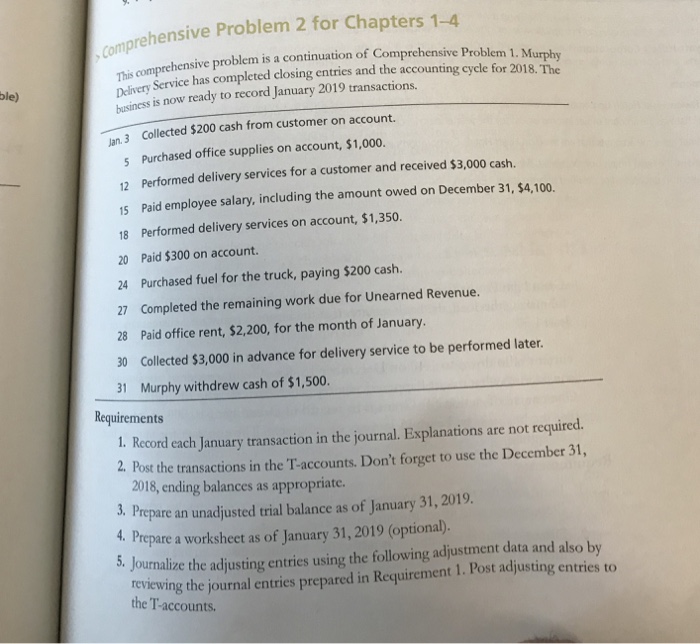

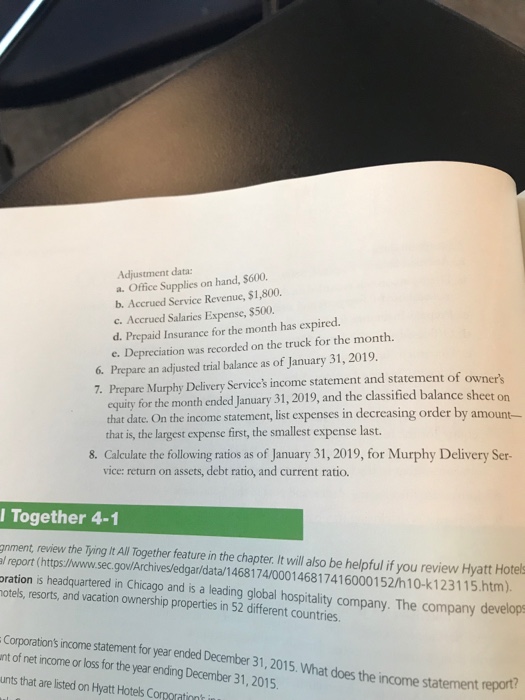

omprehensive Problem 2 for Chapters 1-4 This comp Delivery business is now ready to record January 2019 transactions. rehensive problem is a continuation of Comprehensive Problem 1. Mu Service has completed closing entries and the accounting cycle for 2018. The ble) Jn 3 Collected $200 cash from customer on account. 5 Purchased office supplies on account, $1,000. 12 Performed delivery services for a customer and received $3,000 cash. 15 Paid employee salary, including the amount owed on December 31, $4,100. 18 Performed delivery services on account, $1,350. 20 Paid $300 on account. 24 Purchased fuel for the truck, paying $200 cash. 27 Completed the remaining work due for Unearned Revenue. 28 Paid office rent, $2,200, for the month of January. 30 Collected $3,000 in advance for delivery service to be performed later 31 Murphy withdrew cash of $1,500. Requirements 1. Record each January transaction in the journal. Explanations are not required. 2. Post the transactions in the T-accounts. Don't forget to use the December 31, 2018, ending balances as appropriate. repare an unadjusted trial balance as of January 31, 2019. 4 Prepare a worksheet as of January 31, 2019 (optional epare a worksheet as of January 31, 2019 (optional)., reviewing the journal entries prepared in Requirement 1. Post adjusting entries to the T-accounts. 5. Journaize the adjusting entries using the following adjustment data and also by omprehensive Problem 2 for Chapters 1-4 This comp Delivery business is now ready to record January 2019 transactions. rehensive problem is a continuation of Comprehensive Problem 1. Mu Service has completed closing entries and the accounting cycle for 2018. The ble) Jn 3 Collected $200 cash from customer on account. 5 Purchased office supplies on account, $1,000. 12 Performed delivery services for a customer and received $3,000 cash. 15 Paid employee salary, including the amount owed on December 31, $4,100. 18 Performed delivery services on account, $1,350. 20 Paid $300 on account. 24 Purchased fuel for the truck, paying $200 cash. 27 Completed the remaining work due for Unearned Revenue. 28 Paid office rent, $2,200, for the month of January. 30 Collected $3,000 in advance for delivery service to be performed later 31 Murphy withdrew cash of $1,500. Requirements 1. Record each January transaction in the journal. Explanations are not required. 2. Post the transactions in the T-accounts. Don't forget to use the December 31, 2018, ending balances as appropriate. repare an unadjusted trial balance as of January 31, 2019. 4 Prepare a worksheet as of January 31, 2019 (optional epare a worksheet as of January 31, 2019 (optional)., reviewing the journal entries prepared in Requirement 1. Post adjusting entries to the T-accounts. 5. Journaize the adjusting entries using the following adjustment data and also by