Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 July 2017, Butternut Ltd acquired all of the assets and liabilities of Pumpkin Ltd. At this date the statement of financial position

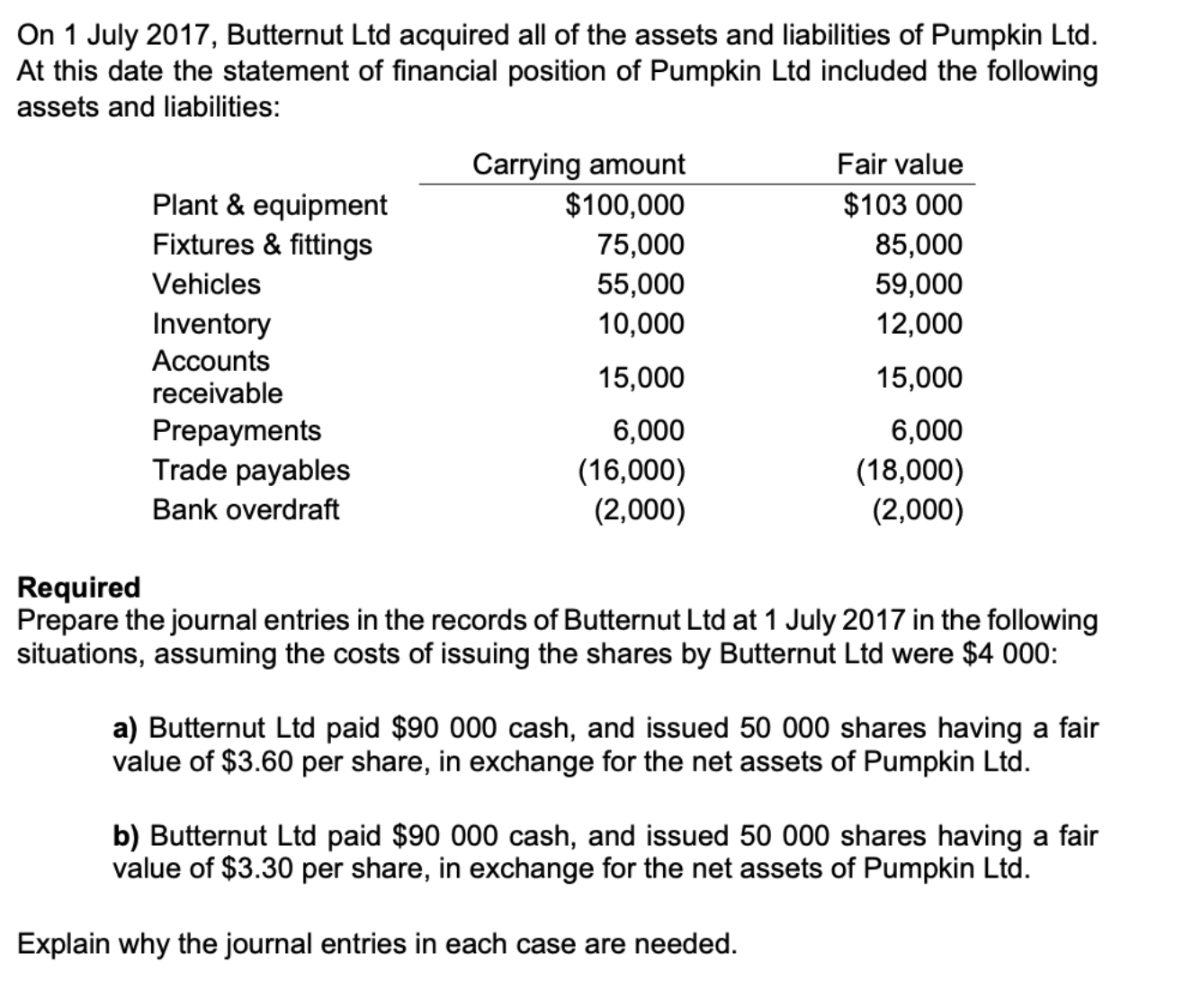

On 1 July 2017, Butternut Ltd acquired all of the assets and liabilities of Pumpkin Ltd. At this date the statement of financial position of Pumpkin Ltd included the following assets and liabilities: Carrying amount Fair value Plant & equipment $100,000 $103 000 Fixtures & fittings 75,000 85,000 Vehicles 55,000 59,000 Inventory 10,000 12,000 Accounts 15,000 15,000 receivable Prepayments 6,000 6,000 Trade payables (16,000) (18,000) Bank overdraft (2,000) (2,000) Required Prepare the journal entries in the records of Butternut Ltd at 1 July 2017 in the following situations, assuming the costs of issuing the shares by Butternut Ltd were $4 000: a) Butternut Ltd paid $90 000 cash, and issued 50 000 shares having a fair value of $3.60 per share, in exchange for the net assets of Pumpkin Ltd. b) Butternut Ltd paid $90 000 cash, and issued 50 000 shares having a fair value of $3.30 per share, in exchange for the net assets of Pumpkin Ltd. Explain why the journal entries in each case are needed.

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a Butternut Ltd paid 90000 cash and issued 50000 shares having a fair value of 360 per share in exchange for the net assets of Pumpkin Ltd Net fair va...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started