Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 July 2015, Zack Ltd acquired all the issued shares (ex div.) of William Ltd for $227 500. At this date the equity

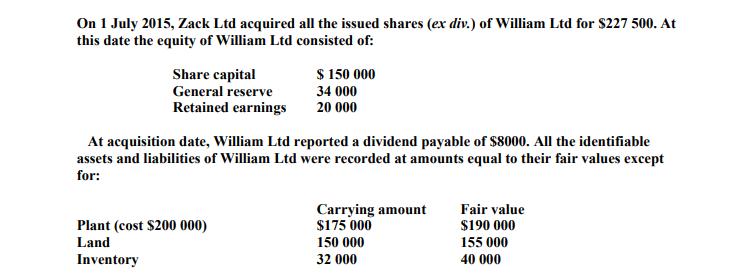

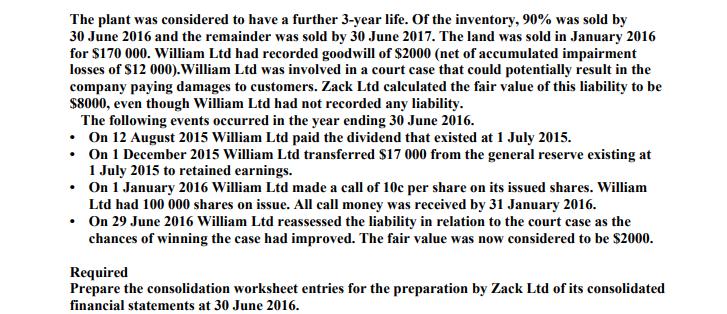

On 1 July 2015, Zack Ltd acquired all the issued shares (ex div.) of William Ltd for $227 500. At this date the equity of William Ltd consisted of: Share capital General reserve Retained earnings $ 150 000 34 000 20 000 At acquisition date, William Ltd reported a dividend payable of $8000. All the identifiable assets and liabilities of William Ltd were recorded at amounts equal to their fair values except for: Plant (cost $200 000) Land Inventory Carrying amount $175 000 150 000 32 000 Fair value $190 000 155 000 40 000 The plant was considered to have a further 3-year life. Of the inventory, 90% was sold by 30 June 2016 and the remainder was sold by 30 June 2017. The land was sold in January 2016 for $170 000. William Ltd had recorded goodwill of $2000 (net of accumulated impairment losses of $12 000). William Ltd was involved in a court case that could potentially result in the company paying damages to customers. Zack Ltd calculated the fair value of this liability to be $8000, even though William Ltd had not recorded any liability. The following events occurred in the year ending 30 June 2016. On 12 August 2015 William Ltd paid the dividend that existed at 1 July 2015. On 1 December 2015 William Ltd transferred $17 000 from the general reserve existing at 1 July 2015 to retained earnings. On 1 January 2016 William Ltd made a call of 10c per share on its issued shares. William Ltd had 100 000 shares on issue. All call money was received by 31 January 2016. . On 29 June 2016 William Ltd reassessed the liability in relation to the court case as the chances of winning the case had improved. The fair value was now considered to be $2000. Required Prepare the consolidation worksheet entries for the preparation by Zack Ltd of its consolidated financial statements at 30 June 2016.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here arethe consolidation worksheet entries for the preparation by Zack Ltd of its consolidated fina...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started