Question

On 1 January 2016, Leibhardt Ltd acquired two identical pieces of equipment for a cost of $410,000 each plus GST. It was estimated that each

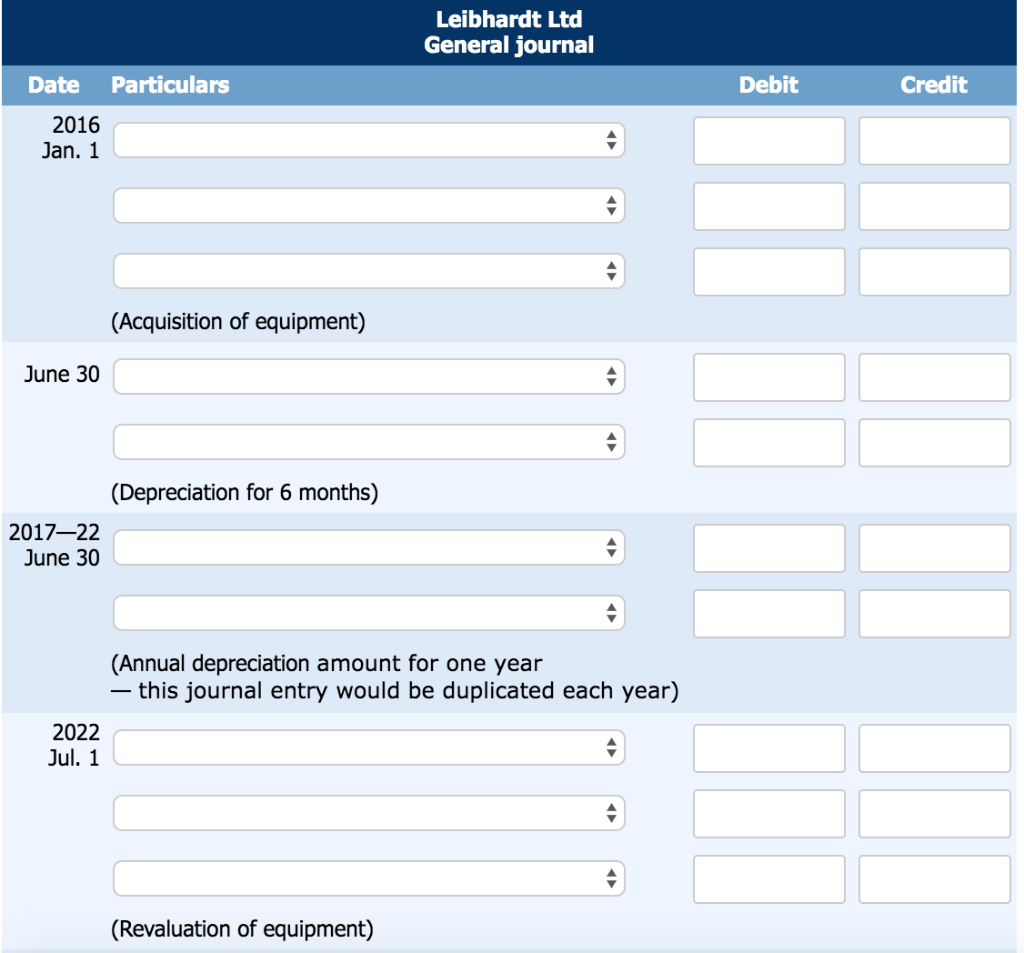

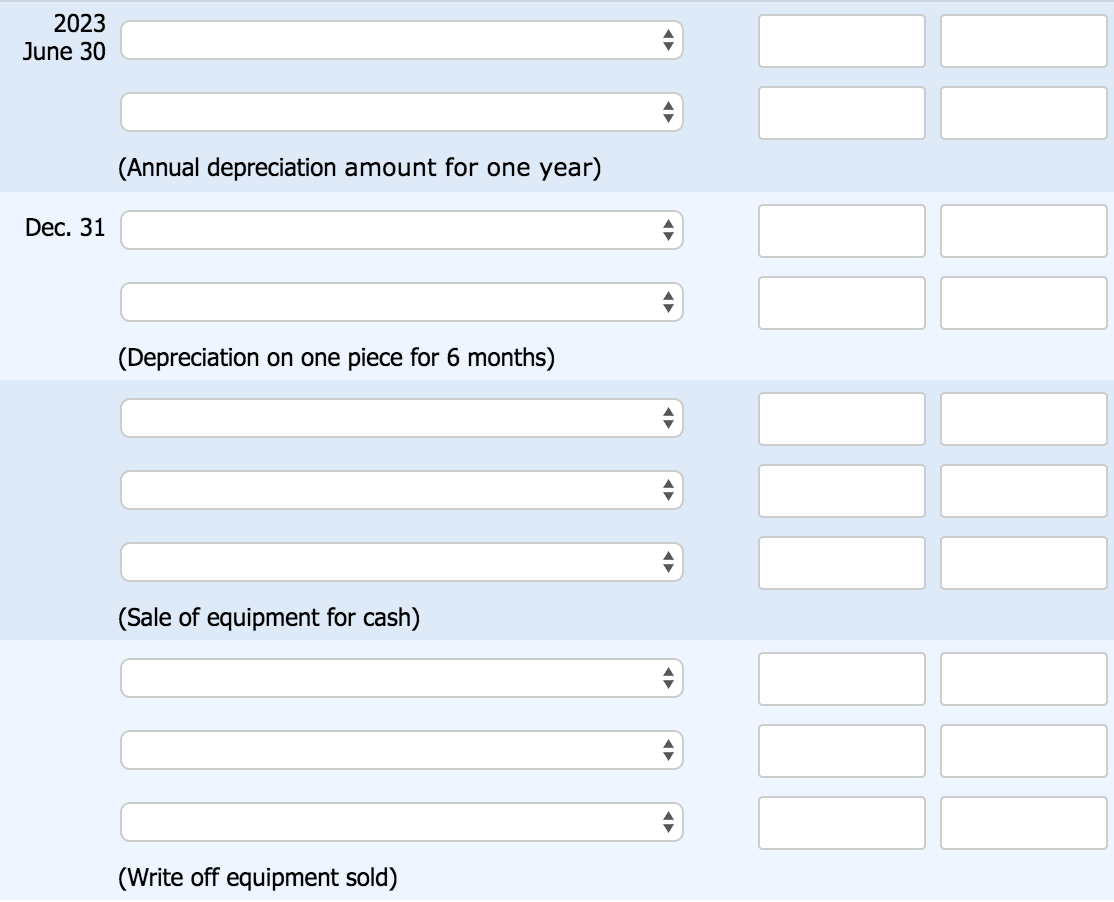

On 1 January 2016, Leibhardt Ltd acquired two identical pieces of equipment for a cost of $410,000 each plus GST. It was estimated that each item would have a useful life of 8 years and a residual value of $30,000 each. The company uses the straight-line method of depreciation and its end of reporting period is 30 June. On 1 July 2022, the company changed its accounting policy and revalued each item of equipment upwards by $46,000, based on an independent valuer's report, to fair value. There was no need to revise useful lives or residual amounts. On 31 December 2023, one of the items of equipment was sold for $91,000 cash plus GST. Prepare entries (in general journal format) in relation to the equipment from acquisition date to 31 December 2023.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started