Question

Omega Medical Supplies Pte Ltd (OMS) is a small but growing manufacturer of medical equipment. Due to its small set-up, the company does not have

Omega Medical Supplies Pte Ltd (OMS) is a small but growing manufacturer of medical equipment. Due to its small set-up, the company does not have a sales force of its own, but relies entirely on independent sales agents to market its products.

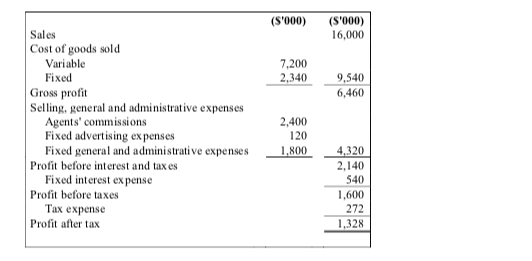

The independent sales agents are paid a commission of 15% of sales. This is reflected in the budget for the new financial year ending 31 December 2022, as follows:

Subsequent to the approval of the budgets for the year ending 31 December 2022, OMS was informed that independent sales agents demanded for an increase in commission rate to 20% for 2022 to cover for advertising, travel and other promotional costs. This effectively rendered the approved budgets invalid.

The founder of OMS, Denzel was indignant that they had to be subjected to the unfounded request by the independent sales agents, and commissioned an urgent study of hiring its own sales team.

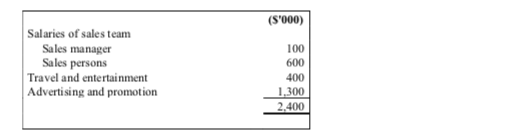

After a detailed analysis, the financial controller proposed to engage the companys own sales team, providing a 7.5% sales commission and a base salary, which is comparable to market rates. However, the company will have to handle all advertising and promotional activities internally.

Under the new proposal, fixed costs would increase by $2,400,000 (see below for details), but this would be better than having to pay the independent sales agents a commission of $3,200,000 (20% of $16,000,000).

Denzel was very pleased with the proposal, commenting that the $2,400,000 is exactly the same as what the company would have paid under the 15% commission rate. In addition, there would be additional savings of $75,000 from auditing fees paid to verify the agents sales reports. In other words, general and admin expenses will decrease by $75,000. He has asked the financial controller to tidy up the proposal quickly and get the new budget approved.

Required:

(a) Compute the breakeven point in sales dollars for the financial year ending 31 December 2022 under the following scenarios:

-

(i) Using independent sales agents commission at 15%.

-

(ii) Using independent sales agents commission at 20%.

-

(iii) Using the companys own hired sales team.

(b) If OMS continues to sell through the independent sales agents and pays the higher commission rate (20% instead of 15%), compute the estimated sales dollars that would be required to generate the level of profit as projected in the budgeted income statement.

(c) Compute the sales dollars at which net income would be equal regardless of whether OMS sells through the independent sales agents (at 20% commission rate) or hire its own sales team. Which option would you recommend OMS adopt? Explain.

(d) Compute the degree of operating leverage that OMS would expect to have as at 31 December 2022 under the following scenarios:

(i) Using independent sales agents commission at 15%.

(ii) Using independent sales agents commission at 20%.

(iii) Using the companys own hired sales team.

(iv) Use operating income before taxes in the above computation. Round your answers to 2

decimal places.

(e) Based on your computations from parts (a) to (d), provide a recommendation, with

appropriate explanations.

(S'000) (S'000) 16,000 7,200 2,340 9.540 6,460 Sales Cost of goods sold Variable Fixed Gross profit Selling, general and administrative expenses Agents' commissions Fixed advertising expenses Fixed general and administrative expenses Profit before interest and taxes Fixed interest expense Profit before taxes Tax expense Profit after tax 2,400 120 1.800 4,320 2.140 540 1,600 272 1,328 (S'000) Salaries of sales team Sales manager Sales persons Travel and entertainment Advertising and promotion 100 600 400 1,300 2.400 (S'000) (S'000) 16,000 7,200 2,340 9.540 6,460 Sales Cost of goods sold Variable Fixed Gross profit Selling, general and administrative expenses Agents' commissions Fixed advertising expenses Fixed general and administrative expenses Profit before interest and taxes Fixed interest expense Profit before taxes Tax expense Profit after tax 2,400 120 1.800 4,320 2.140 540 1,600 272 1,328 (S'000) Salaries of sales team Sales manager Sales persons Travel and entertainment Advertising and promotion 100 600 400 1,300 2.400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started