Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 January 2020, Ceria Sdn Bhd acquired 70% of the ordinary share capital of Daya Sdn Bhd, its sole subsidiary. On 1 July

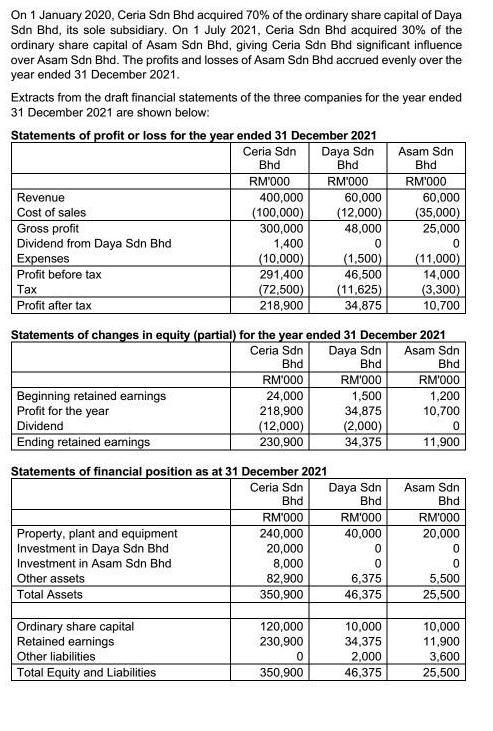

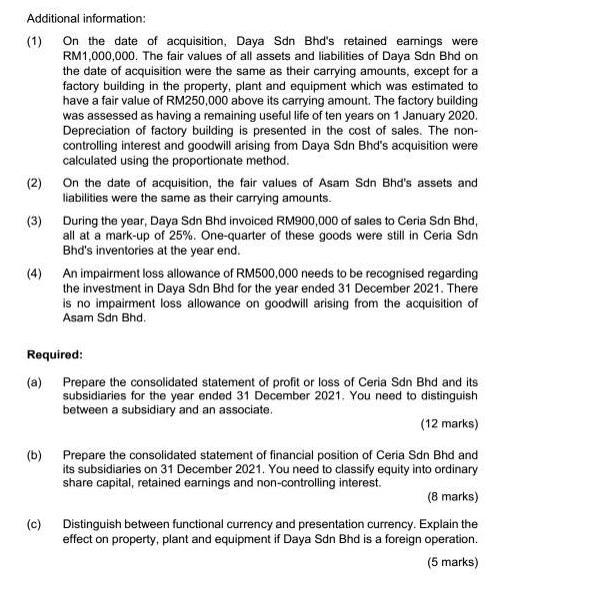

On 1 January 2020, Ceria Sdn Bhd acquired 70% of the ordinary share capital of Daya Sdn Bhd, its sole subsidiary. On 1 July 2021, Ceria Sdn Bhd acquired 30% of the ordinary share capital of Asam Sdn Bhd, giving Ceria Sdn Bhd significant influence over Asam Sdn Bhd. The profits and losses of Asam Sdn Bhd accrued evenly over the year ended 31 December 2021. Extracts from the draft financial statements of the three companies for the year ended 31 December 2021 are shown below: Statements of profit or loss for the year ended 31 December 2021 Ceria Sdn Bhd RM'000 Daya Sdn Bhd RM'000 Revenue Cost of sales Gross profit Dividend from Daya Sdn Bhd Expenses Profit before tax Tax Profit after tax Beginning retained earnings Profit for the year Dividend Ending retained earnings Property, plant and equipment Investment in Daya Sdn Bhd Investment in Asam Sdn Bhd Statements of financial position as at 31 December 2021 Ceria Sdn Bhd Other assets Total Assets 400,000 (100,000) 300,000 1,400 (10,000) 291,400 (72,500) 218,900 Ordinary share capital Retained earnings Statements of changes in equity (partial) for the year ended 31 December 2021 Ceria Sdn Bhd Other liabilities Total Equity and Liabilities RM'000 24,000 218,900 (12,000) 230,900 RM'000 240,000 20,000 8,000 82,900 350,900 60,000 (12,000) 48,000 0 (1,500) 46,500 120,000 230,900 0 350,900 (11,625) 34,875 Daya Sdn Bhd RM'000 1,500 34,875 (2,000) 34,375 Daya Sdn Bhd RM'000 40,000 0 6,375 46,375 Asam Sdn Bhd RM'000 10,000 34,375 2,000 46,375 60,000 (35,000) 25,000 0 (11,000) 14,000 (3,300) 10,700 Asam Sdn Bhd RM'000 1,200 10,700 0 11,900 Asam Sdn Bhd RM'000 20,000 0 5,500 25,500 10,000 11,900 3,600 25,500 Additional information: (1) On the date of acquisition, Daya Sdn Bhd's retained earnings were RM1,000,000. The fair values of all assets and liabilities of Daya Sdn Bhd on the date of acquisition were the same as their carrying amounts, except for a factory building in the property, plant and equipment which was estimated to have a fair value of RM250,000 above its carrying amount. The factory building was assessed as having a remaining useful life of ten years on 1 January 2020. Depreciation of factory building is presented in the cost of sales. The non- controlling interest and goodwill arising from Daya Sdn Bhd's acquisition were calculated using the proportionate method. (2) (3) On the date of acquisition, the fair values of Asam Sdn Bhd's assets and liabilities were the same as their carrying amounts. During the year, Daya Sdn Bhd invoiced RM900,000 of sales to Ceria Sdn Bhd, all at a mark-up of 25%. One-quarter of these goods were still in Ceria Sdn Bhd's inventories at the year end. (4) An impairment loss allowance of RM500,000 needs to be recognised regarding the investment in Daya Sdn Bhd for the year ended 31 December 2021. There is no impairment loss allowance on goodwill arising from the acquisition of Asam Sdn Bhd. Required: (a) Prepare the consolidated statement of profit or loss of Ceria Sdn Bhd and its subsidiaries for the year ended 31 December 2021. You need to distinguish between a subsidiary and an associate. (12 marks) (c) (b) Prepare the consolidated statement of financial position of Ceria Sdn Bhd and its subsidiaries on 31 December 2021. You need to classify equity into ordinary share capital, retained earnings and non-controlling interest. (8 marks) Distinguish between functional currency and presentation currency. Explain the effect on property, plant and equipment if Daya Sdn Bhd is a foreign operation. (5 marks)

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Ceria Sdn Bhd Consolidated Statement of Financial Position As at December 31 2021 Assets PPE Other A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started