Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 Jan 2022, A Ltd acquired all the outstanding shares of B Ltd when the equity of B Ltd consisted of share capital of

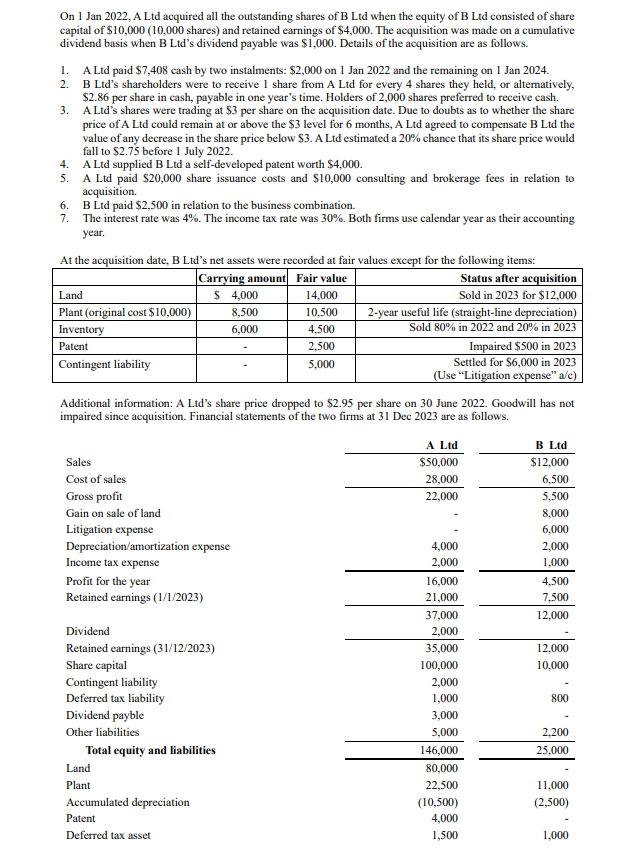

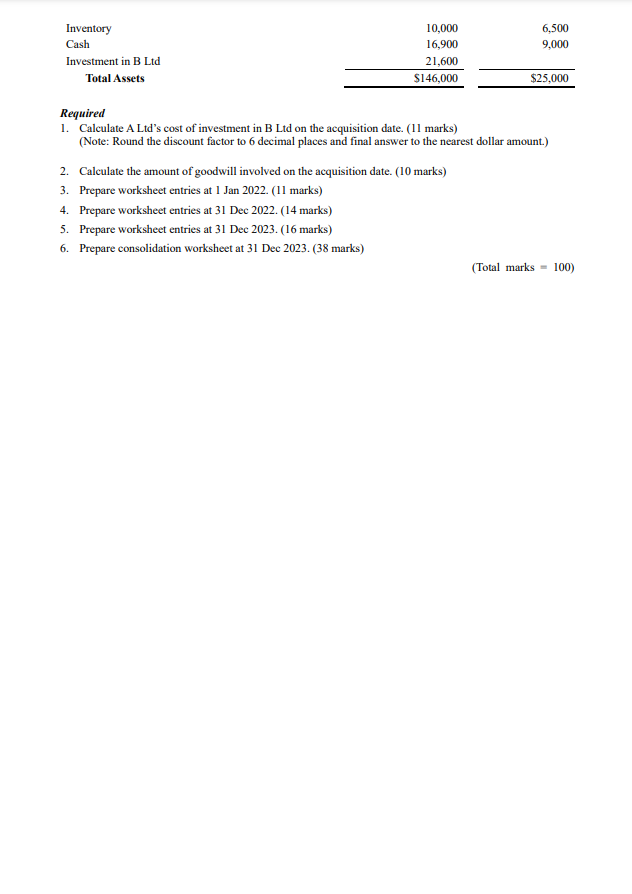

On 1 Jan 2022, A Ltd acquired all the outstanding shares of B Ltd when the equity of B Ltd consisted of share capital of $10,000 ( 10,000 shares) and retained earnings of $4,000. The acquisition was made on a cumulative dividend basis when B Ltd's dividend payable was $1,000. Details of the acquisition are as follows. 1. A Ltd paid $7,408 cash by two instalments: $2,000 on 1 Jan 2022 and the remaining on 1 Jan 2024 . 2. B Ltd's shareholders were to receive 1 share from A Ltd for every 4 shares they held, or altematively, $2.86 per share in cash, payable in one year's time. Holders of 2,000 shares preferred to receive cash. 3. A Ltd's shares were trading at $3 per share on the acquisition date. Due to doubts as to whether the share price of A Ltd could remain at or above the \$3 level for 6 months, A Ltd agreed to compensate B Ltd the value of any decrease in the share price below \$3. A Ltd estimated a 20% chance that its share price would fall to $2.75 before 1 July 2022 . 4. A Ltd supplied B Ltd a self-developed patent worth $4,000. 5. A Ltd paid $20,000 share issuance costs and $10,000 consulting and brokerage fees in relation to acquisition. 6. B Ltd paid $2,500 in relation to the business combination. 7. The interest rate was 4%. The income tax rate was 30%. Both firms use calendar year as their accounting year. At the acquisition date, B Ltd's net assets were recorded at fair values except for the following items: Additional information: A Ltd's share price dropped to \$2.95 per share on 30 June 2022. Goodwill has not impaired since acquisition. Financial statements of the two firms at 31 Dec 2023 are as follows. Required 1. Calculate A Ltd's cost of investment in B Ltd on the acquisition date. (11 marks) (Note: Round the discount factor to 6 decimal places and final answer to the nearest dollar amount) 2. Calculate the amount of goodwill involved on the acquisition date. (10 marks) 3. Prepare worksheet entries at 1 Jan 2022. (11 marks) 4. Prepare worksheet entries at 31 Dec 2022. (14 marks) 5. Prepare worksheet entries at 31 Dec 2023. (16 marks) 6. Prepare consolidation worksheet at 31 Dec 2023. (38 marks) ( Total marks =100)

On 1 Jan 2022, A Ltd acquired all the outstanding shares of B Ltd when the equity of B Ltd consisted of share capital of $10,000 ( 10,000 shares) and retained earnings of $4,000. The acquisition was made on a cumulative dividend basis when B Ltd's dividend payable was $1,000. Details of the acquisition are as follows. 1. A Ltd paid $7,408 cash by two instalments: $2,000 on 1 Jan 2022 and the remaining on 1 Jan 2024 . 2. B Ltd's shareholders were to receive 1 share from A Ltd for every 4 shares they held, or altematively, $2.86 per share in cash, payable in one year's time. Holders of 2,000 shares preferred to receive cash. 3. A Ltd's shares were trading at $3 per share on the acquisition date. Due to doubts as to whether the share price of A Ltd could remain at or above the \$3 level for 6 months, A Ltd agreed to compensate B Ltd the value of any decrease in the share price below \$3. A Ltd estimated a 20% chance that its share price would fall to $2.75 before 1 July 2022 . 4. A Ltd supplied B Ltd a self-developed patent worth $4,000. 5. A Ltd paid $20,000 share issuance costs and $10,000 consulting and brokerage fees in relation to acquisition. 6. B Ltd paid $2,500 in relation to the business combination. 7. The interest rate was 4%. The income tax rate was 30%. Both firms use calendar year as their accounting year. At the acquisition date, B Ltd's net assets were recorded at fair values except for the following items: Additional information: A Ltd's share price dropped to \$2.95 per share on 30 June 2022. Goodwill has not impaired since acquisition. Financial statements of the two firms at 31 Dec 2023 are as follows. Required 1. Calculate A Ltd's cost of investment in B Ltd on the acquisition date. (11 marks) (Note: Round the discount factor to 6 decimal places and final answer to the nearest dollar amount) 2. Calculate the amount of goodwill involved on the acquisition date. (10 marks) 3. Prepare worksheet entries at 1 Jan 2022. (11 marks) 4. Prepare worksheet entries at 31 Dec 2022. (14 marks) 5. Prepare worksheet entries at 31 Dec 2023. (16 marks) 6. Prepare consolidation worksheet at 31 Dec 2023. (38 marks) ( Total marks =100) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started