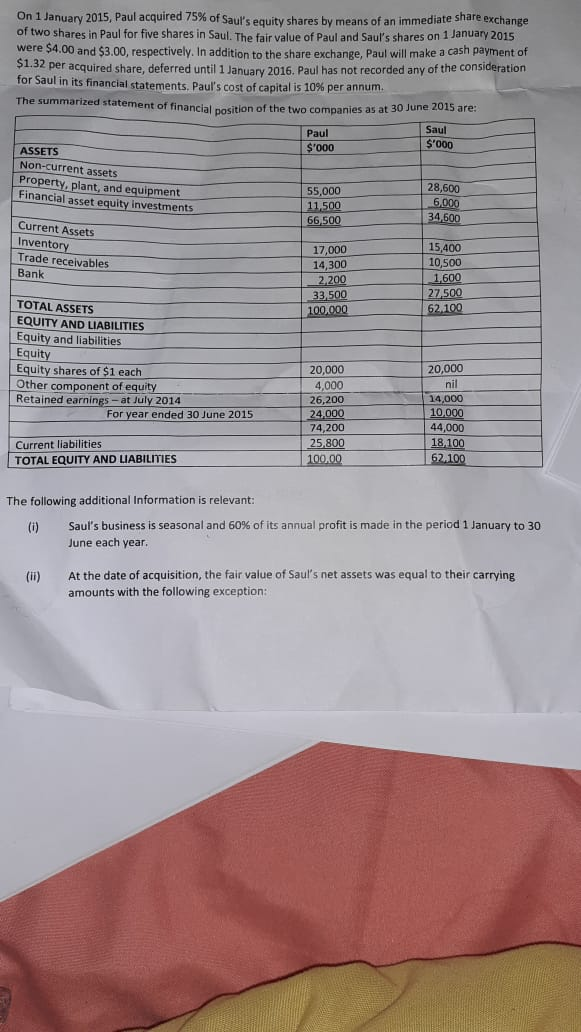

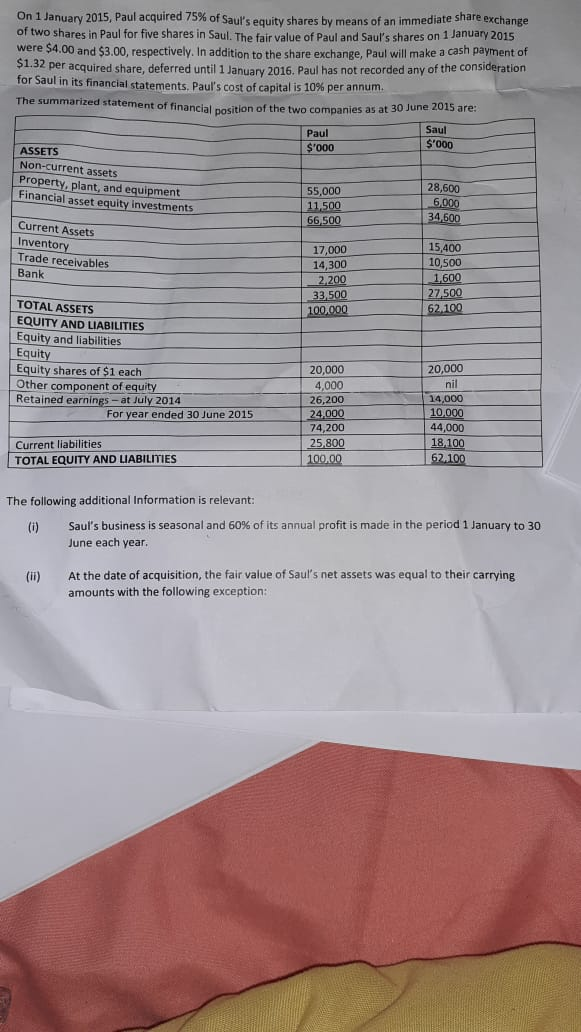

On 1 January 2015, Paul acquired 75% of Saul's equity shares by means of an immediate share exchange of two shares in Paul for five shares in Saul. The fair value of Paul and Saul's shares on 1 January 2015 were $4.00 and $3.00, respectively. In addition to the share exchange, Paul will make a cash payment of $1.32 per acquired share, deferred until 1 January 2016. Paul has not recorded any of the consideration for Saul in its financial statements. Paul's cost of capital is 10% per annum. The summarized statement of financial position of the two companies as at 30 June 2015 are: Saul $'000 Paul ASSETS $'000 Non-current assets Property, plant, and equipment Financial asset equity investments 55,000 11.500 66 500 28,600 6.000 34 600 Current Assets Inventory Trade receivables Bank 17,000 14,300 2.200 33,500 100.000 15,400 10,500 1,600 27.500 62.100 TOTAL ASSETS EQUITY AND LIABILITIES Equity and liabilities Equity Equity shares of $1 each Other component of equity Retained earnings - at July 2014 For year ended 30 June 2015 20,000 4,000 26,200 24,000 74,200 25,800 100.00 20,000 nil 14,000 10.000 44,000 18.100 62.100 Current liabilities TOTAL EQUITY AND LIABILITIES The following additional Information is relevant: (i) ( Saul's business is seasonal and 60% of its annual profit is made in the period 1 January to 30 June each year (IT) At the date of acquisition, the fair value of Saul's net assets was equal to their carrying amounts with the following exception: On 1 January 2015, Paul acquired 75% of Saul's equity shares by means of an immediate share exchange of two shares in Paul for five shares in Saul. The fair value of Paul and Saul's shares on 1 January 2015 were $4.00 and $3.00, respectively. In addition to the share exchange, Paul will make a cash payment of $1.32 per acquired share, deferred until 1 January 2016. Paul has not recorded any of the consideration for Saul in its financial statements. Paul's cost of capital is 10% per annum. The summarized statement of financial position of the two companies as at 30 June 2015 are: Saul $'000 Paul ASSETS $'000 Non-current assets Property, plant, and equipment Financial asset equity investments 55,000 11.500 66 500 28,600 6.000 34 600 Current Assets Inventory Trade receivables Bank 17,000 14,300 2.200 33,500 100.000 15,400 10,500 1,600 27.500 62.100 TOTAL ASSETS EQUITY AND LIABILITIES Equity and liabilities Equity Equity shares of $1 each Other component of equity Retained earnings - at July 2014 For year ended 30 June 2015 20,000 4,000 26,200 24,000 74,200 25,800 100.00 20,000 nil 14,000 10.000 44,000 18.100 62.100 Current liabilities TOTAL EQUITY AND LIABILITIES The following additional Information is relevant: (i) ( Saul's business is seasonal and 60% of its annual profit is made in the period 1 January to 30 June each year (IT) At the date of acquisition, the fair value of Saul's net assets was equal to their carrying amounts with the following exception