Question

On 1 January 2023, Mr Lim set up ABC Pte Ltd to manufacture and sell face masks. He manages the company single-handedly and at the

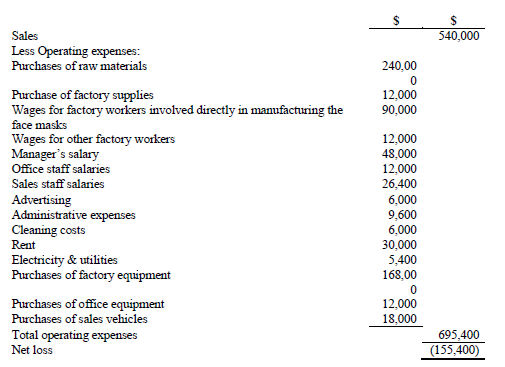

On 1 January 2023, Mr Lim set up ABC Pte Ltd to manufacture and sell face masks. He manages the company single-handedly and at the end of the year, he prepared the following income statement for the year.

Although Mr Lim is disappointed with the result, he is certain that the statement is not correctly prepared. However, he is unable to identify the error. Hence, he approached you for help to review the statement.

To help you in your review, Mr Lim has also provided the following additional information: (i)The factory occupies 80% of the rented building, the sales area 15% and the administration area 5%. (ii)All the companys non-current assets are estimated to have a useful life of 5years and no salvage value at the end of their useful life. (iii)Mr Lim spends 50% of his time as factory manager and the remaining time equally on sales and general administration. (iv)Electricity & utilities costs are consumed almost entirely by the factory. (v)Cleaning costs are to be allocated to factory, sales and general administration based on the areas occupied.

At 31 December 2023, the following inventories existed: Raw material: $24,000 Work in process: $48,000 Finished goods: $1,800

- Based on the information provided, determine the following: (i) Direct material used. (ii) Total manufacturing cost. (iii) Cost of goods manufactured. (iv) Cost of goods sold. (v) Gross profit. (vi) Sales and administrative expenses. (vii) Net profit. Show all workings.

2. Identify the mistake made by Mr Lim with regards to his understanding of costs when computing ABC Pte Ltd's net profit for the year ending 31 December 2023. Explain why this is a mistake.

3. Assuming ABC Pte Ltd uses normal costing and applies manufacturing overhead based on direct labour cost and if the pre-determined manufacturing overhead rate is 135%, determine the cost of goods manufactured. Compute the MOH variance and pass the journal entry to close off the Manufacturing Overhead Control account assuming that the MOH variance is immaterial.

Sales Less Operating expenses: Purchases of raw materials Purchase of factory supplies Wages for factory workers involved directly in manufacturing the face masks Wages for other factory workers Manager's salary Office staff salaries Sales staff salaries Advertising Administrative expenses Cleaning costs Rent Electricity \& utilities Purchases of factory equipment Purchases of office equipment Purchases of sales vehicles Total operating expenses Net loss \begin{tabular}{rr} $ & $ \\ & 540,000 \\ 240,00 & \\ 0 & \\ 12,000 & \\ 90,000 & \\ & \\ 12,000 & \\ 48,000 & \\ 12,000 & \\ 26,400 & \\ 6,000 & \\ 9,600 & \\ 6,000 & \\ 30,000 & \\ 5,400 & \\ 168,00 & \\ 0 & \\ 12,000 & \\ 18,000 & \\ & 695,400 \\ \hline & (155,400) \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started