Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 April 2019, Lisa borrowed $37576 at an interest rate of 2.37% from her employer, Solarcity Pty Ltd. This was lower than that offered

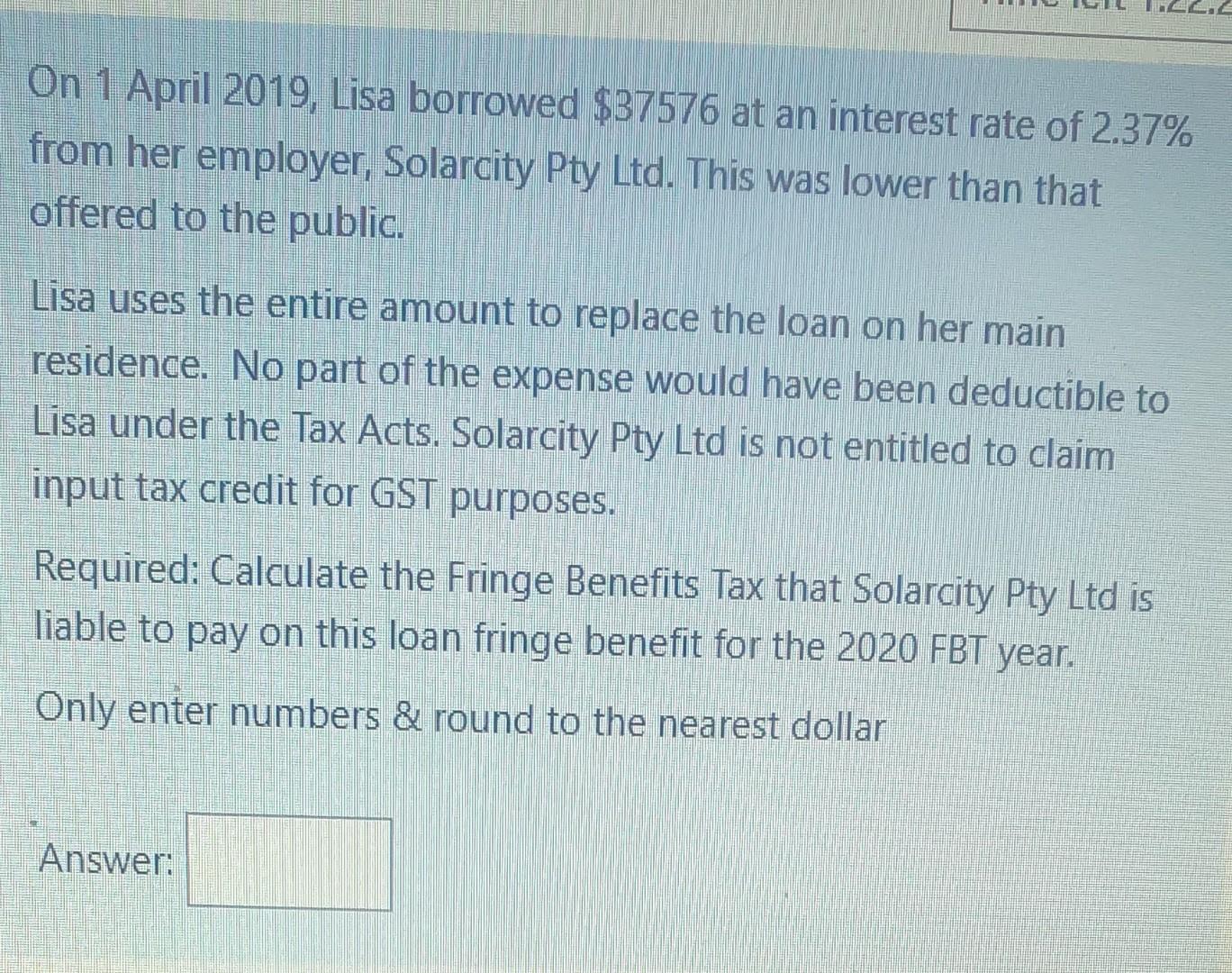

On 1 April 2019, Lisa borrowed $37576 at an interest rate of 2.37% from her employer, Solarcity Pty Ltd. This was lower than that offered to the public. Lisa uses the entire amount to replace the loan on her main residence. No part of the expense would have been deductible to Lisa under the Tax Acts. Solarcity Pty Ltd is not entitled to claim input tax credit for GST purposes. Required: Calculate the Fringe Benefits Tax that Solarcity Pty Ltd is liable to pay on this loan fringe benefit for the 2020 FBT year. Only enter numbers & round to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started