Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Omit questions 5 and 6, please help with the rest, thank you! Not sure why rate of interest is not given, may have to do

Omit questions 5 and 6, please help with the rest, thank you!

Not sure why rate of interest is not given, may have to do calculation to find it first, this was the only information given, thank you again.

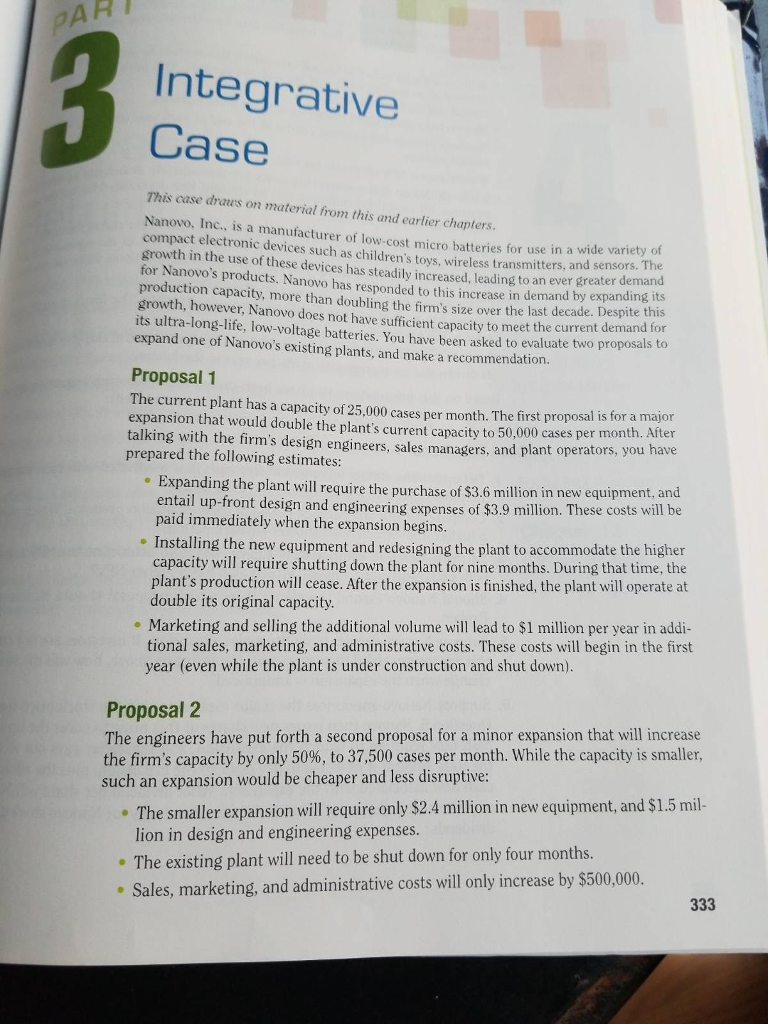

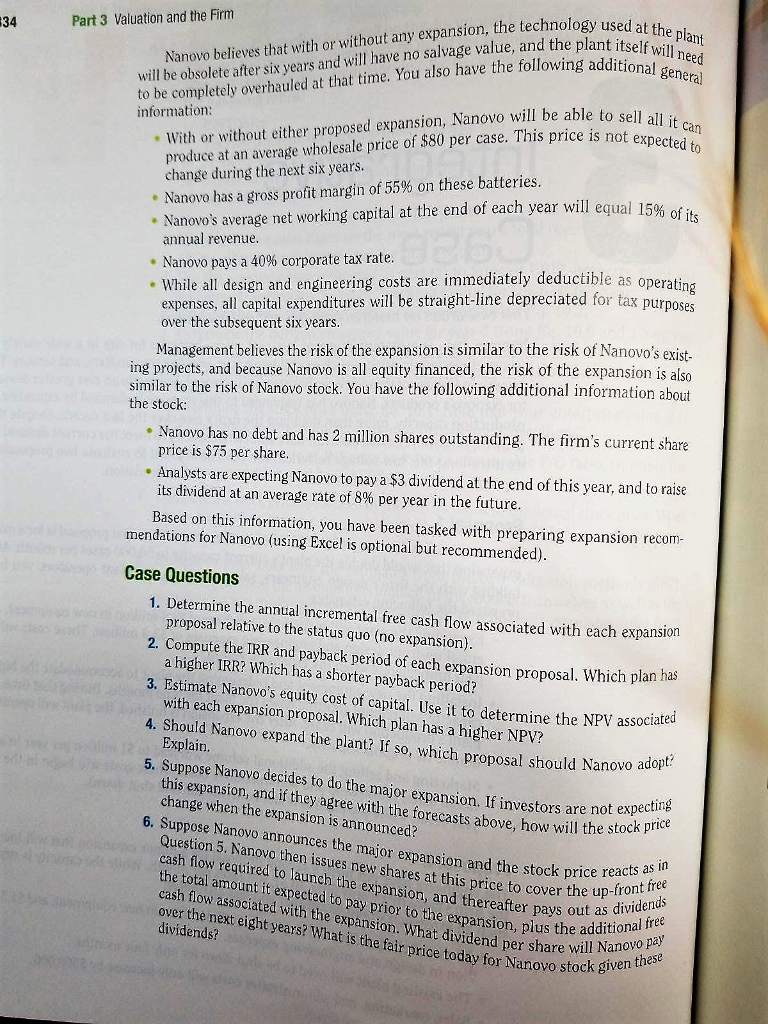

PAR 3 b Integrative Case This case draus on material from this and earlier chapters Nanovo, Inc., is a manufacturer of low-cost micro batteries for use compact electronic devices such as children's toys, wireless transmitters, a growth in the use of these devices has steadily increased, leading to an ever for Nanovo's in a wide variety of nd sensors. The greater demand products. Nanovo has responded to this increase in demand by expanding its production capacity, more than doubling the firm's size over the last decade. Despite this growth, however, Nanovo does not have sufficient capacity to meet the current demand tor its ultra-long-life, low-voltage batteries. You have been asked to evaluate two proposals to expand one of Nanovo's existing plants, and make a recommendation Proposal 1 The current plant has a capacity of 25,000 cases per month. The first proposal is for a major expansion that would double the plant's current capacity to 50,000 cases per mon talking with the firm's design engineers, sales managers, and plant operators, you have prepared the following estimates: th. After . Expanding the plant will require the purchase of $3. 6 million in new equipment, and tail up-front design and engineering expenses of $3.9 million. These costs wil paid immediately when the expansion begins. Installing the new equipment and redesigning the plant to accommodate the higher capacity will require shutting down the plant for nine months. During that time, the plant's production will cease. After the expansion is finished, the plant will operate at double its original capacity o Marketing and selling the additional volume will lead to $1 million per year in addi- tional sales, marketing, and administrative costs. These costs will begin in the first year (even while the plant is under construction and shut down). Proposal 2 The engineers have put forth a second proposal for a minor expansion that will increase the firm's capacity by only 50%, to 37,500 cases per month, while the capacity is smaller. such an expansion would be cheaper and less disruptive: The smaller expansion will require only $2.4 million in new equipment, and $1.5 mil- lion in design and engineering expenses. The existing plant will need to be shut down for only four months. Sales, marketing, and administrative costs will only increase by $500,000. PAR 3 b Integrative Case This case draus on material from this and earlier chapters Nanovo, Inc., is a manufacturer of low-cost micro batteries for use compact electronic devices such as children's toys, wireless transmitters, a growth in the use of these devices has steadily increased, leading to an ever for Nanovo's in a wide variety of nd sensors. The greater demand products. Nanovo has responded to this increase in demand by expanding its production capacity, more than doubling the firm's size over the last decade. Despite this growth, however, Nanovo does not have sufficient capacity to meet the current demand tor its ultra-long-life, low-voltage batteries. You have been asked to evaluate two proposals to expand one of Nanovo's existing plants, and make a recommendation Proposal 1 The current plant has a capacity of 25,000 cases per month. The first proposal is for a major expansion that would double the plant's current capacity to 50,000 cases per mon talking with the firm's design engineers, sales managers, and plant operators, you have prepared the following estimates: th. After . Expanding the plant will require the purchase of $3. 6 million in new equipment, and tail up-front design and engineering expenses of $3.9 million. These costs wil paid immediately when the expansion begins. Installing the new equipment and redesigning the plant to accommodate the higher capacity will require shutting down the plant for nine months. During that time, the plant's production will cease. After the expansion is finished, the plant will operate at double its original capacity o Marketing and selling the additional volume will lead to $1 million per year in addi- tional sales, marketing, and administrative costs. These costs will begin in the first year (even while the plant is under construction and shut down). Proposal 2 The engineers have put forth a second proposal for a minor expansion that will increase the firm's capacity by only 50%, to 37,500 cases per month, while the capacity is smaller. such an expansion would be cheaper and less disruptive: The smaller expansion will require only $2.4 million in new equipment, and $1.5 mil- lion in design and engineering expenses. The existing plant will need to be shut down for only four months. Sales, marketing, and administrative costs will only increase by $500,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started