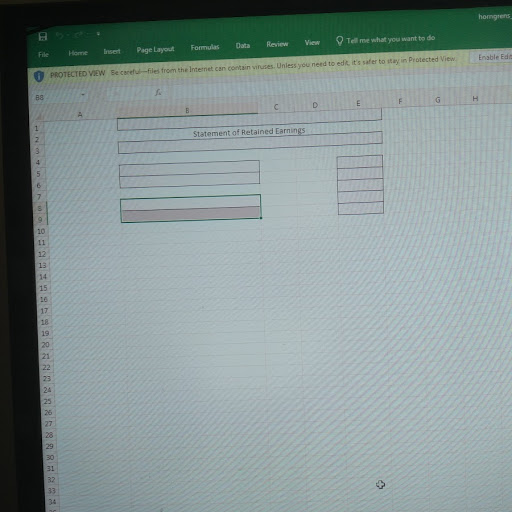

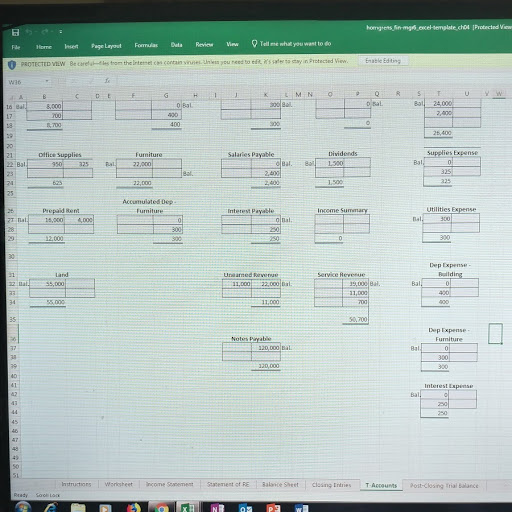

Step: 2

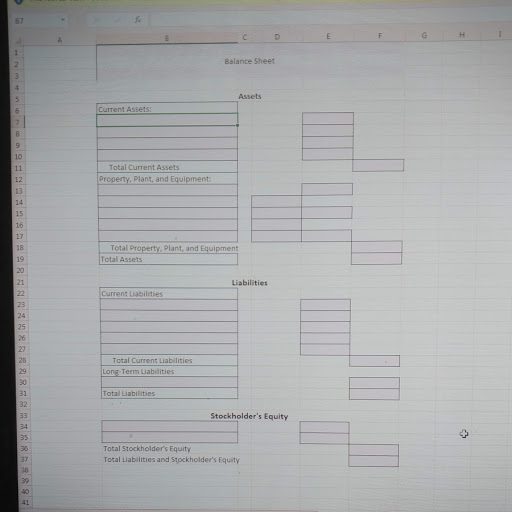

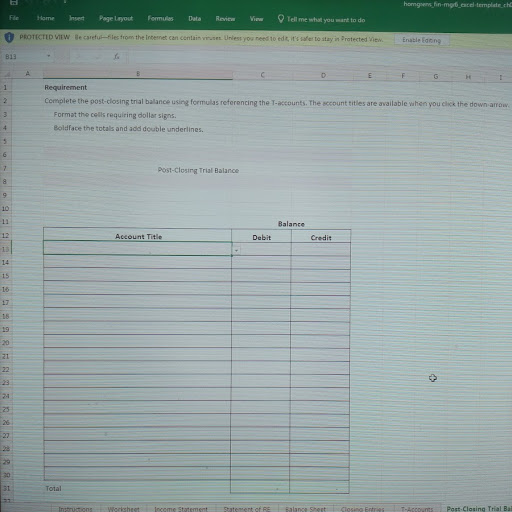

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started