Answered step by step

Verified Expert Solution

Question

1 Approved Answer

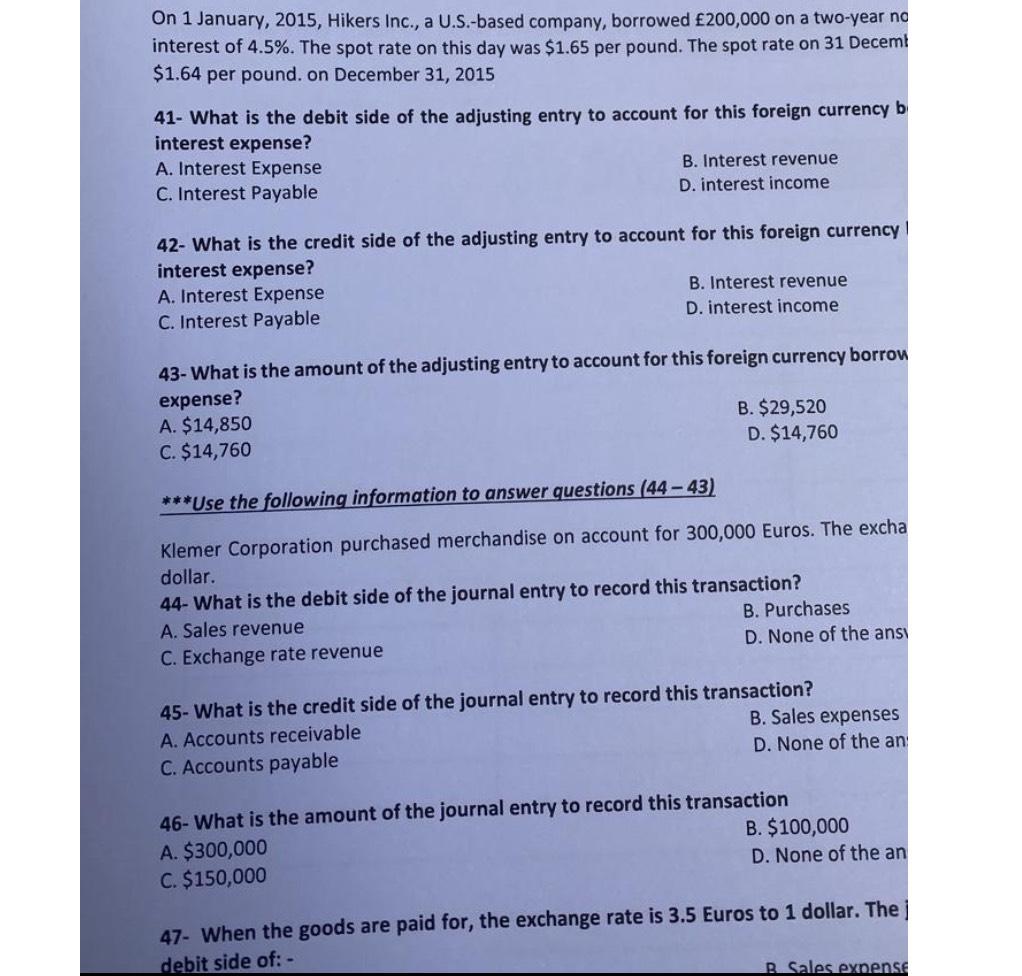

On 1 January, 2 0 1 5 , Hikers Inc., a U . S . - based company, borrowed 2 0 0 , 0 0

On January, Hikers Inc., a USbased company, borrowed on a twoyear no interest of The spot rate on this day was $ per pound. The spot rate on Decem! $ per pound. on December

What is the debit side of the adjusting entry to account for this foreign currency interest expense?

A Interest Expense

B Interest revenue

C Interest Payable

D interest income

What is the credit side of the adjusting entry to account for this foreign currency interest expense?

A Interest Expense

B Interest revenue

C Interest Payable

D interest income

What is the amount of the adjusting entry to account for this foreign currency borrou expense?

A $

B $

C $

D $

Use the following information to answer questions

Klemer Corporation purchased merchandise on account for Euros. The excha dollar.

What is the debit side of the journal entry to record this transaction?

A Sales revenue

B Purchases

C Exchange rate revenue

D None of the ansi

What is the credit side of the journal entry to record this transaction?

A Accounts receivable

B Sales expenses

C Accounts payable

D None of the an

What is the amount of the journal entry to record this transaction

A $

B $

C $

D None of the an

When the goods are paid for, the exchange rate is Euros to dollar. The debit side of:

B Sales exnensf

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started