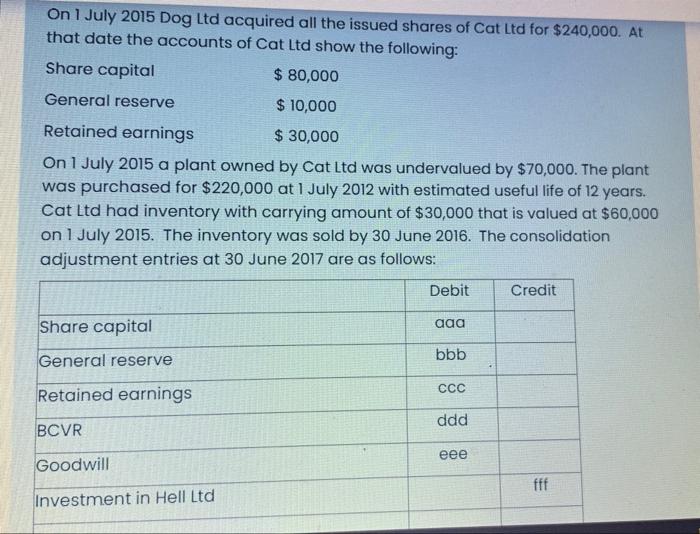

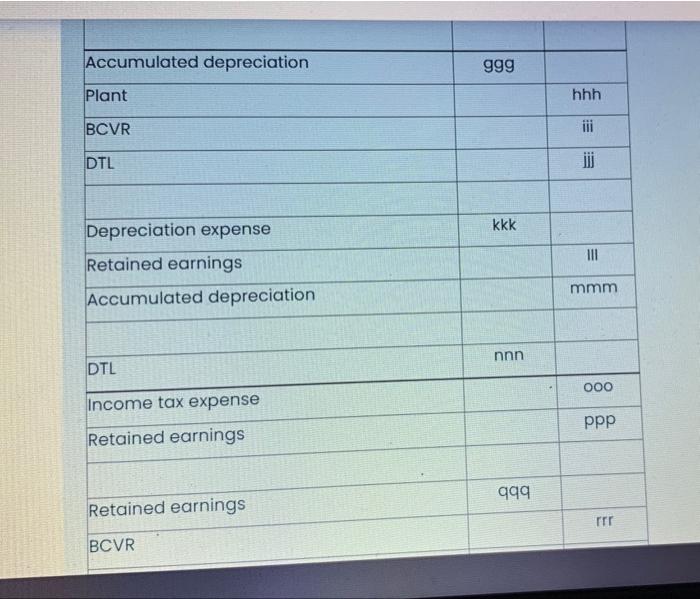

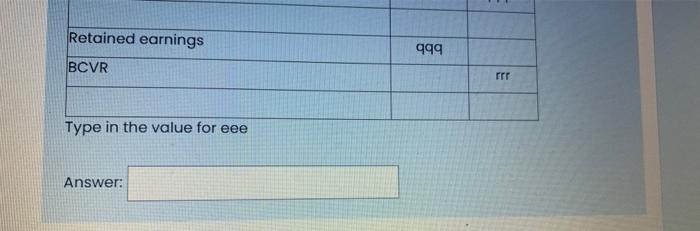

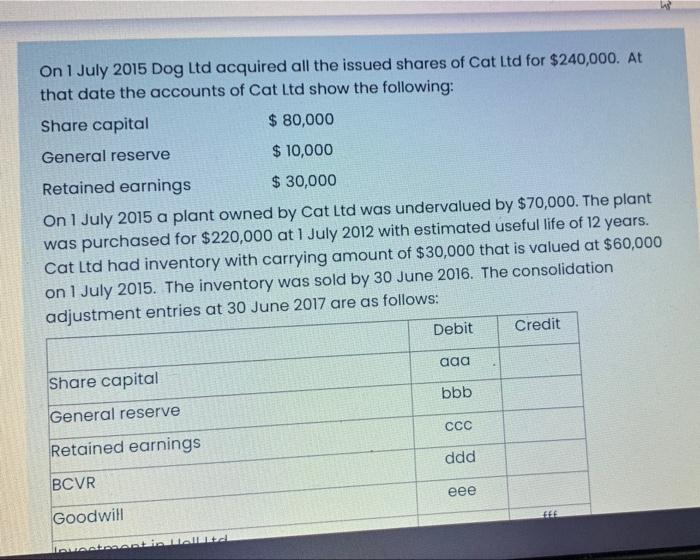

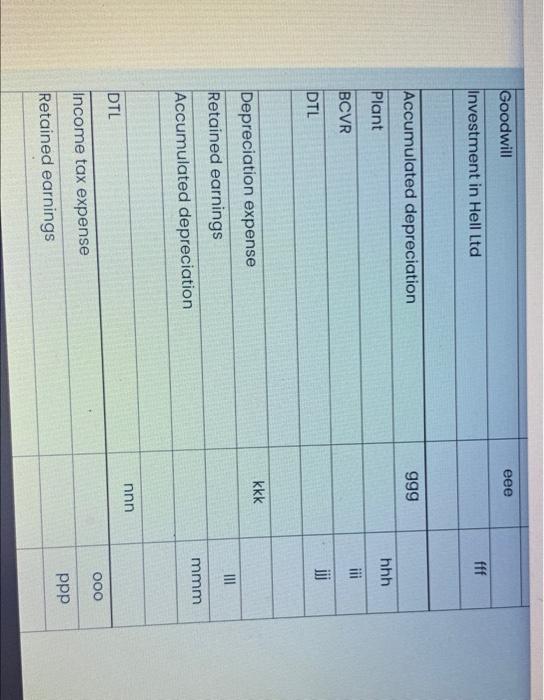

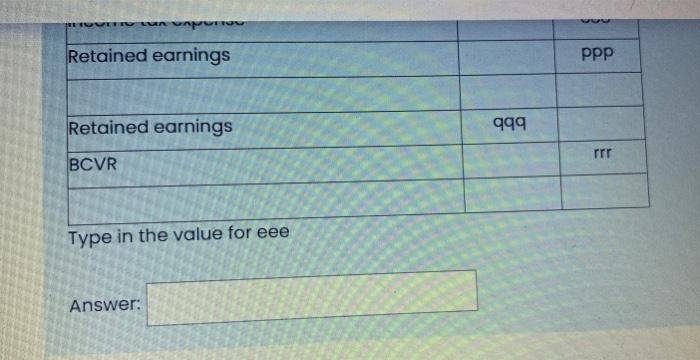

On 1 July 2015 Dog Ltd acquired all the issued shares of Cat Ltd for $240,000. At that date the accounts of Cat Ltd show the following: Share capital $ 80,000 General reserve $ 10,000 Retained earnings $ 30,000 On 1 July 2015 a plant owned by Cat Ltd was undervalued by $70,000. The plant was purchased for $220,000 at 1 July 2012 with estimated useful life of 12 years. Cat Ltd had inventory with carrying amount of $30,000 that is valued at $60,000 on 1 July 2015. The inventory was sold by 30 June 2016. The consolidation adjustment entries at 30 June 2017 are as follows: Debit Credit Share capital aaa General reserve bbb CCC Retained earnings ddd BCVR eee Goodwill fff Investment in Hell Ltd Accumulated depreciation ggg Plant hhh BCVR iii DTL kkk Depreciation expense Retained earnings Accumulated depreciation mmm nnn DTL ooo Income tax expense Retained earnings ppp 999 Retained earnings rrr BCVR Retained earnings 999 BCVR rrr Type in the value for eee Answer: On 1 July 2015 Dog Ltd acquired all the issued shares of Cat Ltd for $240,000. At that date the accounts of Cat Ltd show the following: Share capital $ 80,000 General reserve $ 10,000 Retained earnings $ 30,000 On1 July 2015 a plant owned by Cat Ltd was undervalued by $70,000. The plant was purchased for $220,000 at 1 July 2012 with estimated useful life of 12 years. Cat Ltd had inventory with carrying amount of $30,000 that is valued at $60,000 on 1 July 2015. The inventory was sold by 30 June 2016. The consolidation adjustment entries at 30 June 2017 are as follows: Debit Credit aaa Share capital bbb General reserve CCC Retained earnings ddd BCVR eee Goodwill ELE Goodwill eee Investment in Hell Ltd fff Accumulated depreciation ggg hhh Plant iii BCVR DTL kkk III Depreciation expense Retained earnings Accumulated depreciation mmm nnn DTL Ooo Income tax expense Retained earnings ppp LUA VAM Retained earnings PPP Retained earnings 999 rrr BCVR Type in the value for eee Answer: On 1 July 2015 Dog Ltd acquired all the issued shares of Cat Ltd for $240,000. At that date the accounts of Cat Ltd show the following: Share capital $ 80,000 General reserve $ 10,000 Retained earnings $ 30,000 On 1 July 2015 a plant owned by Cat Ltd was undervalued by $70,000. The plant was purchased for $220,000 at 1 July 2012 with estimated useful life of 12 years. Cat Ltd had inventory with carrying amount of $30,000 that is valued at $60,000 on 1 July 2015. The inventory was sold by 30 June 2016. The consolidation adjustment entries at 30 June 2017 are as follows: Debit Credit Share capital aaa General reserve bbb CCC Retained earnings ddd BCVR eee Goodwill fff Investment in Hell Ltd Accumulated depreciation ggg Plant hhh BCVR iii DTL kkk Depreciation expense Retained earnings Accumulated depreciation mmm nnn DTL ooo Income tax expense Retained earnings ppp 999 Retained earnings rrr BCVR Retained earnings 999 BCVR rrr Type in the value for eee Answer: On 1 July 2015 Dog Ltd acquired all the issued shares of Cat Ltd for $240,000. At that date the accounts of Cat Ltd show the following: Share capital $ 80,000 General reserve $ 10,000 Retained earnings $ 30,000 On1 July 2015 a plant owned by Cat Ltd was undervalued by $70,000. The plant was purchased for $220,000 at 1 July 2012 with estimated useful life of 12 years. Cat Ltd had inventory with carrying amount of $30,000 that is valued at $60,000 on 1 July 2015. The inventory was sold by 30 June 2016. The consolidation adjustment entries at 30 June 2017 are as follows: Debit Credit aaa Share capital bbb General reserve CCC Retained earnings ddd BCVR eee Goodwill ELE Goodwill eee Investment in Hell Ltd fff Accumulated depreciation ggg hhh Plant iii BCVR DTL kkk III Depreciation expense Retained earnings Accumulated depreciation mmm nnn DTL Ooo Income tax expense Retained earnings ppp LUA VAM Retained earnings PPP Retained earnings 999 rrr BCVR Type in the value for eee