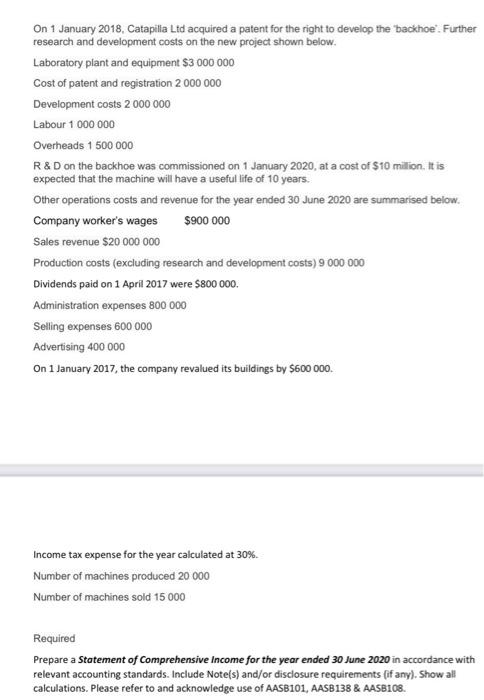

On 1 January 2018. Catapita Ltd acquired a patent for the right to develop the backhoe'. Further research and development costs on the new project shown below. Laboratory plant and equipment $3 000 000 Cost of patent and registration 2 000 000 Development costs 2 000 000 Labour 1 000 000 Overheads 1 500 000 R&D on the backhoe was commissioned on 1 January 2020, at a cost of $10 million. It is expected that the machine will have a useful life of 10 years. Other operations costs and revenue for the year ended 30 June 2020 are summarised below. Company worker's wages $900 000 Sales revenue $20 000 000 Production costs (excluding research and development costs) 9 000 000 Dividends paid on 1 April 2017 were $800 000. Administration expenses 800 000 Selling expenses 600 000 Advertising 400 000 On 1 January 2017, the company revalued its buildings by $600 000. Income tax expense for the year calculated at 30%. Number of machines produced 20 000 Number of machines sold 15 000 Required Prepare a statement of Comprehensive Income for the year ended 30 June 2020 in accordance with relevant accounting standards. Include Note(s) and/or disclosure requirements (if any). Show all calculations. Please refer to and acknowledge use of AASB101. AASB138 & AASB108. On 1 January 2018. Catapita Ltd acquired a patent for the right to develop the backhoe'. Further research and development costs on the new project shown below. Laboratory plant and equipment $3 000 000 Cost of patent and registration 2 000 000 Development costs 2 000 000 Labour 1 000 000 Overheads 1 500 000 R&D on the backhoe was commissioned on 1 January 2020, at a cost of $10 million. It is expected that the machine will have a useful life of 10 years. Other operations costs and revenue for the year ended 30 June 2020 are summarised below. Company worker's wages $900 000 Sales revenue $20 000 000 Production costs (excluding research and development costs) 9 000 000 Dividends paid on 1 April 2017 were $800 000. Administration expenses 800 000 Selling expenses 600 000 Advertising 400 000 On 1 January 2017, the company revalued its buildings by $600 000. Income tax expense for the year calculated at 30%. Number of machines produced 20 000 Number of machines sold 15 000 Required Prepare a statement of Comprehensive Income for the year ended 30 June 2020 in accordance with relevant accounting standards. Include Note(s) and/or disclosure requirements (if any). Show all calculations. Please refer to and acknowledge use of AASB101. AASB138 & AASB108