Answered step by step

Verified Expert Solution

Question

1 Approved Answer

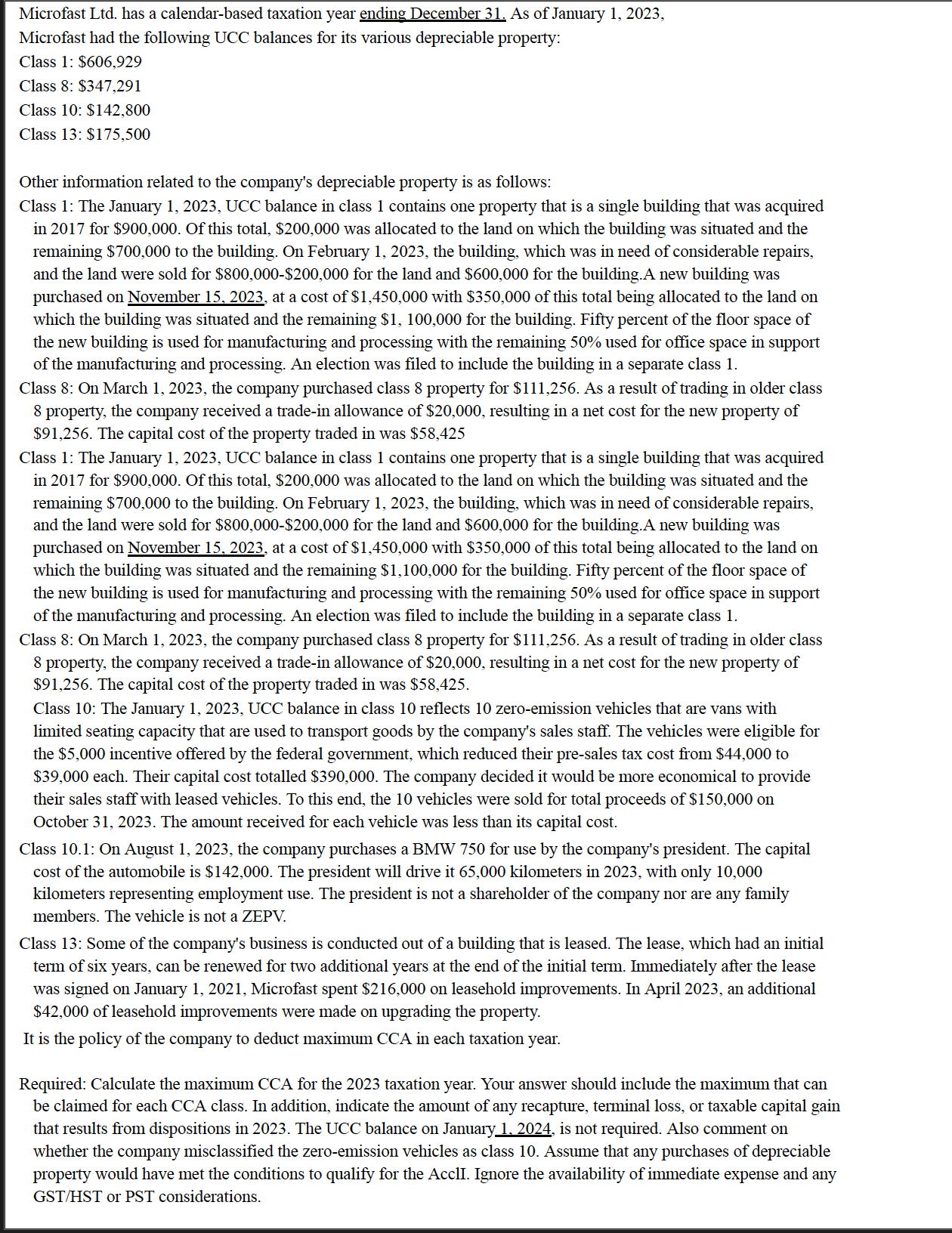

Microfast Ltd. has a calendar-based taxation year ending December 31. As of January 1, 2023, Microfast had the following UCC balances for its various

Microfast Ltd. has a calendar-based taxation year ending December 31. As of January 1, 2023, Microfast had the following UCC balances for its various depreciable property: Class 1: $606,929 Class 8: $347,291 Class 10: $142,800 Class 13: $175,500 Other information related to the company's depreciable property is as follows: Class 1: The January 1, 2023, UCC balance in class 1 contains one property that is a single building that was acquired in 2017 for $900,000. Of this total, $200,000 was allocated to the land on which the building was situated and the remaining $700,000 to the building. On February 1, 2023, the building, which was in need of considerable repairs, and the land were sold for $800,000-$200,000 for the land and $600,000 for the building.A new building was purchased on November 15, 2023, at a cost of $1,450,000 with $350,000 of this total being allocated to the land on which the building was situated and the remaining $1, 100,000 for the building. Fifty percent of the floor space of the new building is used for manufacturing and processing with the remaining 50% used for office space in support of the manufacturing and processing. An election was filed to include the building in a separate class 1. Class 8: On March 1, 2023, the company purchased class 8 property for $111,256. As a result of trading in older class 8 property, the company received a trade-in allowance of $20,000, resulting in a net cost for the new property of $91,256. The capital cost of the property traded in was $58,425 Class 1: The January 1, 2023, UCC balance in class 1 contains one property that is a single building that was acquired in 2017 for $900,000. Of this total, $200,000 was allocated to the land on which the building was situated and the remaining $700,000 to the building. On February 1, 2023, the building, which was in need of considerable repairs, and the land were sold for $800,000-$200,000 for the land and $600,000 for the building.A new building was purchased on November 15, 2023, at a cost of $1,450,000 with $350,000 of this total being allocated to the land on which the building was situated and the remaining $1,100,000 for the building. Fifty percent of the floor space of the new building is used for manufacturing and processing with the remaining 50% used for office space in support of the manufacturing and processing. An election was filed to include the building in a separate class 1. Class 8: On March 1, 2023, the company purchased class 8 property for $111,256. As a result of trading in older class 8 property, the company received a trade-in allowance of $20,000, resulting in a net cost for the new property of $91,256. The capital cost of the property traded in was $58,425. Class 10: The January 1, 2023, UCC balance in class 10 reflects 10 zero-emission vehicles that are vans with limited seating capacity that are used to transport goods by the company's sales staff. The vehicles were eligible for the $5,000 incentive offered by the federal government, which reduced their pre-sales tax cost from $44,000 to $39,000 each. Their capital cost totalled $390,000. The company decided it would be more economical to provide their sales staff with leased vehicles. To this end, the 10 vehicles were sold for total proceeds of $150,000 on October 31, 2023. The amount received for each vehicle was less than its capital cost. Class 10.1: On August 1, 2023, the company purchases a BMW 750 for use by the company's president. The capital cost of the automobile is $142,000. The president will drive it 65,000 kilometers in 2023, with only 10,000 kilometers representing employment use. The president is not a shareholder of the company nor are any family members. The vehicle is not a ZEPV. Class 13: Some of the company's business is conducted out of a building that is leased. The lease, which had an initial term of six years, can be renewed for two additional years at the end of the initial term. Immediately after the lease was signed on January 1, 2021, Microfast spent $216,000 on leasehold improvements. In April 2023, an additional $42,000 of leasehold improvements were made on upgrading the property. It is the policy of the company to deduct maximum CCA in each taxation year. Required: Calculate the maximum CCA for the 2023 taxation year. Your answer should include the maximum that can be claimed for each CCA class. In addition, indicate the amount of any recapture, terminal loss, or taxable capital gain that results from dispositions in 2023. The UCC balance on January 1, 2024, is not required. Also comment on whether the company misclassified the zero-emission vehicles as class 10. Assume that any purchases of depreciable property would have met the conditions to qualify for the AcclI. Ignore the availability of immediate expense and any GST/HST or PST considerations.

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the maximum Capital Cost Allowance CCA for the 2023 taxation year and determine any recapture terminal loss or taxable capital gain resul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started