Answered step by step

Verified Expert Solution

Question

1 Approved Answer

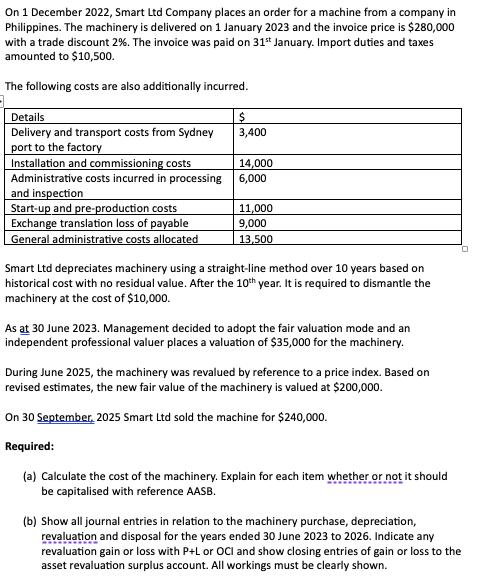

On 1 December 2022, Smart Ltd Company places an order for a machine from a company in Philippines. The machinery is delivered on 1

On 1 December 2022, Smart Ltd Company places an order for a machine from a company in Philippines. The machinery is delivered on 1 January 2023 and the invoice price is $280,000 with a trade discount 2%. The invoice was paid on 31st January. Import duties and taxes amounted to $10,500. The following costs are also additionally incurred. 3 Details Delivery and transport costs from Sydney port to the factory Installation and commissioning costs Administrative costs incurred in processing and inspection Start-up and pre-production costs Exchange translation loss of payable General administrative costs allocated $ 3,400 14,000 6,000 11,000 9,000 13,500 Smart Ltd depreciates machinery using a straight-line method over 10 years based on historical cost with no residual value. After the 10th year. It is required to dismantle the machinery at the cost of $10,000. As at 30 June 2023. Management decided to adopt the fair valuation mode and an independent professional valuer places a valuation of $35,000 for the machinery. During June 2025, the machinery was revalued by reference to a price index. Based on revised estimates, the new fair value of the machinery is valued at $200,000. On 30 September, 2025 Smart Ltd sold the machine for $240,000. Required: (a) Calculate the cost of the machinery. Explain for each item whether or not it should be capitalised with reference AASB. 0 (b) Show all journal entries in relation to the machinery purchase, depreciation, revaluation and disposal for the years ended 30 June 2023 to 2026. Indicate any revaluation gain or loss with P+L or OCI and show closing entries of gain or loss to the asset revaluation surplus account. All workings must be clearly shown.

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a Calculation of the cost of the machinery and determination of capitalization 1 Invoice Price 280000 Trade Discount 2 280000 002 5600 Net Invoice Price 280000 5600 274400 2 Import Duties and Taxes 10...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started