Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 January of the year X company ALPHA acquires 100% of the share capital of company BETA. The cost of the investment is

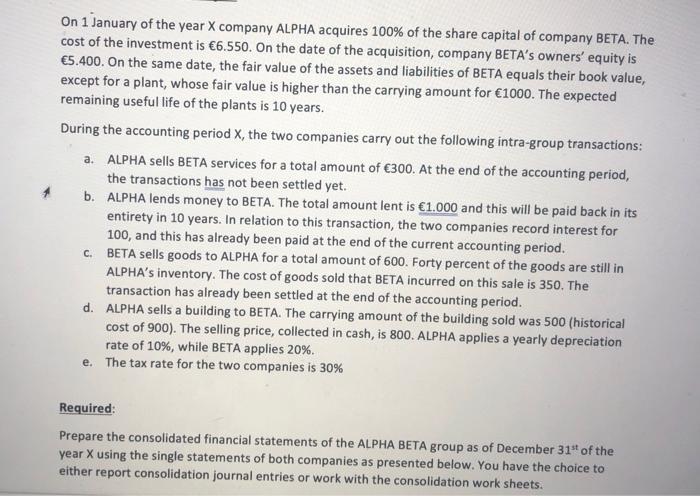

On 1 January of the year X company ALPHA acquires 100% of the share capital of company BETA. The cost of the investment is 6.550. On the date of the acquisition, company BETA's owners' equity is 5.400. On the same date, the fair value of the assets and liabilities of BETA equals their book value, except for a plant, whose fair value is higher than the carrying amount for 1000. The expected remaining useful life of the plants is 10 years. During the accounting period X, the two companies carry out the following intra-group transactions: a. ALPHA sells BETA services for a total amount of 300. At the end of the accounting period, the transactions has not been settled yet. b. ALPHA lends money to BETA. The total amount lent is 1.000 and this will be paid back in its entirety in 10 years. In relation to this transaction, the two companies record interest for 100, and this has already been paid at the end of the current accounting period. c. BETA sells goods to ALPHA for a total amount of 600. Forty percent of the goods are still in ALPHA's inventory. The cost of goods sold that BETA incurred on this sale is 350. The transaction has already been settled at the end of the accounting period. d. ALPHA sells a building to BETA. The carrying amount of the building sold was 500 (historical cost of 900). The selling price, collected in cash, is 800. ALPHA applies a yearly depreciation rate of 10%, while BETA applies 20%. e. The tax rate for the two companies is 30% Required: Prepare the consolidated financial statements of the ALPHA BETA group as of December 31st of the year X using the single statements of both companies as presented below. You have the choice to either report consolidation journal entries or work with the consolidation work sheets.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started