Question

On 1 January 2014: A Company bought a Mine for $2,000,000. Of this amount, $1,000,000 was attributable to the land value. The Company spent

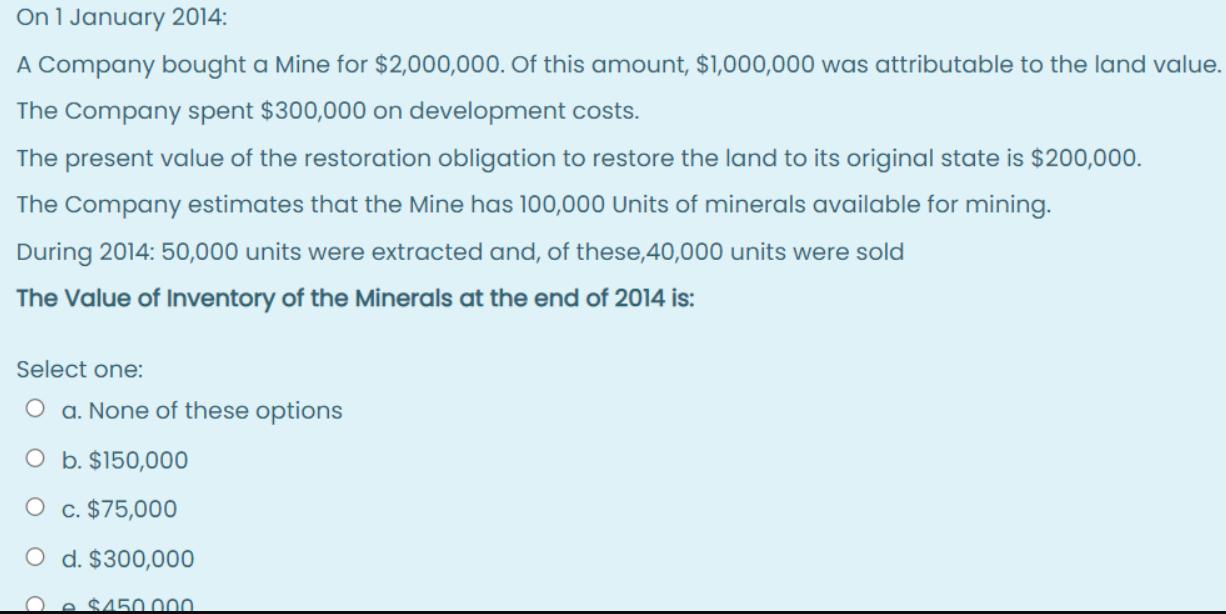

On 1 January 2014: A Company bought a Mine for $2,000,000. Of this amount, $1,000,000 was attributable to the land value. The Company spent $300,000 on development costs. The present value of the restoration obligation to restore the land to its original state is $200,000. The Company estimates that the Mine has 100,000 Units of minerals available for mining. During 2014: 50,000 units were extracted and, of these,40,000 units were sold The Value of Inventory of the Minerals at the end of 2014 is: Select one: O a. None of these options O b. $150,000 O c. $75,000 O d. $300,000 $450.000

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Lompany boughtD 2000 100000 w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Earl K. Stice, James D. Stice

19th edition

1133957919, 978-1285632988, 1285632982, 978-0357691229, 978-1133957911

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App