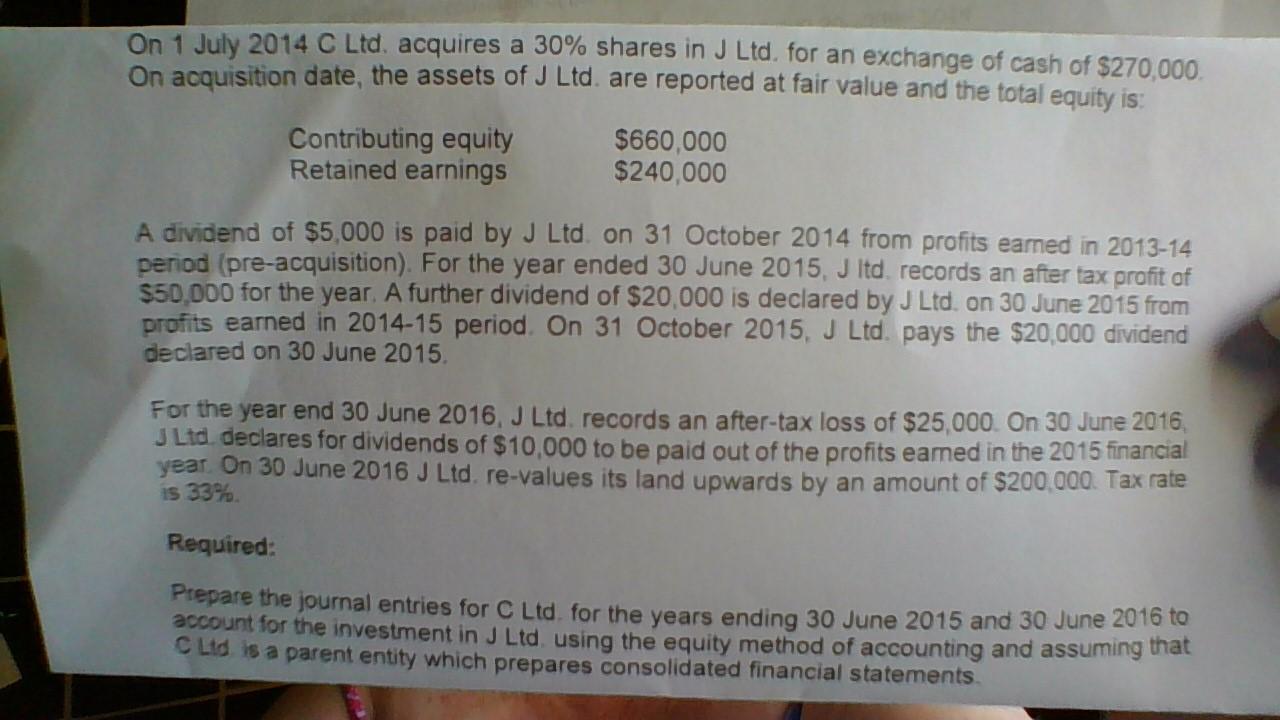

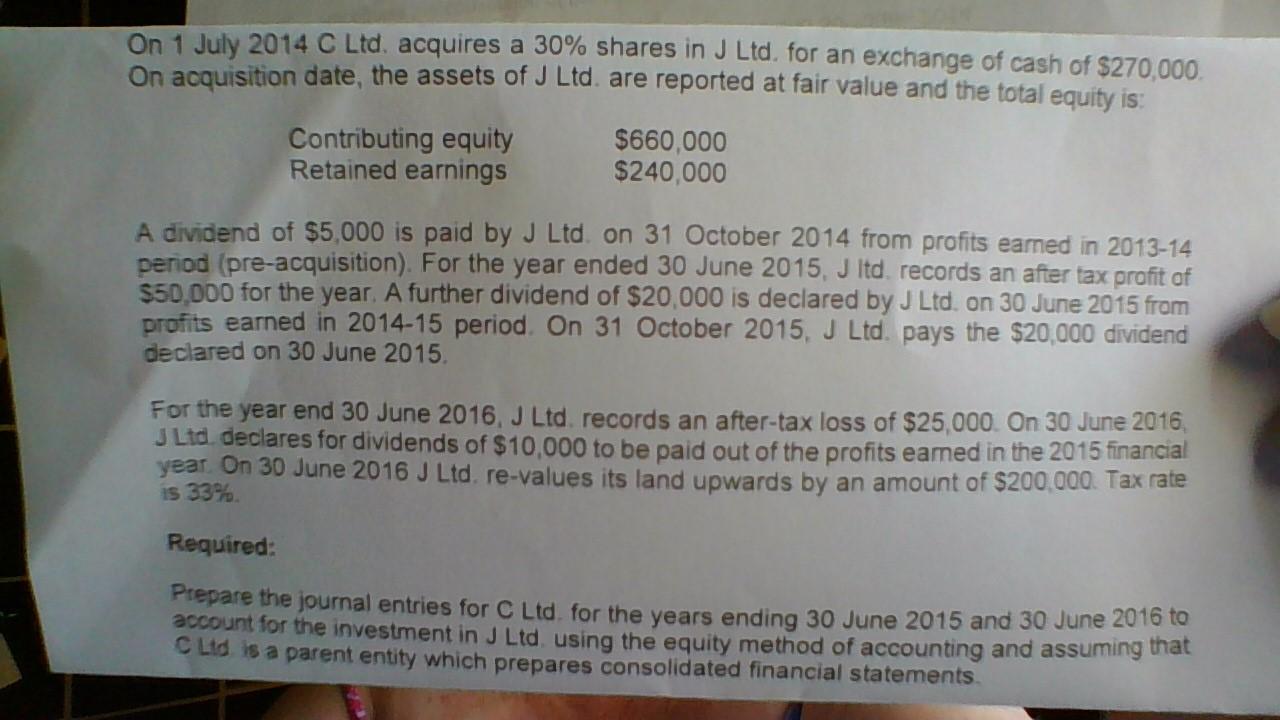

On 1 July 2014C Ltd. acquires a 30% shares in J Ltd. for an exchange of cash of $270,000. On acquisition date, the assets of JLtd. are reported at fair value and the total equity is: A dividend of $5,000 is paid by J Ltd. on 31 October 2014 from profits eamed in 2013-14 period (pre-acquisition). For the year ended 30 June 2015, J ltd. records an after tax profit of $50,000 for the year. A further dividend of $20,000 is declared by JLtd. on 30 June 2015 from profits earned in 2014-15 period. On 31 October 2015, J Ltd. pays the $20,000 dividend declared on 30 June 2015 . For the year end 30 June 2016, J Ltd. records an after-tax loss of $25,000. On 30 June 2016 J Ltd declares for dividends of $10,000 to be paid out of the profits eamed in the 2015 financial year. On 30 June 2016J Ltd. re-values its land upwards by an amount of $200,000. Tax rate is 33%. Required: Prepare the journal entries for C Ltd. for the years ending 30 June 2015 and 30 June 2016 to account for the investment in JLtd. using the equity method of accounting and assuming that C Lid is a parent entity which prepares consolidated financial statements. On 1 July 2014C Ltd. acquires a 30% shares in J Ltd. for an exchange of cash of $270,000. On acquisition date, the assets of JLtd. are reported at fair value and the total equity is: A dividend of $5,000 is paid by J Ltd. on 31 October 2014 from profits eamed in 2013-14 period (pre-acquisition). For the year ended 30 June 2015, J ltd. records an after tax profit of $50,000 for the year. A further dividend of $20,000 is declared by JLtd. on 30 June 2015 from profits earned in 2014-15 period. On 31 October 2015, J Ltd. pays the $20,000 dividend declared on 30 June 2015 . For the year end 30 June 2016, J Ltd. records an after-tax loss of $25,000. On 30 June 2016 J Ltd declares for dividends of $10,000 to be paid out of the profits eamed in the 2015 financial year. On 30 June 2016J Ltd. re-values its land upwards by an amount of $200,000. Tax rate is 33%. Required: Prepare the journal entries for C Ltd. for the years ending 30 June 2015 and 30 June 2016 to account for the investment in JLtd. using the equity method of accounting and assuming that C Lid is a parent entity which prepares consolidated financial statements