Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 January 20x6, F Limited commenced business selling goods on hire purchase. Under the terms of the agreements, an initial deposit of 20

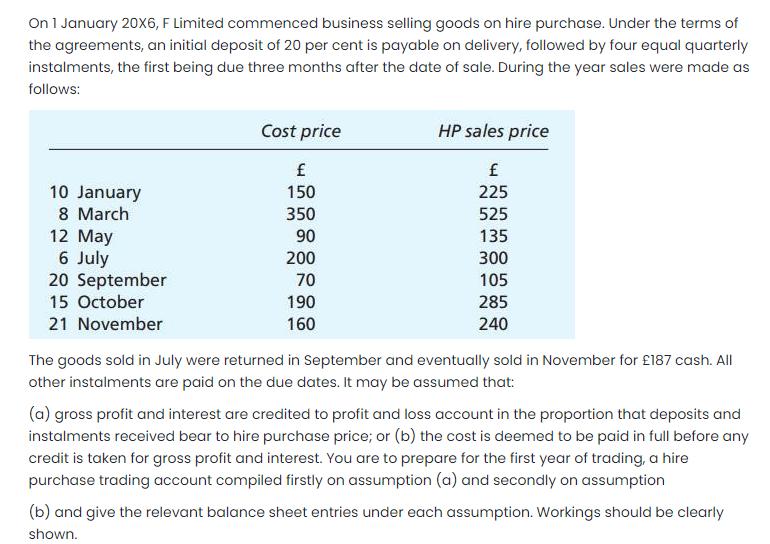

On 1 January 20x6, F Limited commenced business selling goods on hire purchase. Under the terms of the agreements, an initial deposit of 20 per cent is payable on delivery, followed by four equal quarterly instalments, the first being due three months after the date of sale. During the year sales were made as follows: Cost price HP sales price 10 January 150 225 8 March 350 525 12 May 6 July 20 September 90 135 200 300 70 105 15 October 190 285 21 November 160 240 The goods sold in July were returned in September and eventually sold in November for 187 cash. All other instalments are paid on the due dates. It may be assumed that: (a) gross profit and interest are credited to profit and loss account in the proportion that deposits and instalments received bear to hire purchase price; or (b) the cost is deemed to be paid in full before any credit is taken for gross profit and interest. You are to prepare for the first year of trading, a hire purchase trading account compiled firstly on assumption (a) and secondly on assumption (b) and give the relevant balance sheet entries under each assumption. Workings should be clearly shown.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Cost HP sales price Cash collected Balance Balance of profit Earned Unearned Cost Jan 10 150 225 180 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started