Answered step by step

Verified Expert Solution

Question

1 Approved Answer

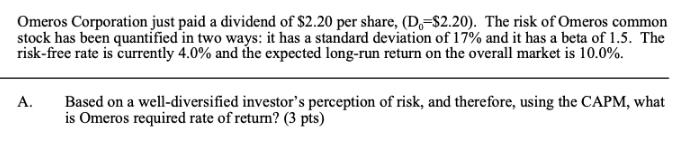

Omeros Corporation just paid a dividend of $2.20 per share, (D-$2.20). The risk of Omeros common stock has been quantified in two ways: it

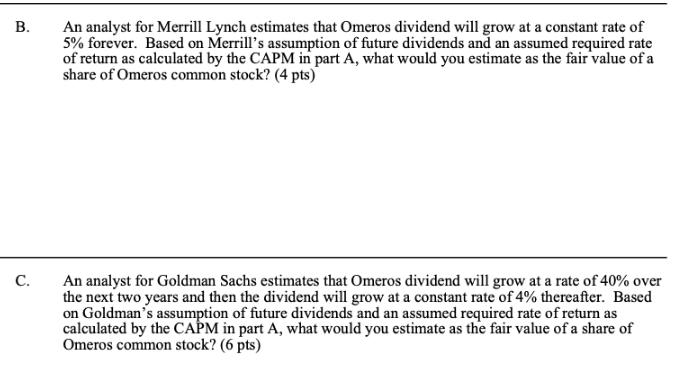

Omeros Corporation just paid a dividend of $2.20 per share, (D-$2.20). The risk of Omeros common stock has been quantified in two ways: it has a standard deviation of 17% and it has a beta of 1.5. The risk-free rate is currently 4.0% and the expected long-run return on the overall market is 10.0%. A. Based on a well-diversified investor's perception of risk, and therefore, using the CAPM, what is Omeros required rate of return? (3 pts) B. C. An analyst for Merrill Lynch estimates that Omeros dividend will grow at a constant rate of 5% forever. Based on Merrill's assumption of future dividends and an assumed required rate of return as calculated by the CAPM in part A, what would you estimate as the fair value of a share of Omeros common stock? (4 pts) An analyst for Goldman Sachs estimates that Omeros dividend will grow at a rate of 40% over the next two years and then the dividend will grow at a constant rate of 4% thereafter. Based on Goldman's assumption of future dividends and an assumed required rate of return as calculated by the CAPM in part A, what would you estimate as the fair value of a share of Omeros common stock? (6 pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A Required rate of return using CAPM The Capital Asset Pricing Model CAPM states that the required r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started