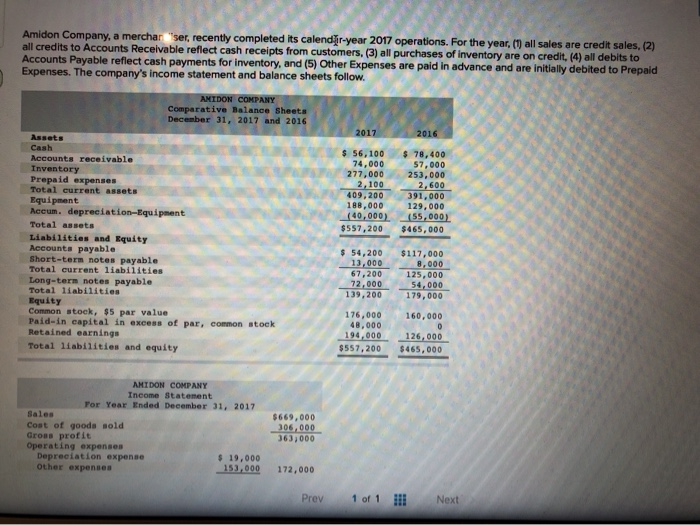

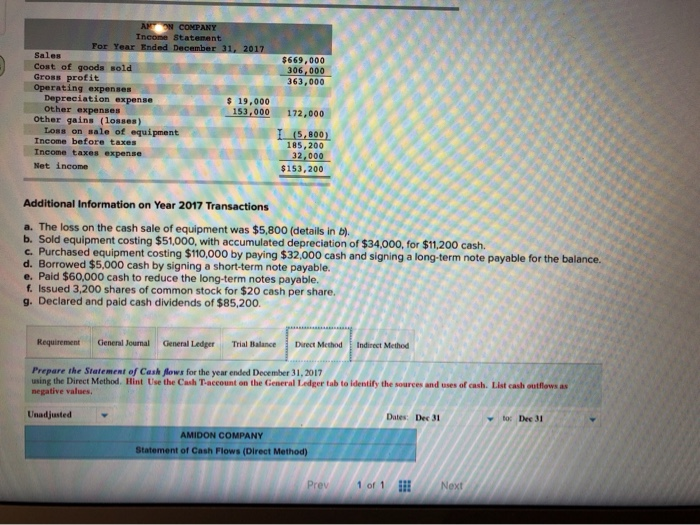

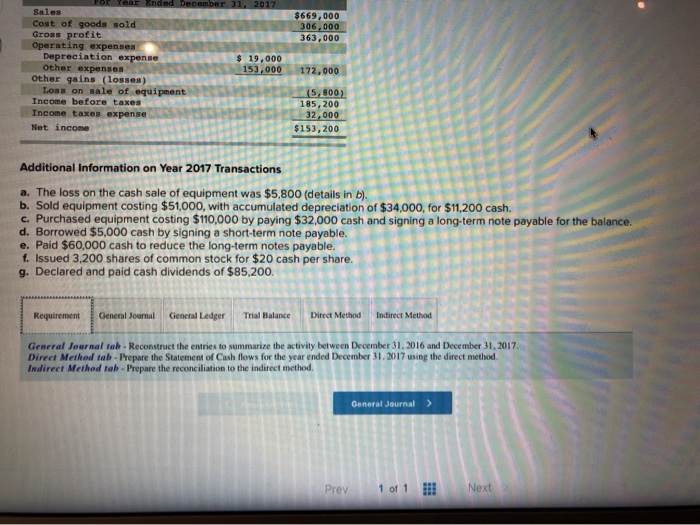

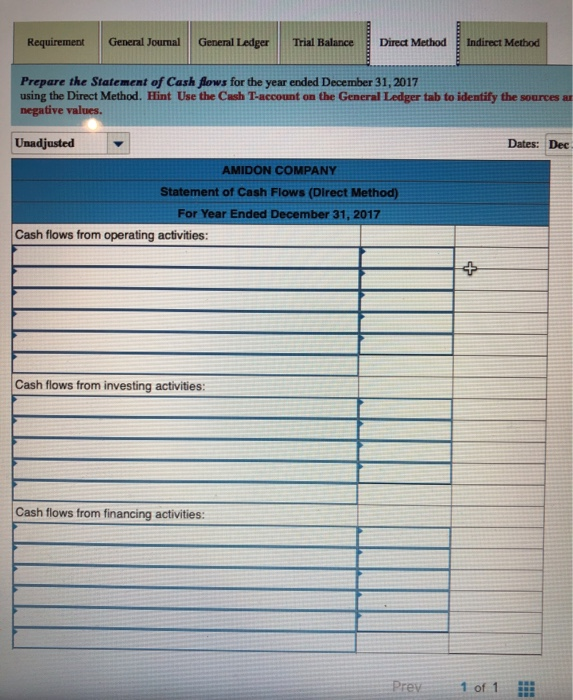

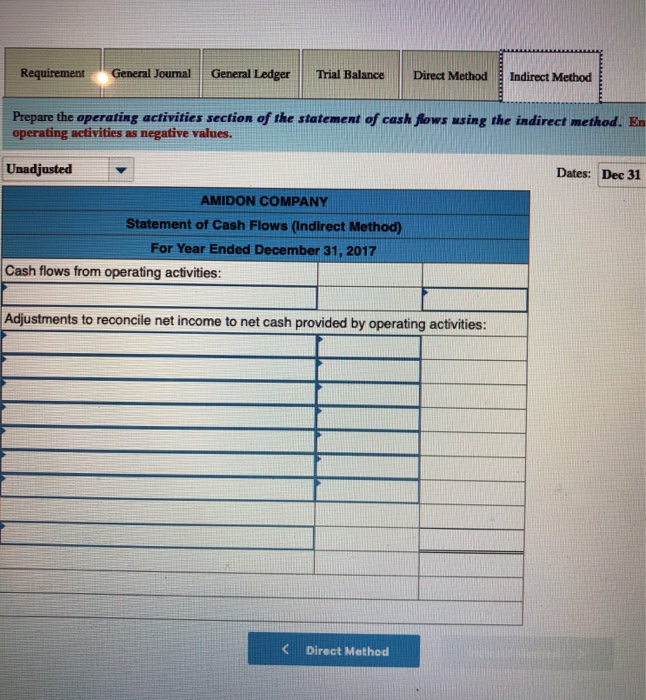

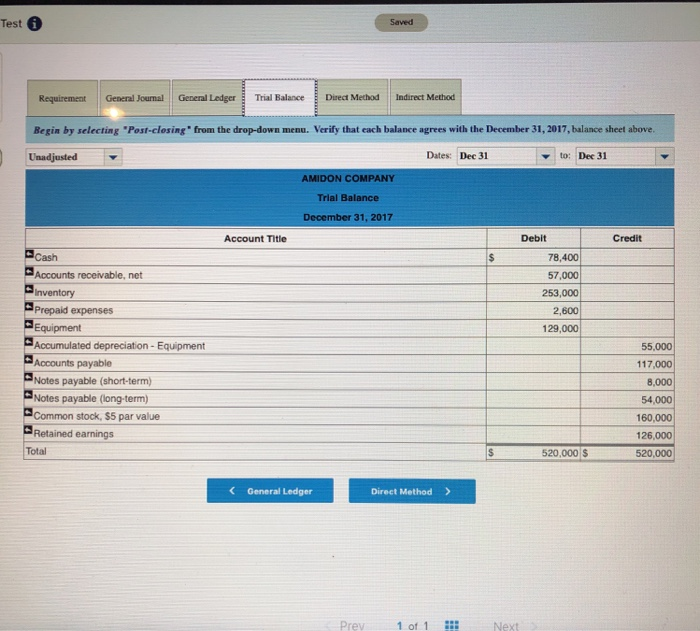

ompany, a merchar ser, recently completed its calendir-year 2017 operations. For the year, () all sales are credit sales, (2) ect cash payments for inventory, and (5) Other Expenses are paid in advance and are initially debited to Prepaid e reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Expenses. The company's income statement and balance sheets follow. Comparative Balance Sheets Decesber 31, 2017 and 2016 2017 Assets Cash Accounts receivable Inventory Prepaid expenses Total current assets Equipment Accum. depreeiation-Equipment Total assets s 56,10078,400 57,000 277,000 253,000 2,600 391,000 129,000 74,000 2,100 409,200 188,000 (40,000) 155,000) $557,200 $465,000 Liabilities and Equity Accounts payable Short-term notes payable Total current liabilities Long-tern notes payable Total liabilities Equity Common stock, $5 par value Paid-in capital in excess of par, common stock Retained earnings 54,200 $117,000 8,000 13,000 67,200 72,000 139,200 125,000 54,000 179,000 176,000 160,000 48,000 194,000 $557,200 126, 000 $465, 000 Total liabilities and equity AMIDON COMPANY Income Statement For Year Ended December 31, 2017 Sales Cost of goods sold Gross profit Operating expenses 669,00 06.000 363 000 Depreciation expense Other expenses $ 19,000 153,000 172,000 Prev 1 of 1 il Next Income Statement Sales Cost of goods sold Gross profit Operating expenses $669,000 306,000 363,000 Depreciation expense s 19,000 Other expenses Other gains (losses) 153,000 172,000 Loss on sale of equipment Income before taxes Income taxes expense Net income (5,800) 185,200 32,000 $153,200 Additional Information on Year 2017 Transactions a. The loss on the cash sale of equipment was $5,800 (details in b) b. Sold equipment costing $51,000, with accumulated depreciation of $34,000, for $11,200 cash. c. Purchased equipment costing $110,000 by paying $32.000 cash and signing a long-term note payable for the balance. d. Borrowed $5,000 cash by signing a short-term note payable. e. Paid $60,000 cash to reduce the l f. Issued 3,200 shares of common stock for $20 cash per share. g. Declared and paid cash dividends of $85,200 long-term notes payable Requirement General Journal General Ledger Trial BalanceDrect MethodIndirect Method Prepare the Statement of Cash Aows for the year ended December 31, 2017 using the Direct Method. Hint Use the Cash T-account on the Ceneral Ledger tab to identify the sources and uses of cash. List cash outflows as negative values Unadjusted Dates: Dec 31 YBo: Dee 31 AMIDON COMPANY Statement of Cash Flows (Direct Method) Prev 1 of Next Sales Cost of goods sold Gross profit Operating expenses $669,000 306,000 363,000 Depreciation expense $ 19,000 Other expenses Other gains (losses) 153,000 172,000 Loss on sale of equipment (5,800 Income before taxes Income taxes expense Net income 185,200 32,000 $153,200 Additional Information on Year 2017 Transactions a. The loss on the cash sale of equipment was $5,800 (details in b). b. Sold equipment costing $51,000, with accumulated depreciation of $34,000, for $11,200 cash. c. Purchased equipment costing $110,000 by paying $32,000 cash and signing a long-term note payable for the balance. d. Borrowed $5,000 cash by signing a short-term note payable. e. Paid $60,000 cash to reduce the long-term notes payable. f. Issued 3,200 shares of common stock for $20 cash per share. g. Declared and paid cash dividends of $85,200. RequirementGeneral Journal General Ledger Trial Balance Direct Method Indirect Method General Journal tab Reconstruct the entries to summarize the activity between December 31,2016 and December 31,2017. Direct Methed tab- Prepare the Statement of Cash flows for the year ended December 31. 2017 using the direct method. Indireet Method tab- Prepare the reconciliation to the indirect method General Journal ) Prev 1 of 1 Next Requirement General Journal General LedgerTrial Balance Direct Method Indirect Method Prepare the Statement of Cash fows for the year ended December 31,2017 using the Direct Method. Hint Use the Cash T-account on the General Ledger tab to identify the sources ar negative values. Unadjusted Dates: Dec AMIDON COMPANY Statement of Cash Flows (Direct Method) For Year Ended December 31, 2017 Cash flows from operating activities: Cash flows from investing activities: Cash flows from financing activities Prev 1 of 1 :. Requirement General Journal General Ledger Trial Balance Direct MethodIndirect Method Prepare the operating activities section of the statement of cash flows wsing the indirect method. En operating activities as negative values. Unadjusted Dates: Dec 31 AMIDON COMPANY Statement of Cash Flows (Indirect Method) For Year Ended December 31, 2017 Cash flows from operating activities: Adjustments to reconcile net income to net cash provided by operating activities: KDirect Method Test G Saved General LedgerTrial Balance Dizect MechodIndirect Method Requirement General Journal Begin by selecting "Post-closing from the drop-down menu. Verify that each balance agrees with the December 31, 2017, balance sheet above Dates: Dec 31 to: Dec 31 AMIDON COMPANY Trial Balance December 31, 2017 Account Title Credit Debit Cash Accounts receivable, net inventory Prepaid expenses 78,400 57,000 253,000 2,600 129,000 Accumulated depreciation Equipment Accounts payable Notes payable (short-term) Notes payable (long-term) Common stock, $5 par value Retained earnings 55,000 117,000 8,000 54,000 160,000 126,000 520,000 Total 520,000 S General Ledger Direct Method> Prev1 of 1