Answered step by step

Verified Expert Solution

Question

1 Approved Answer

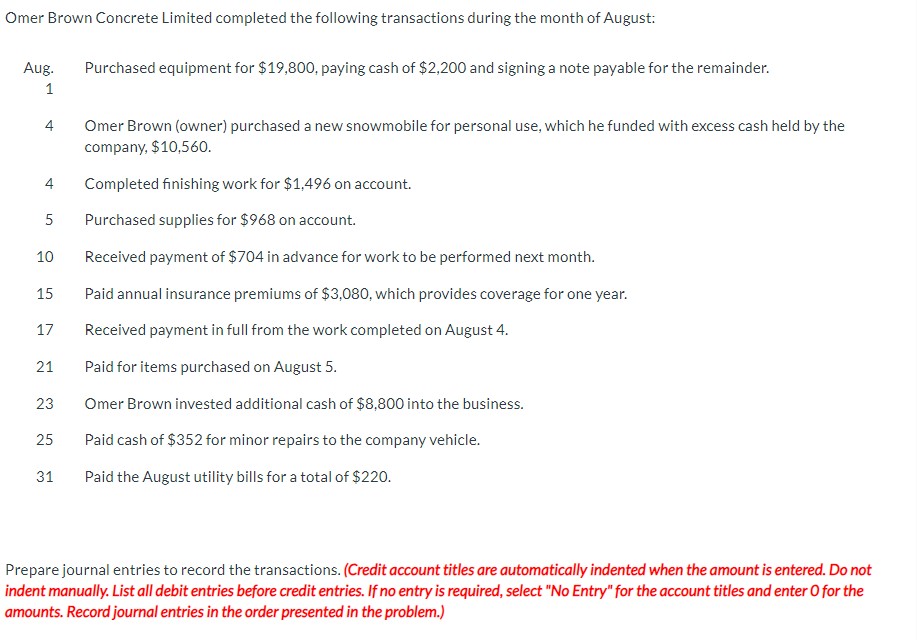

Omer Brown Concrete Limited completed the following transactions during the month of August: Aug. Purchased equipment for ( $ 19,800 ), paying cash of (

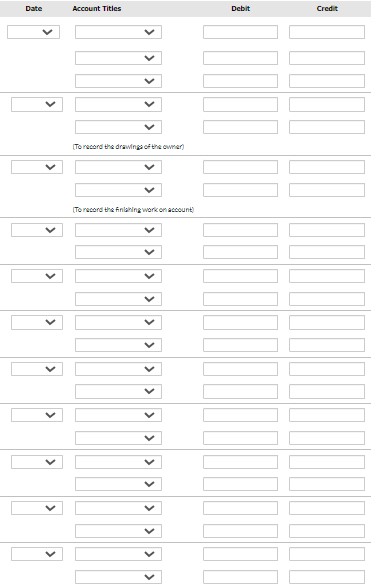

Omer Brown Concrete Limited completed the following transactions during the month of August: Aug. Purchased equipment for \\( \\$ 19,800 \\), paying cash of \\( \\$ 2,200 \\) and signing a note payable for the remainder. 1 4 Omer Brown (owner) purchased a new snowmobile for personal use, which he funded with excess cash held by the company, \\$10,560. 4 Completed finishing work for \\( \\$ 1,496 \\) on account. 5 Purchased supplies for \\( \\$ 968 \\) on account. 10 Received payment of \\( \\$ 704 \\) in advance for work to be performed next month. 15 Paid annual insurance premiums of \\( \\$ 3,080 \\), which provides coverage for one year. 17 Received payment in full from the work completed on August 4. 21 Paid for items purchased on August 5. 23 Omer Brown invested additional cash of \\( \\$ 8,800 \\) into the business. 25 Paid cash of \\( \\$ 352 \\) for minor repairs to the company vehicle. 31 Paid the August utility bills for a total of \\( \\$ 220 \\). Prepare journal entries to record the transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.) Date Account Tities Debit Credit \\( \\checkmark \\) (To record the drawine of the cowner) (To recerd tha finlehing werk on account)

Omer Brown Concrete Limited completed the following transactions during the month of August: Aug. Purchased equipment for \\( \\$ 19,800 \\), paying cash of \\( \\$ 2,200 \\) and signing a note payable for the remainder. 1 4 Omer Brown (owner) purchased a new snowmobile for personal use, which he funded with excess cash held by the company, \\$10,560. 4 Completed finishing work for \\( \\$ 1,496 \\) on account. 5 Purchased supplies for \\( \\$ 968 \\) on account. 10 Received payment of \\( \\$ 704 \\) in advance for work to be performed next month. 15 Paid annual insurance premiums of \\( \\$ 3,080 \\), which provides coverage for one year. 17 Received payment in full from the work completed on August 4. 21 Paid for items purchased on August 5. 23 Omer Brown invested additional cash of \\( \\$ 8,800 \\) into the business. 25 Paid cash of \\( \\$ 352 \\) for minor repairs to the company vehicle. 31 Paid the August utility bills for a total of \\( \\$ 220 \\). Prepare journal entries to record the transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.) Date Account Tities Debit Credit \\( \\checkmark \\) (To record the drawine of the cowner) (To recerd tha finlehing werk on account) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started