Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 July 2010 BNM, a listed entity, had 5,000,000 R1 ordinary shares in issue. On 1 September 2010, BNM made a 1 for

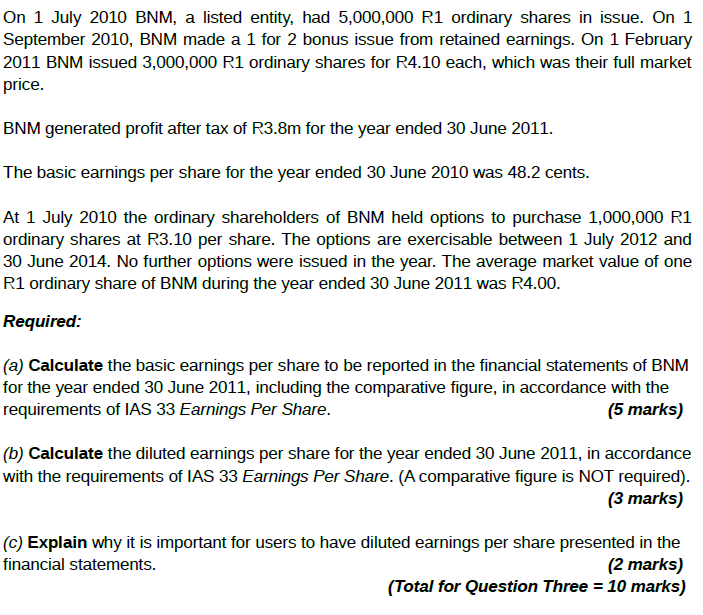

On 1 July 2010 BNM, a listed entity, had 5,000,000 R1 ordinary shares in issue. On 1 September 2010, BNM made a 1 for 2 bonus issue from retained earnings. On 1 February 2011 BNM issued 3,000,000 R1 ordinary shares for R4.10 each, which was their full market price. BNM generated profit after tax of R3.8m for the year ended 30 June 2011. The basic earnings per share for the year ended 30 June 2010 was 48.2 cents. At 1 July 2010 the ordinary shareholders of BNM held options to purchase 1,000,000 R1 ordinary shares at R3.10 per share. The options are exercisable between 1 July 2012 and 30 June 2014. No further options were issued in the year. The average market value of one R1 ordinary share of BNM during the year ended 30 June 2011 was R4.00. Required: (a) Calculate the basic earnings per share to be reported in the financial statements of BNM for the year ended 30 June 2011, including the comparative figure, in accordance with the requirements of IAS 33 Earnings Per Share. (5 marks) (b) Calculate the diluted earnings per share for the year ended 30 June 2011, in accordance with the requirements of IAS 33 Earnings Per Share. (A comparative figure is NOT required). (3 marks) (c) Explain why it is important for users to have diluted earnings per share presented in the financial statements. (2 marks) (Total for Question Three = 10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a Basic Earnings per Share BEPS 1 Weighted Average Number of Shares WANS Prebonus issue July 1 2010 to Aug 31 2010 5000000 shares 2 months 12 m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started