Answered step by step

Verified Expert Solution

Question

1 Approved Answer

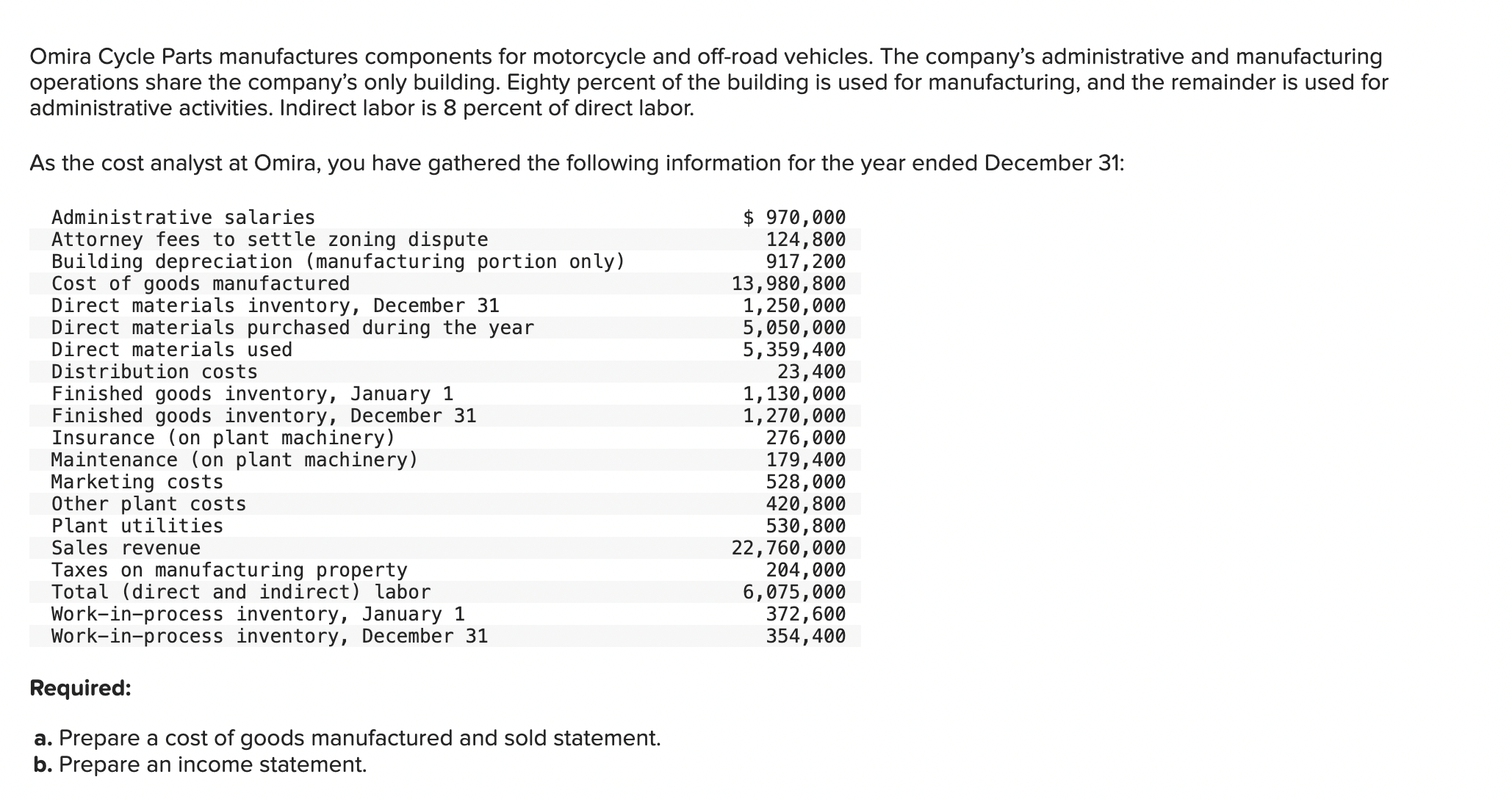

Omira Cycle Parts manufactures components for motorcycle and off-road vehicles. The company's administrative and manufacturing operations share the company's only building. Eighty percent of

Omira Cycle Parts manufactures components for motorcycle and off-road vehicles. The company's administrative and manufacturing operations share the company's only building. Eighty percent of the building is used for manufacturing, and the remainder is used for administrative activities. Indirect labor is 8 percent of direct labor. As the cost analyst at Omira, you have gathered the following information for the year ended December 31: Administrative salaries Attorney fees to settle zoning dispute $ 970,000 124,800 Building depreciation (manufacturing portion only) 917,200 Cost of goods manufactured Direct materials inventory, December 31 Direct materials purchased during the year Direct materials used Distribution costs Finished goods inventory, January 1 Finished goods inventory, December 31 Insurance (on plant machinery) Maintenance (on plant machinery) Marketing costs Other plant costs Plant utilities Sales revenue Taxes on manufacturing property Total (direct and indirect) labor Work-in-process inventory, January 1 Work-in-process inventory, December 31 Required: a. Prepare a cost of goods manufactured and sold statement. b. Prepare an income statement. 13,980,800 1,250,000 5,050,000 5,359,400 23,400 1,130,000 1,270,000 276,000 179,400 528,000 420,800 530,800 22,760,000 204,000 6,075,000 372,600 354,400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answering the question step by step Omira Corporation produces components for electric and offroad v...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started