Answered step by step

Verified Expert Solution

Question

1 Approved Answer

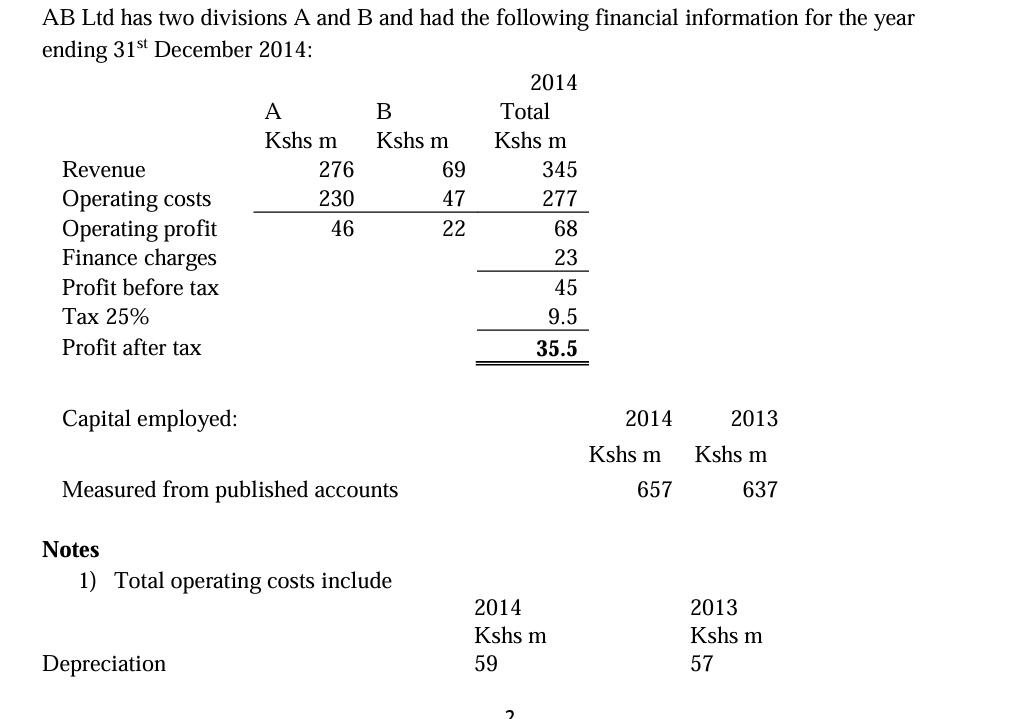

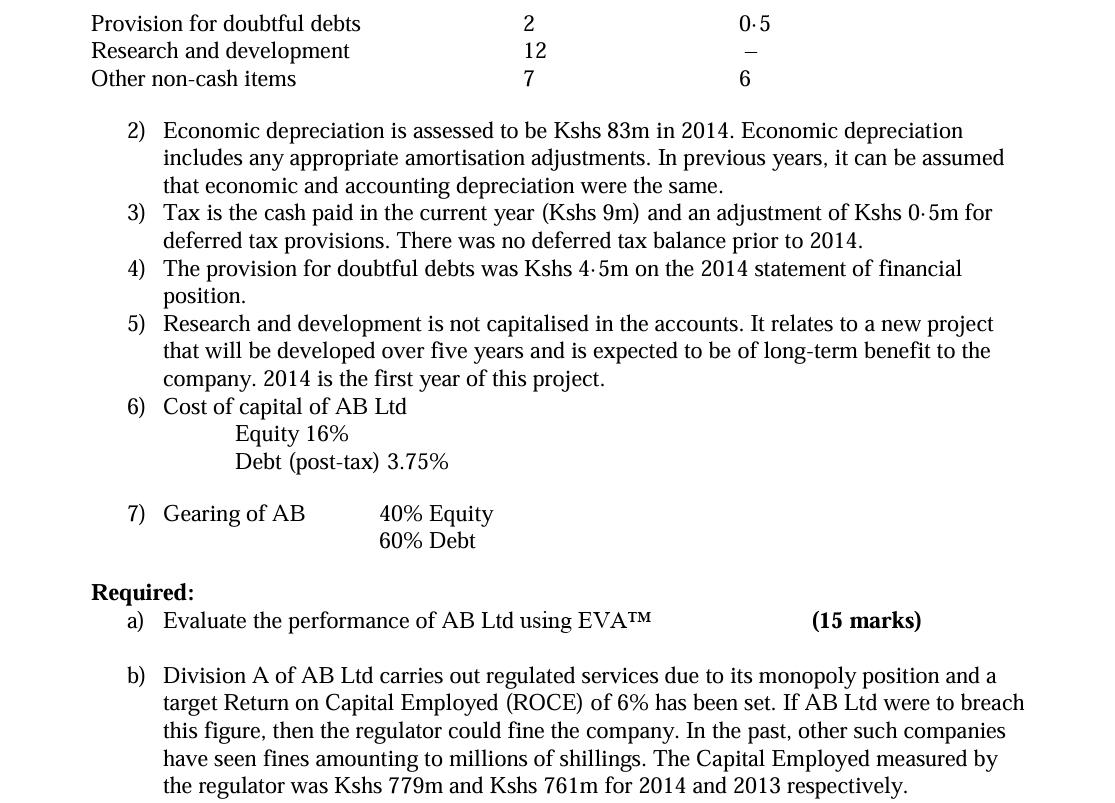

AB Ltd has two divisions A and B and had the following financial information for the year ending 31st December 2014: Revenue Operating costs

AB Ltd has two divisions A and B and had the following financial information for the year ending 31st December 2014: Revenue Operating costs Operating profit Finance charges Profit before tax Tax 25% Profit after tax Capital employed: Notes A Kshs m 276 230 46 Measured from published accounts Depreciation B Kshs m 1) Total operating costs include 69 47 22 2014 Total Kshs m 2 345 277 68 23 45 9.5 35.5 2014 Kshs m 59 2014 Kshs m 657 2013 Kshs m 637 2013 Kshs m 57 Provision for doubtful debts Research and development Other non-cash items 6) Cost of capital of AB Ltd Equity 16% Debt (post-tax) 3.75% 2) Economic depreciation is assessed to be Kshs 83m in 2014. Economic depreciation includes any appropriate amortisation adjustments. In previous years, it can be assumed that economic and accounting depreciation were the same. 3) Tax is the cash paid in the current year (Kshs 9m) and an adjustment of Kshs 0.5m for deferred tax provisions. There was no deferred tax balance prior to 2014. 4) The provision for doubtful debts was Kshs 4.5m on the 2014 statement of financial position. 5) Research and development is not capitalised in the accounts. It relates to a new project that will be developed over five years and is expected to be of long-term benefit to the company. 2014 is the first year of this project. 7) Gearing of AB 2 12 7 40% Equity 60% Debt 0.5 Required: a) Evaluate the performance of AB Ltd using EVA 6 (15 marks) b) Division A of AB Ltd carries out regulated services due to its monopoly position and a target Return on Capital Employed (ROCE) of 6% has been set. If AB Ltd were to breach this figure, then the regulator could fine the company. In the past, other such companies have seen fines amounting to millions of shillings. The Capital Employed measured by the regulator was Kshs 779m and Kshs 761m for 2014 and 2013 respectively.

Step by Step Solution

★★★★★

3.36 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

a Calculate EVATM for AB Ltd for 2014 1 Calculate Operating Profit after Tax OPAT Operating Profit K...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started