Answered step by step

Verified Expert Solution

Question

1 Approved Answer

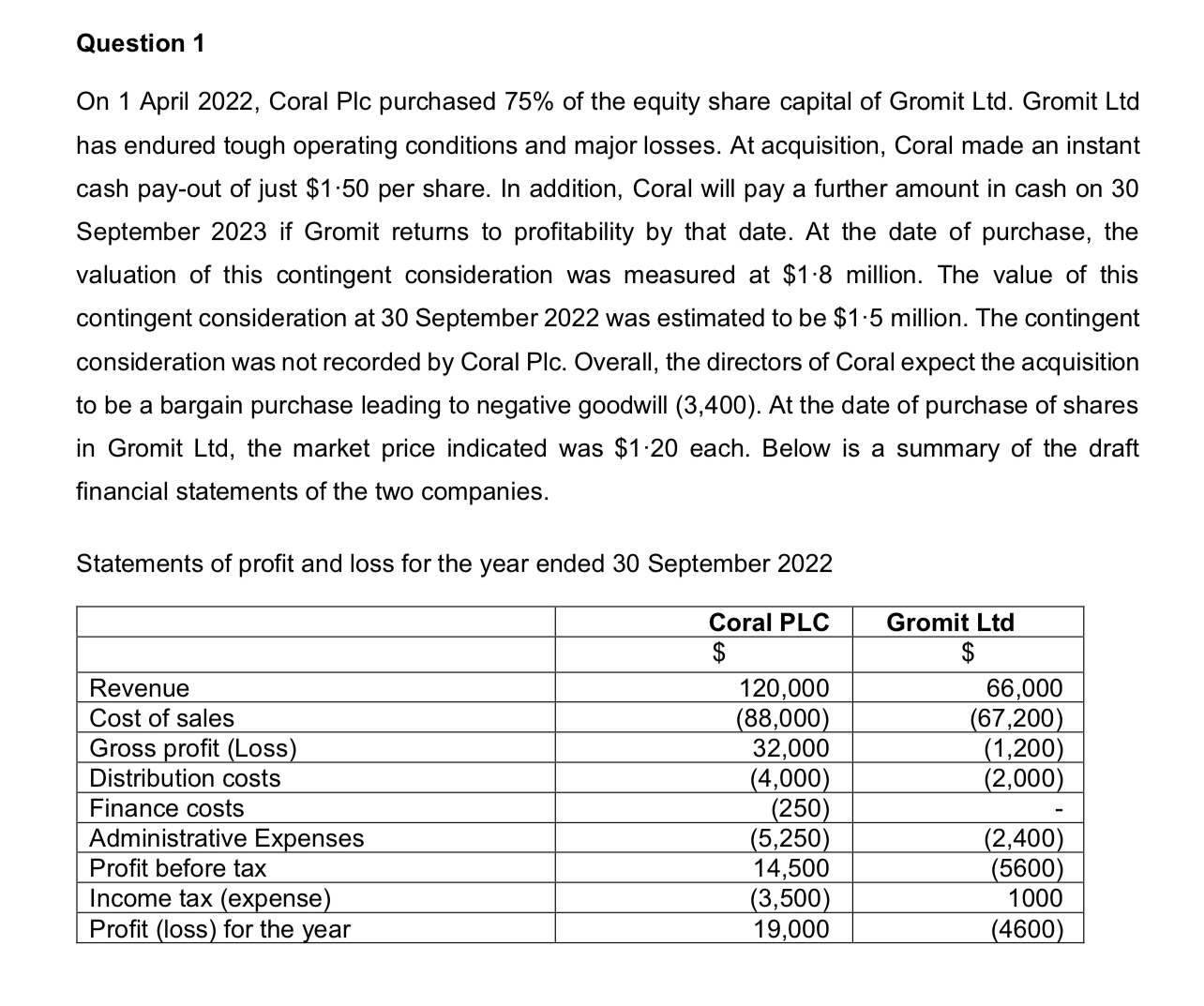

On 1 April 2022, Coral Plc purchased 75% of the equity share capital of Gromit Ltd. Gromit Ltd has endured tough operating conditions and major

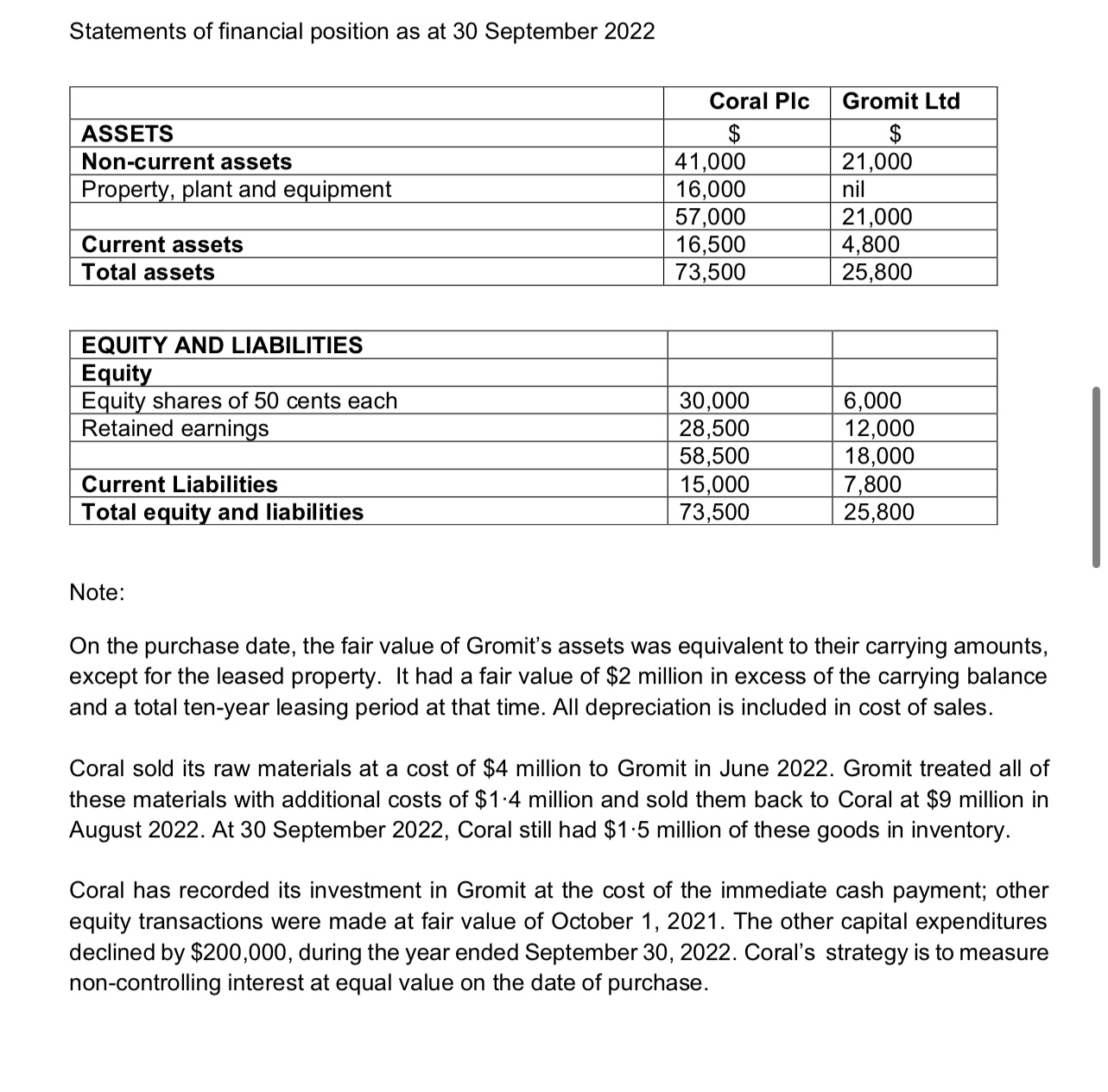

On 1 April 2022, Coral Plc purchased 75% of the equity share capital of Gromit Ltd. Gromit Ltd has endured tough operating conditions and major losses. At acquisition, Coral made an instant cash pay-out of just $1.50 per share. In addition, Coral will pay a further amount in cash on 30 September 2023 if Gromit returns to profitability by that date. At the date of purchase, the valuation of this contingent consideration was measured at $1.8 million. The value of this contingent consideration at 30 September 2022 was estimated to be $1.5 million. The contingent consideration was not recorded by Coral Plc. Overall, the directors of Coral expect the acquisition to be a bargain purchase leading to negative goodwill (3,400). At the date of purchase of shares in Gromit Ltd, the market price indicated was $120 each. Below is a summary of the draft financial statements of the two companies. Statements of financial position as at 30 September 2022 Note: On the purchase date, the fair value of Gromit's assets was equivalent to their carrying amounts, except for the leased property. It had a fair value of $2 million in excess of the carrying balance and a total ten-year leasing period at that time. All depreciation is included in cost of sales. Coral sold its raw materials at a cost of $4 million to Gromit in June 2022. Gromit treated all of these materials with additional costs of $1.4 million and sold them back to Coral at $9 million in August 2022. At 30 September 2022, Coral still had $1.5 million of these goods in inventory. Coral has recorded its investment in Gromit at the cost of the immediate cash payment; other equity transactions were made at fair value of October 1, 2021. The other capital expenditures declined by $200,000, during the year ended September 30,2022 . Coral's strategy is to measure non-controlling interest at equal value on the date of purchase. Required: a. Prepare the consolidated statement of profit or loss for Coral Plc for the year ended 30 September 2022 b. Prepare the consolidated statement of financial position for Coral PIc as at 30 September 2022 .. On 1 April 2022, Coral Plc purchased 75% of the equity share capital of Gromit Ltd. Gromit Ltd has endured tough operating conditions and major losses. At acquisition, Coral made an instant cash pay-out of just $1.50 per share. In addition, Coral will pay a further amount in cash on 30 September 2023 if Gromit returns to profitability by that date. At the date of purchase, the valuation of this contingent consideration was measured at $1.8 million. The value of this contingent consideration at 30 September 2022 was estimated to be $1.5 million. The contingent consideration was not recorded by Coral Plc. Overall, the directors of Coral expect the acquisition to be a bargain purchase leading to negative goodwill (3,400). At the date of purchase of shares in Gromit Ltd, the market price indicated was $120 each. Below is a summary of the draft financial statements of the two companies. Statements of financial position as at 30 September 2022 Note: On the purchase date, the fair value of Gromit's assets was equivalent to their carrying amounts, except for the leased property. It had a fair value of $2 million in excess of the carrying balance and a total ten-year leasing period at that time. All depreciation is included in cost of sales. Coral sold its raw materials at a cost of $4 million to Gromit in June 2022. Gromit treated all of these materials with additional costs of $1.4 million and sold them back to Coral at $9 million in August 2022. At 30 September 2022, Coral still had $1.5 million of these goods in inventory. Coral has recorded its investment in Gromit at the cost of the immediate cash payment; other equity transactions were made at fair value of October 1, 2021. The other capital expenditures declined by $200,000, during the year ended September 30,2022 . Coral's strategy is to measure non-controlling interest at equal value on the date of purchase. Required: a. Prepare the consolidated statement of profit or loss for Coral Plc for the year ended 30 September 2022 b. Prepare the consolidated statement of financial position for Coral PIc as at 30 September 2022

On 1 April 2022, Coral Plc purchased 75% of the equity share capital of Gromit Ltd. Gromit Ltd has endured tough operating conditions and major losses. At acquisition, Coral made an instant cash pay-out of just $1.50 per share. In addition, Coral will pay a further amount in cash on 30 September 2023 if Gromit returns to profitability by that date. At the date of purchase, the valuation of this contingent consideration was measured at $1.8 million. The value of this contingent consideration at 30 September 2022 was estimated to be $1.5 million. The contingent consideration was not recorded by Coral Plc. Overall, the directors of Coral expect the acquisition to be a bargain purchase leading to negative goodwill (3,400). At the date of purchase of shares in Gromit Ltd, the market price indicated was $120 each. Below is a summary of the draft financial statements of the two companies. Statements of financial position as at 30 September 2022 Note: On the purchase date, the fair value of Gromit's assets was equivalent to their carrying amounts, except for the leased property. It had a fair value of $2 million in excess of the carrying balance and a total ten-year leasing period at that time. All depreciation is included in cost of sales. Coral sold its raw materials at a cost of $4 million to Gromit in June 2022. Gromit treated all of these materials with additional costs of $1.4 million and sold them back to Coral at $9 million in August 2022. At 30 September 2022, Coral still had $1.5 million of these goods in inventory. Coral has recorded its investment in Gromit at the cost of the immediate cash payment; other equity transactions were made at fair value of October 1, 2021. The other capital expenditures declined by $200,000, during the year ended September 30,2022 . Coral's strategy is to measure non-controlling interest at equal value on the date of purchase. Required: a. Prepare the consolidated statement of profit or loss for Coral Plc for the year ended 30 September 2022 b. Prepare the consolidated statement of financial position for Coral PIc as at 30 September 2022 .. On 1 April 2022, Coral Plc purchased 75% of the equity share capital of Gromit Ltd. Gromit Ltd has endured tough operating conditions and major losses. At acquisition, Coral made an instant cash pay-out of just $1.50 per share. In addition, Coral will pay a further amount in cash on 30 September 2023 if Gromit returns to profitability by that date. At the date of purchase, the valuation of this contingent consideration was measured at $1.8 million. The value of this contingent consideration at 30 September 2022 was estimated to be $1.5 million. The contingent consideration was not recorded by Coral Plc. Overall, the directors of Coral expect the acquisition to be a bargain purchase leading to negative goodwill (3,400). At the date of purchase of shares in Gromit Ltd, the market price indicated was $120 each. Below is a summary of the draft financial statements of the two companies. Statements of financial position as at 30 September 2022 Note: On the purchase date, the fair value of Gromit's assets was equivalent to their carrying amounts, except for the leased property. It had a fair value of $2 million in excess of the carrying balance and a total ten-year leasing period at that time. All depreciation is included in cost of sales. Coral sold its raw materials at a cost of $4 million to Gromit in June 2022. Gromit treated all of these materials with additional costs of $1.4 million and sold them back to Coral at $9 million in August 2022. At 30 September 2022, Coral still had $1.5 million of these goods in inventory. Coral has recorded its investment in Gromit at the cost of the immediate cash payment; other equity transactions were made at fair value of October 1, 2021. The other capital expenditures declined by $200,000, during the year ended September 30,2022 . Coral's strategy is to measure non-controlling interest at equal value on the date of purchase. Required: a. Prepare the consolidated statement of profit or loss for Coral Plc for the year ended 30 September 2022 b. Prepare the consolidated statement of financial position for Coral PIc as at 30 September 2022 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started