Answered step by step

Verified Expert Solution

Question

1 Approved Answer

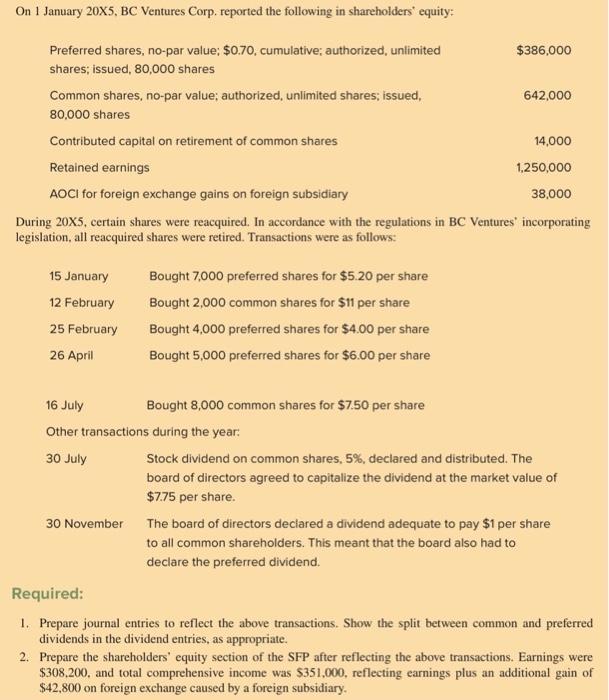

On 1 January 20X5, BC Ventures Corp. reported the following in shareholders' equity: Preferred shares, no-par value; $0.70, cumulative; authorized, unlimited shares; issued, 80,000

On 1 January 20X5, BC Ventures Corp. reported the following in shareholders' equity: Preferred shares, no-par value; $0.70, cumulative; authorized, unlimited shares; issued, 80,000 shares Common shares, no-par value; authorized, unlimited shares; issued, 80,000 shares 15 January 12 February 25 February 26 April Contributed capital on retirement of common shares Retained earnings AOCI for foreign exchange gains on foreign subsidiary During 20X5, certain shares were reacquired. In accordance with the regulations in BC Ventures incorporating legislation, all reacquired shares were retired. Transactions were as follows: Bought 7,000 preferred shares for $5.20 per share Bought 2,000 common shares for $11 per share Bought 4,000 preferred shares for $4.00 per share Bought 5,000 preferred shares for $6.00 per share 16 July Other transactions 30 July 30 November $386,000 642,000 14,000 1,250,000 38,000 Bought 8,000 common shares for $7.50 per share during the year: Stock dividend on common shares, 5%, declared and distributed. The board of directors agreed to capitalize the dividend at the market value of $7.75 per share. The board of directors declared a dividend adequate to pay $1 per share to all common shareholders. This meant that the board also had to declare the preferred dividend. Required: 1. Prepare journal entries to reflect the above transactions. Show the split between common and preferred dividends in the dividend entries, as appropriate. 2. Prepare the shareholders' equity section of the SFP after reflecting the above transactions. Earnings were $308.200, and total comprehensive income was $351,000, reflecting earnings plus an additional gain of $42,800 on foreign exchange caused by a foreign subsidiary.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started