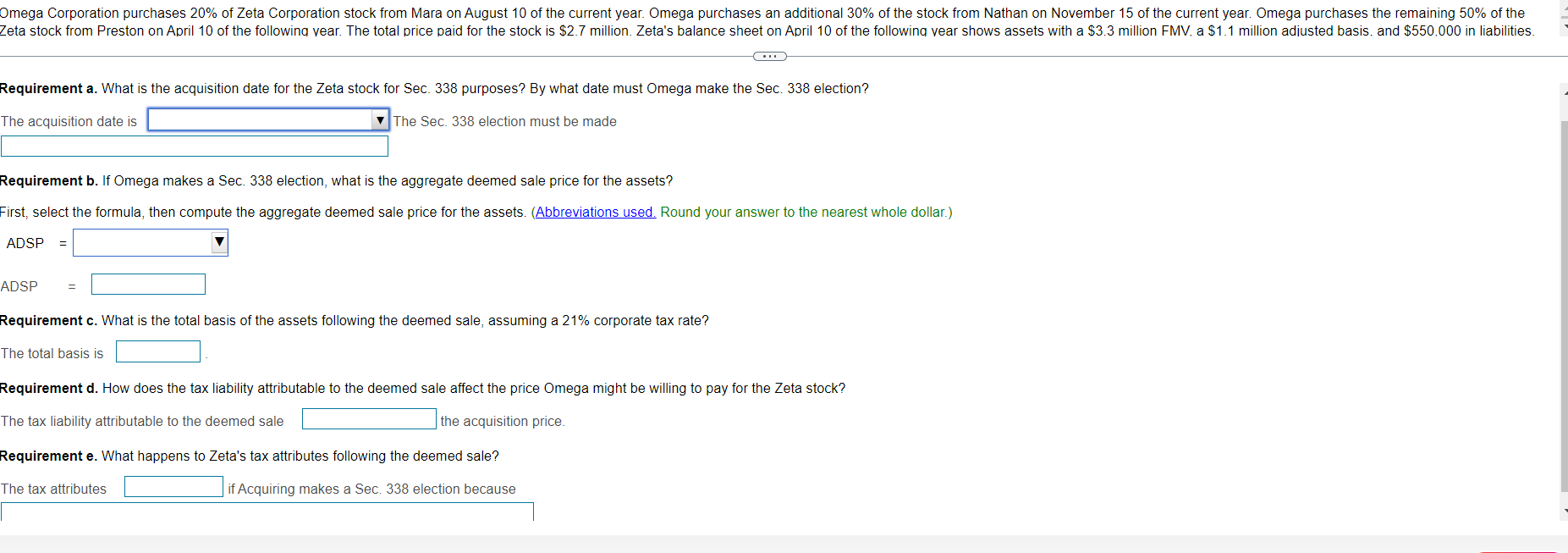

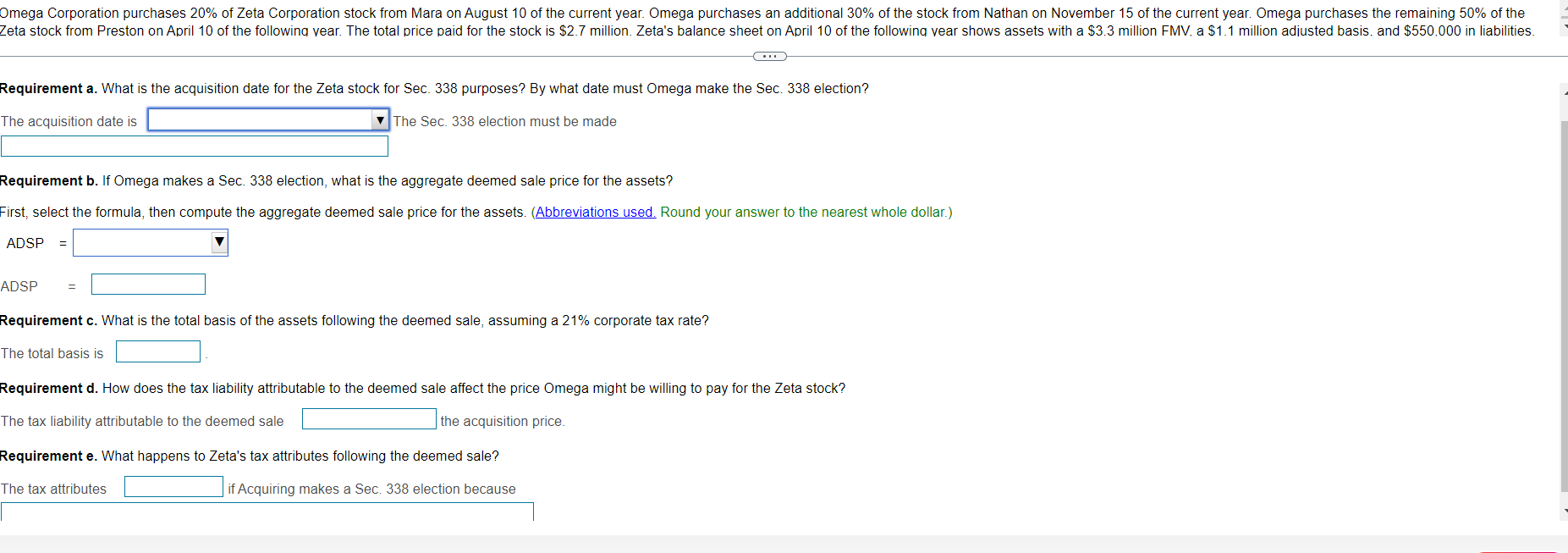

Omega Corporation purchases 20% of Zeta Corporation stock from Mara on August 10 of the current year. Omega purchases an additional 30% of the stock from Nathan on November 15 of the current year. Omega purchases the remaining 50% of the Zeta stock from Preston on April 10 of the following year. The total price paid for the stock is $2.7 million. Zeta's balance sheet on April 10 of the following year shows assets with a $3.3 million FMV, a $1.1 million adjusted basis, and $550.000 in liabilities. Requirement a. What is the acquisition date for the Zeta stock for Sec. 338 purposes? By what date must Omega make the Sec. 338 election? The acquisition date is The Sec. 338 election must be made Requirement b. If Omega makes a Sec. 338 election, what is the aggregate deemed sale price for the assets? First, select the formula, then compute the aggregate deemed sale price for the assets. (Abbreviations used. Round your answer to the nearest whole dollar.) ADSP ADSP Requirement c. What is the total basis of the assets following the deemed sale, assuming a 21% corporate tax rate? The total basis is Requirement d. How does the tax liability attributable to the deemed sale affect the price Omega might be willing to pay for the Zeta stock? The tax liability attributable to the deemed sale the acquisition price. Requirement e. What happens to Zeta's tax attributes following the deemed sale? The tax attributes if Acquiring makes a Sec. 338 election because Omega Corporation purchases 20% of Zeta Corporation stock from Mara on August 10 of the current year. Omega purchases an additional 30% of the stock from Nathan on November 15 of the current year. Omega purchases the remaining 50% of the Zeta stock from Preston on April 10 of the following year. The total price paid for the stock is $2.7 million. Zeta's balance sheet on April 10 of the following year shows assets with a $3.3 million FMV, a $1.1 million adjusted basis, and $550.000 in liabilities. Requirement a. What is the acquisition date for the Zeta stock for Sec. 338 purposes? By what date must Omega make the Sec. 338 election? The acquisition date is The Sec. 338 election must be made Requirement b. If Omega makes a Sec. 338 election, what is the aggregate deemed sale price for the assets? First, select the formula, then compute the aggregate deemed sale price for the assets. (Abbreviations used. Round your answer to the nearest whole dollar.) ADSP ADSP Requirement c. What is the total basis of the assets following the deemed sale, assuming a 21% corporate tax rate? The total basis is Requirement d. How does the tax liability attributable to the deemed sale affect the price Omega might be willing to pay for the Zeta stock? The tax liability attributable to the deemed sale the acquisition price. Requirement e. What happens to Zeta's tax attributes following the deemed sale? The tax attributes if Acquiring makes a Sec. 338 election because