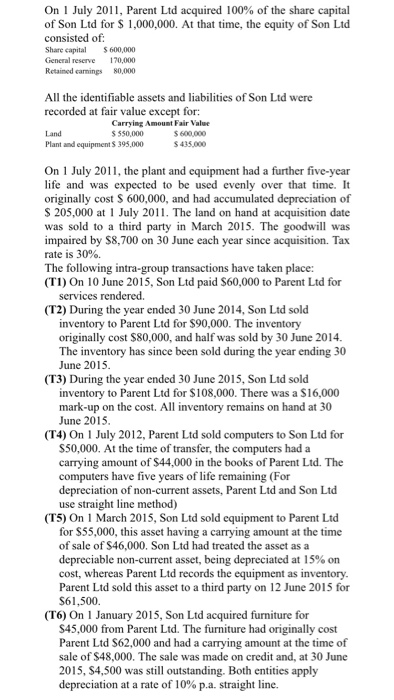

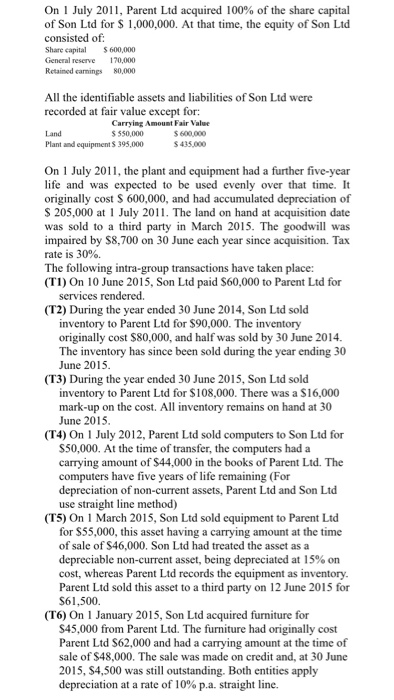

On 1 July 2011, Parent Ltd acquired 100% of the share capital of Son Ltd for $1,000,000. At that time, the equity of Son Ltd All the identifiable assets and liabilities of Son Ltd were recorded at fair value except for: On 1 July 2011, the plant and equipment had a further five-year life and was expected to be used evenly over that time. It originally cost $ 600,000, and had accumulated depreciation of $ 205,000 at July 2011. The land on hand at acquisition date was sold to a third party in March 2015. The goodwill was impaired by $8, 700 on 30 June each year since acquisition. Ta rate is 30% The following intra-group transactions have taken place services rendered. On 10 June 2015, Son, Ltd paid $60,000 to Parent Ltd for services rendered. During the year ended 30 June 2014, Son Ltd sold inventory to Parent Ltd for $90,000. The inventory originally cost $80,000, and half was sold by 30 June 2014 The inventory has since been sold during the year ending 30 June 2015 During the year ended 30 June 2015, Son Ltd sold inventory to Parent Ltd for $108,000. There was a $16,000 mark-up on the cost. All inventory remains on hand at 30 June 2015 On 1 July 2012, Parent Ltd sold computers to Son Ltd for $50,000. At the time of transfer, the computers had a carrying amount of $44,000 in the books of Parent Ltd. The computers have five years of life remaining (For depreciation of non-current assets, Parent Ltd and Son Ltd use straight line method) On 1 March 2015, Son Ltd sold equipment to Parent Ltd for $55,000, this asset having a carrying amount at the time of sale of $46,000. Son Ltd had treated the asset as a depreciable non-current asset, being depreciated at 15% on cost, whereas Parent Ltd records the equipment as inventory. Parent Ltd sold this asset to a third party on 12 June 2015 for $61, 500 On 1 January 2015, Son Ltd acquired furniture for $45,000 from Parent Ltd. The furniture had originally cost Parent Ltd $62,000 and had a carrying amount at the time of sale of $48.000. The sale was made on credit and, at 30 June 2015, $4, 500 was still outstanding. Both entities apply depreciation at a rate of 10% a. straight line. On 1 July 2011, Parent Ltd acquired 100% of the share capital of Son Ltd for $1,000,000. At that time, the equity of Son Ltd All the identifiable assets and liabilities of Son Ltd were recorded at fair value except for: On 1 July 2011, the plant and equipment had a further five-year life and was expected to be used evenly over that time. It originally cost $ 600,000, and had accumulated depreciation of $ 205,000 at July 2011. The land on hand at acquisition date was sold to a third party in March 2015. The goodwill was impaired by $8, 700 on 30 June each year since acquisition. Ta rate is 30% The following intra-group transactions have taken place services rendered. On 10 June 2015, Son, Ltd paid $60,000 to Parent Ltd for services rendered. During the year ended 30 June 2014, Son Ltd sold inventory to Parent Ltd for $90,000. The inventory originally cost $80,000, and half was sold by 30 June 2014 The inventory has since been sold during the year ending 30 June 2015 During the year ended 30 June 2015, Son Ltd sold inventory to Parent Ltd for $108,000. There was a $16,000 mark-up on the cost. All inventory remains on hand at 30 June 2015 On 1 July 2012, Parent Ltd sold computers to Son Ltd for $50,000. At the time of transfer, the computers had a carrying amount of $44,000 in the books of Parent Ltd. The computers have five years of life remaining (For depreciation of non-current assets, Parent Ltd and Son Ltd use straight line method) On 1 March 2015, Son Ltd sold equipment to Parent Ltd for $55,000, this asset having a carrying amount at the time of sale of $46,000. Son Ltd had treated the asset as a depreciable non-current asset, being depreciated at 15% on cost, whereas Parent Ltd records the equipment as inventory. Parent Ltd sold this asset to a third party on 12 June 2015 for $61, 500 On 1 January 2015, Son Ltd acquired furniture for $45,000 from Parent Ltd. The furniture had originally cost Parent Ltd $62,000 and had a carrying amount at the time of sale of $48.000. The sale was made on credit and, at 30 June 2015, $4, 500 was still outstanding. Both entities apply depreciation at a rate of 10% a. straight line