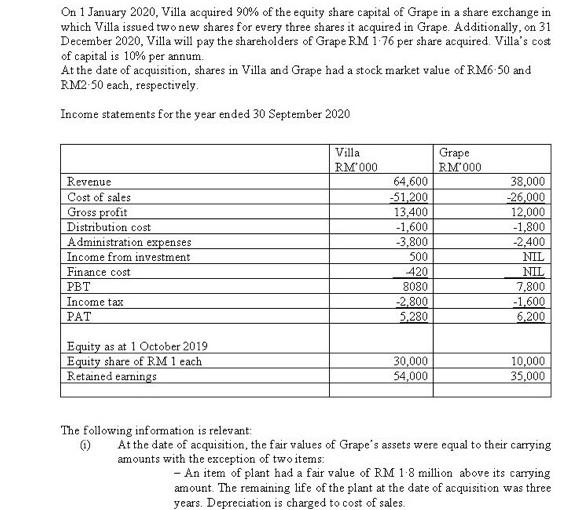

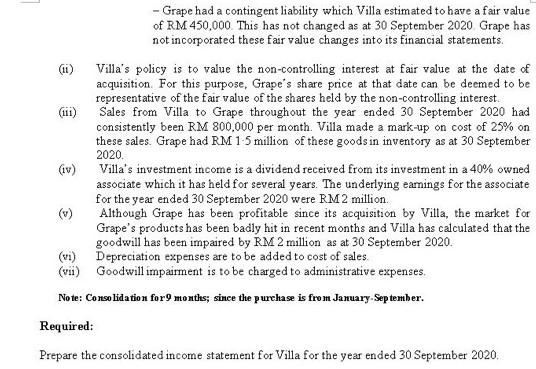

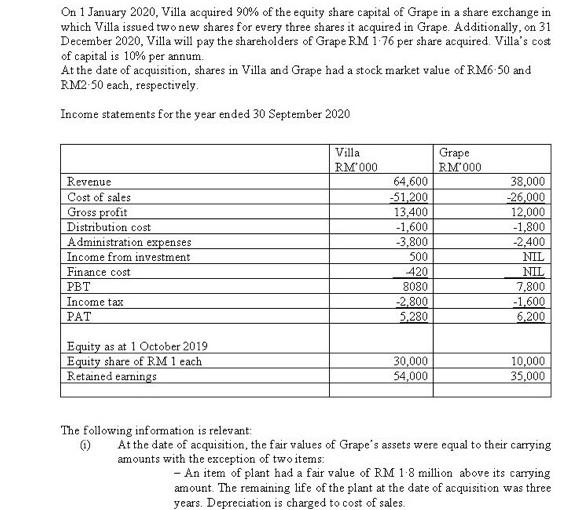

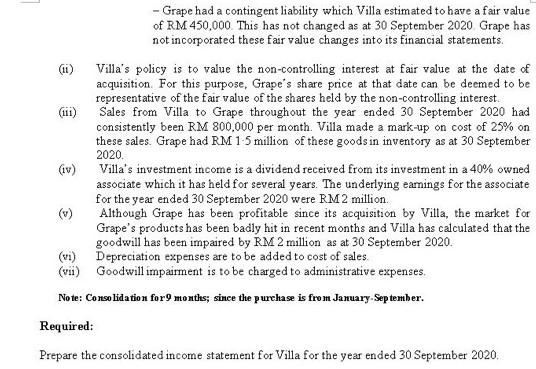

On 1 January 2020, Villa acquired 90% of the equity share capital of Grape in a share exchange in which Villa issued two new shares for every three shares it acquired in Grape. Additionally, on 31 December 2020, Villa will pay the shareholders of Grape RM 1 76 per share acquired. Villa's cost of capital is 10% per annum At the date of acquisition, shares in Villa and Grape had a stock market value of RM6-50 and RM2.50 each, respectively, Income statements for the year ended 30 September 2020 Villa RM 000 Revenue Cost of sales Gross profit Distribution cost Administration expenses Income from investment Finance cost PBT Income tax PAT Grape RM000 64,600 -51,200 13,400 -1,600 -3,800 500 420 8080 -2.800 5.280 38.000 -26,000 12,000 -1,800 -2,400 NIL NIL 7,800 -1.600 6,200 Equity as at 1 October 2019 Equity share of RM 1 each Retained earnings 30,000 54,000 10,000 35,000 The following information is relevant 0 At the date of acquisition, the fair values of Grape's assets were equal to their carrying amounts with the exception of two items - An item of plant had a fair value of RM 1.8 million above its carrying amount. The remaining life of the plant at the date of acquisition was three years. Depreciation is charged to cost of sales. (11) - Grape had a contingent liability which Villa estimated to have a fair value of RM 450,000 This has not changed as at 30 September 2020 Grape has not incorporated these fair value changes into its financial statements Villa's policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose, Grape's share price at that date can be deemed to be representative of the fair value of the shares held by the non-controlling interest. Sales from Villa to Grape throughout the year ended 30 September 2020 had consistently been RM 800,000 per month. Villa made a mark-up on cost of 25% on these sales. Grape had RM 15 million of these goods in inventory as at 30 September 2020 (iv) Villa's investment income is a dividend received from its investment in a 40% owned associate which it has held for several years. The underlying earnings for the associate for the year ended 30 September 2020 were RM 2 million Although Grape has been profitable since its acquisition by Villa, the market for Grape's products has been badly hit in recent months and Villa has calculated that the goodwill has been impaired by RM 2 million as at 30 September 2020. (vi) Depreciation expenses are to be added to cost of sales. (vii) Goodwill impairment is to be charged to administrative expenses. Note: Consolidation for9 months; since the purchase is from January. September. Required: Prepare the consolidated income statement for Villa for the year ended 30 September 2020 v) On 1 January 2020, Villa acquired 90% of the equity share capital of Grape in a share exchange in which Villa issued two new shares for every three shares it acquired in Grape. Additionally, on 31 December 2020, Villa will pay the shareholders of Grape RM 1 76 per share acquired. Villa's cost of capital is 10% per annum At the date of acquisition, shares in Villa and Grape had a stock market value of RM6-50 and RM2.50 each, respectively, Income statements for the year ended 30 September 2020 Villa RM 000 Revenue Cost of sales Gross profit Distribution cost Administration expenses Income from investment Finance cost PBT Income tax PAT Grape RM000 64,600 -51,200 13,400 -1,600 -3,800 500 420 8080 -2.800 5.280 38.000 -26,000 12,000 -1,800 -2,400 NIL NIL 7,800 -1.600 6,200 Equity as at 1 October 2019 Equity share of RM 1 each Retained earnings 30,000 54,000 10,000 35,000 The following information is relevant 0 At the date of acquisition, the fair values of Grape's assets were equal to their carrying amounts with the exception of two items - An item of plant had a fair value of RM 1.8 million above its carrying amount. The remaining life of the plant at the date of acquisition was three years. Depreciation is charged to cost of sales. (11) - Grape had a contingent liability which Villa estimated to have a fair value of RM 450,000 This has not changed as at 30 September 2020 Grape has not incorporated these fair value changes into its financial statements Villa's policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose, Grape's share price at that date can be deemed to be representative of the fair value of the shares held by the non-controlling interest. Sales from Villa to Grape throughout the year ended 30 September 2020 had consistently been RM 800,000 per month. Villa made a mark-up on cost of 25% on these sales. Grape had RM 15 million of these goods in inventory as at 30 September 2020 (iv) Villa's investment income is a dividend received from its investment in a 40% owned associate which it has held for several years. The underlying earnings for the associate for the year ended 30 September 2020 were RM 2 million Although Grape has been profitable since its acquisition by Villa, the market for Grape's products has been badly hit in recent months and Villa has calculated that the goodwill has been impaired by RM 2 million as at 30 September 2020. (vi) Depreciation expenses are to be added to cost of sales. (vii) Goodwill impairment is to be charged to administrative expenses. Note: Consolidation for9 months; since the purchase is from January. September. Required: Prepare the consolidated income statement for Villa for the year ended 30 September 2020 v)