Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 January 2017, Magnum acquired 90% of the equity share capital of Picaccio in a share exchange in which Magnum issued two (2)

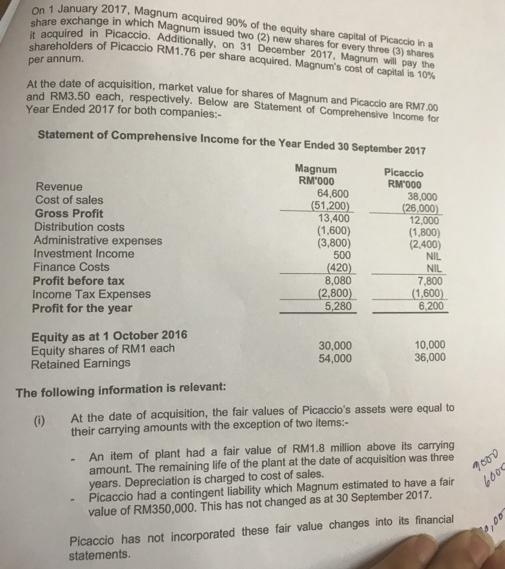

On 1 January 2017, Magnum acquired 90% of the equity share capital of Picaccio in a share exchange in which Magnum issued two (2) new shares for every three (3) shares it acquired in Picaccio. Additionally, on 31 December 2017, Magnum will pay the shareholders of Picaccio RM1.76 per share acquired. Magnum's cost of capital is 10% per annum. At the date of acquisition, market value for shares of Magnum and Picaccio are RM7.00 and RM3.50 each, respectively. Below are Statement of Comprehensive Income for Year Ended 2017 for both companies:- Statement of Comprehensive Income for the Year Ended 30 September 2017 Magnum RM'000 Revenue Cost of sales Gross Profit Distribution costs Administrative expenses Investment Income Finance Costs Profit before tax Income Tax Expenses Profit for the year Equity as at 1 October 2016 Equity shares of RM1 each Retained Earnings The following information is relevant: (10) 64,600 (51,200) 13,400 (1.600) (3,800) 500 (420) 8,080 (2,800) 5,280 30,000 54,000 Picaccio RM'000 38,000 (26,000) 12,000 (1,800) (2,400) NIL NIL 7,800 (1,600) 6,200 10,000 36,000 At the date of acquisition, the fair values of Picaccio's assets were equal to their carrying amounts with the exception of two items:- three An item of plant had a fair value of RM1.8 million above its carrying amount. The remaining life of the plant at the date of acquisition was years. Depreciation is charged to cost of sales. Picaccio had a contingent liability which Magnum estimated to have a fair value of RM350,000. This has not changed as at 30 September 2017. Picaccio has not incorporated these fair value changes into its financial statements. 9000 6000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started