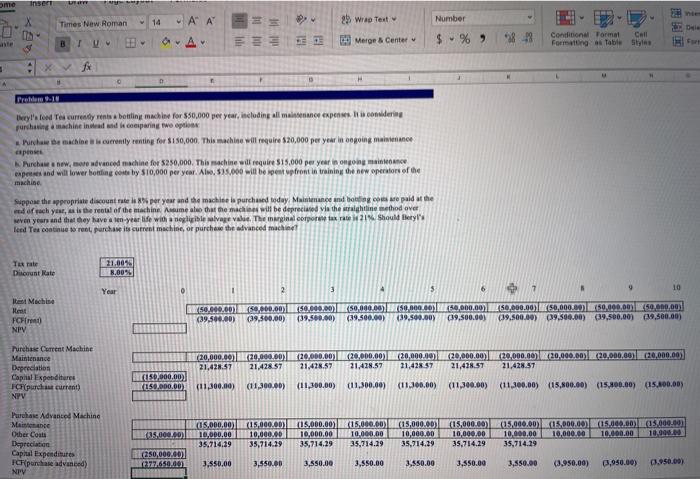

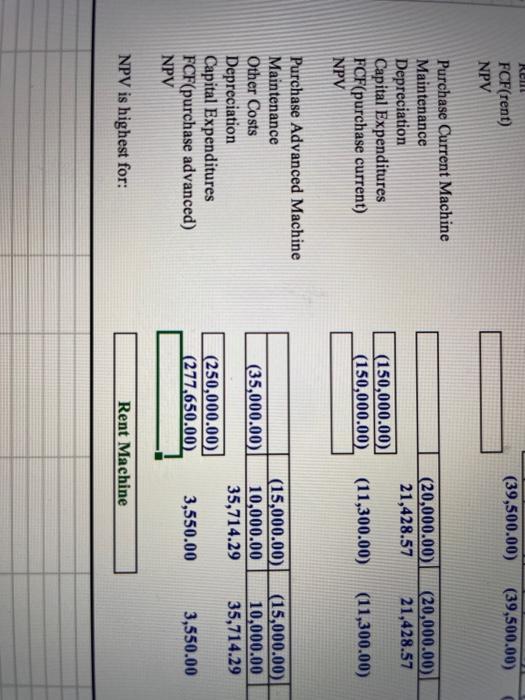

ome insert UFT Times New Roman 14 - A A Number 2 Wrap Test A B $ % ) Metor Center Conditional Format Call Formatting Table Styles f A Prod. they stond a currently is betting machine for 550,000 per year, including all maintenance expenses. It considering purchasing machine inand comparing tweet Muchaw beach comely renting for $150,000. The machine will require $20,000 per year in ongoing more ps Purchawan, mere advanced machine for $250,000. This machine will require 515.000 per year ongoing expresses and will lower hotting only 310,000 per year. As 335.000 will be sent upfront in training the new operators of the machine Suppose the appropriate discount els per you and the machine la purchased today Maintenance and boring core paid at the med of ach you, as is the rest of the machine. Asime ale that the machen will be deprecated in the straightline method over seven year and that they have a ten-year life with a nelle salvage value. The marginal corpore takrat 21 Should Beryl leed Tea continue to rent purchase is current machine, or purchase the advanced machine Texte Discount Kate 8.00% Year 2 3 $ 6 7 10 I Mechise 50,000.00 50.00.00 50.000,00) (50,000.00 (39.500.00) (39.500,00) (39.500.00) (39.500,00) (50, 600.00 (39.500.00 (50,000.00 50.000.000 (50,000.00) 150.000,00 59.000,00 (39,500.00 (39.500.00) 39,500.00) (19,500.00) 39,500.00) FCF NPV (20,000.00 21,428.57 (20,000.00) 21.428.57 120.000.00) 21.428.57 (20,000,00) (20,000.00) 21.418.57 31,428.57 Purchase Current Machine Maintenance Depreciation Capital Expenditure FCpurch is current) NPV (20,000.00 20.000,00) 20,990,00) 20,000.09(20.000,00) 21,478.57 21,428.57 150.000,00) (150.000,00) (11.300.000) (11.300.00) (11,300.00) (11,300.09) (11.300.00) (11,390.00) (11,300.00) (15.800.00) (15.800.00) (15.100.00 (35,000.00 Purchase Advanced Machine Maine Other Costa Depreciation Capital Expenditures FCF purchase advanced) (05.000,00) 10.000.00 35.714.39 (15,000.00 US.000,00) 10,000.00 10,000.00 35,714.29 35,714.29 (15,000.00) (15,000.00 10.000.00 10,000.00 35,714.29 35.714.29 (15,000.00) 10,000.00 35,714.29 (05.000.000.000,00 15.000.000.000.000 10.000.00 10,000.00 10.000.00 10.00 35,714.29 250,000.00 (2.777.650,00 3,550,00 3,550.00 3.550.00 3,550.00 3.550.00 3,550.00 3,550.00 (3,950.00) 0.950.00) 0.950.00) NY Reul FCF(rent) NPV (39,500.00) (39,500.00) II (20,000.00 21,428.57 (20,000.00 21,428.57 Purchase Current Machine Maintenance Depreciation Capital Expenditures FCF(purchase current) NPV (150,000.00 (150,000.00 (11,300.00) (11,300.00) (35,000.00) Purchase Advanced Machine Maintenance Other Costs Depreciation Capital Expenditures FCF(purchase advanced) NPV (15,000.00 10,000.00 35,714.29 (15,000.00) 10,000.00 35,714.29 (250,000.00) (277,650.00) 3,550.00 3,550.00 NPV is highest for: Rent Machine ome insert UFT Times New Roman 14 - A A Number 2 Wrap Test A B $ % ) Metor Center Conditional Format Call Formatting Table Styles f A Prod. they stond a currently is betting machine for 550,000 per year, including all maintenance expenses. It considering purchasing machine inand comparing tweet Muchaw beach comely renting for $150,000. The machine will require $20,000 per year in ongoing more ps Purchawan, mere advanced machine for $250,000. This machine will require 515.000 per year ongoing expresses and will lower hotting only 310,000 per year. As 335.000 will be sent upfront in training the new operators of the machine Suppose the appropriate discount els per you and the machine la purchased today Maintenance and boring core paid at the med of ach you, as is the rest of the machine. Asime ale that the machen will be deprecated in the straightline method over seven year and that they have a ten-year life with a nelle salvage value. The marginal corpore takrat 21 Should Beryl leed Tea continue to rent purchase is current machine, or purchase the advanced machine Texte Discount Kate 8.00% Year 2 3 $ 6 7 10 I Mechise 50,000.00 50.00.00 50.000,00) (50,000.00 (39.500.00) (39.500,00) (39.500.00) (39.500,00) (50, 600.00 (39.500.00 (50,000.00 50.000.000 (50,000.00) 150.000,00 59.000,00 (39,500.00 (39.500.00) 39,500.00) (19,500.00) 39,500.00) FCF NPV (20,000.00 21,428.57 (20,000.00) 21.428.57 120.000.00) 21.428.57 (20,000,00) (20,000.00) 21.418.57 31,428.57 Purchase Current Machine Maintenance Depreciation Capital Expenditure FCpurch is current) NPV (20,000.00 20.000,00) 20,990,00) 20,000.09(20.000,00) 21,478.57 21,428.57 150.000,00) (150.000,00) (11.300.000) (11.300.00) (11,300.00) (11,300.09) (11.300.00) (11,390.00) (11,300.00) (15.800.00) (15.800.00) (15.100.00 (35,000.00 Purchase Advanced Machine Maine Other Costa Depreciation Capital Expenditures FCF purchase advanced) (05.000,00) 10.000.00 35.714.39 (15,000.00 US.000,00) 10,000.00 10,000.00 35,714.29 35,714.29 (15,000.00) (15,000.00 10.000.00 10,000.00 35,714.29 35.714.29 (15,000.00) 10,000.00 35,714.29 (05.000.000.000,00 15.000.000.000.000 10.000.00 10,000.00 10.000.00 10.00 35,714.29 250,000.00 (2.777.650,00 3,550,00 3,550.00 3.550.00 3,550.00 3.550.00 3,550.00 3,550.00 (3,950.00) 0.950.00) 0.950.00) NY Reul FCF(rent) NPV (39,500.00) (39,500.00) II (20,000.00 21,428.57 (20,000.00 21,428.57 Purchase Current Machine Maintenance Depreciation Capital Expenditures FCF(purchase current) NPV (150,000.00 (150,000.00 (11,300.00) (11,300.00) (35,000.00) Purchase Advanced Machine Maintenance Other Costs Depreciation Capital Expenditures FCF(purchase advanced) NPV (15,000.00 10,000.00 35,714.29 (15,000.00) 10,000.00 35,714.29 (250,000.00) (277,650.00) 3,550.00 3,550.00 NPV is highest for: Rent Machine