Answered step by step

Verified Expert Solution

Question

1 Approved Answer

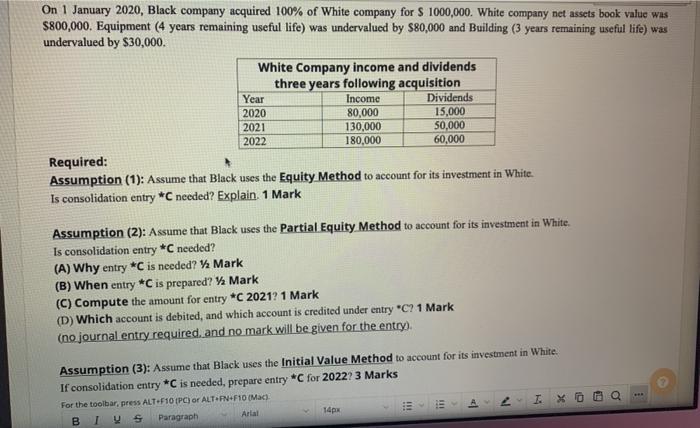

On 1 January 2020, Black company acquired 100% of White company for $ 1000,000. White company net assets book value was $800,000. Equipment (4

On 1 January 2020, Black company acquired 100% of White company for $ 1000,000. White company net assets book value was $800,000. Equipment (4 years remaining useful life) was undervalued by $80,000 and Building (3 years remaining useful life) was undervalued by $30,000. White Company income and dividends three years following acquisition Income Year 2020 2021 2022 80,000 130,000 180,000 Dividends 15,000 50,000 60,000 Required: Assumption (1): Assume that Black uses the Equity Method to account for its investment in White. Is consolidation entry *C needed? Explain. 1 Mark Assumption (2): Assume that Black uses the Partial Equity Method to account for its investment in White. Is consolidation entry *C needed? (A) Why entry *C is needed? Mark (B) When entry *C is prepared? Mark (C) Compute the amount for entry *C 2021? 1 Mark (D) Which account is debited, and which account is credited under entry "C? 1 Mark (no journal entry required, and no mark will be given for the entry). 14px Assumption (3): Assume that Black uses the Initial Value Method to account for its investment in White. If consolidation entry *C is needed, prepare entry *C for 2022? 3 Marks For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac) BIVS Paragraph Arial (11 4 2- I x P H o

Step by Step Solution

★★★★★

3.49 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

in the equity method of accounting the investment in subsid...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started