Answered step by step

Verified Expert Solution

Question

1 Approved Answer

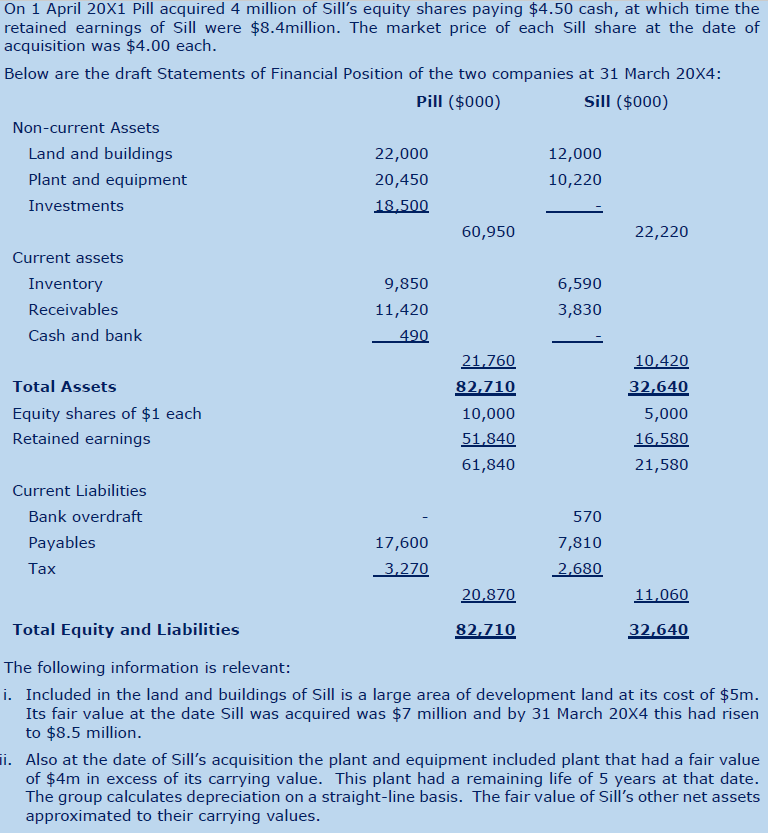

On 1 April 20X1 Pill acquired 4 million of Sill's equity shares paying $4.50 cash, at which time the retained earnings of Sill were $8.4

On 1 April 20X1 Pill acquired 4 million of Sill's equity shares paying $4.50 cash, at which time the retained earnings of Sill were $8.4 million. The market price of each Sill share at the date of acquisition was $4.00 each. The following information is relevant: - Included in the land and buildings of Sill is a large area of development land at its cost of $5m. Its fair value at the date Sill was acquired was $7 million and by 31 March 204 this had risen to $8.5 million. Also at the date of Sill's acquisition the plant and equipment included plant that had a fair value of $4m in excess of its carrying value. This plant had a remaining life of 5 years at that date. The group calculates depreciation on a straight-line basis. The fair value of Sill's other net assets approximated to their carrying values. iii. The balance on the current accounts of the parent and subsidiary included in receivables and payables was agreed at $240,000 on 31 March 204. iv. An impairment test at 31 March 204 concluded that consolidated goodwill was impaired by $200,000. Prepare the Consolidated Statement of Financial Position for the Pill group as at 31 March 204

On 1 April 20X1 Pill acquired 4 million of Sill's equity shares paying $4.50 cash, at which time the retained earnings of Sill were $8.4 million. The market price of each Sill share at the date of acquisition was $4.00 each. The following information is relevant: - Included in the land and buildings of Sill is a large area of development land at its cost of $5m. Its fair value at the date Sill was acquired was $7 million and by 31 March 204 this had risen to $8.5 million. Also at the date of Sill's acquisition the plant and equipment included plant that had a fair value of $4m in excess of its carrying value. This plant had a remaining life of 5 years at that date. The group calculates depreciation on a straight-line basis. The fair value of Sill's other net assets approximated to their carrying values. iii. The balance on the current accounts of the parent and subsidiary included in receivables and payables was agreed at $240,000 on 31 March 204. iv. An impairment test at 31 March 204 concluded that consolidated goodwill was impaired by $200,000. Prepare the Consolidated Statement of Financial Position for the Pill group as at 31 March 204 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started