Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 July 2017, Doreen Ltd acquired control over Milgate Ltd by acquiring 80% of the shares of Milgate for $9,000. On the date

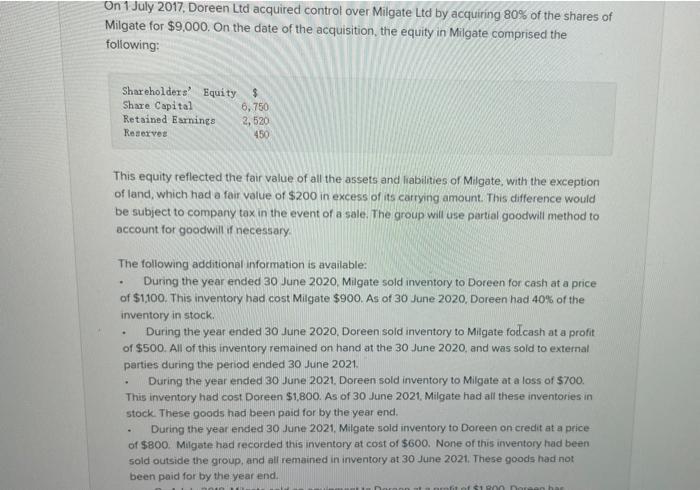

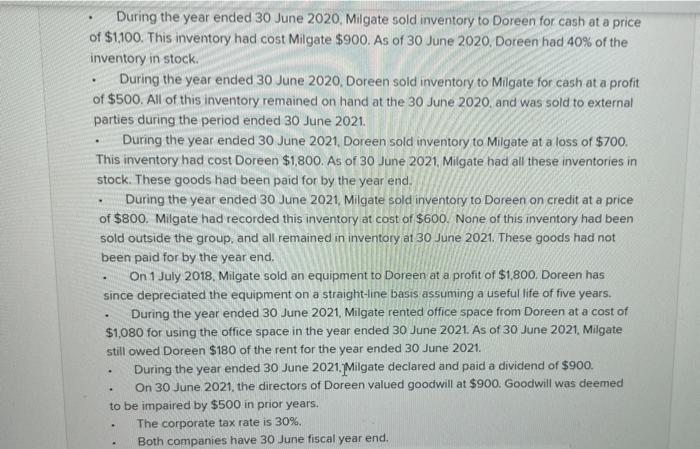

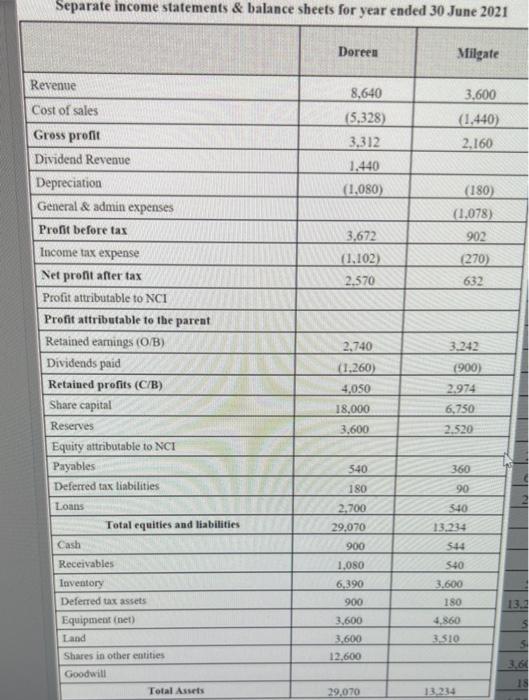

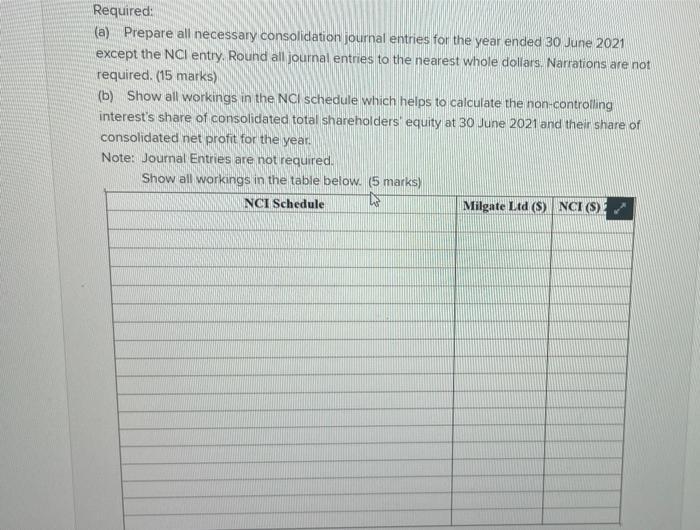

On 1 July 2017, Doreen Ltd acquired control over Milgate Ltd by acquiring 80% of the shares of Milgate for $9,000. On the date of the acquisition, the equity in Milgate comprised the following: Shareholders' Equity $ 6,750 2,520 450 Share Capital Retained Earnings Reserves This equity reflected the fair value of all the assets and liabilities of Milgate, with the exception of land, which had a fair value of $200 in excess of its carrying amount. This difference would be subject to company tax in the event of a sale. The group will use partial goodwill method to account for goodwill if necessary. The following additional information is available: During the year ended 30 June 2020, Milgate sold inventory to Doreen for cash at a price. of $1,100. This inventory had cost Milgate $900. As of 30 June 2020, Doreen had 40% of the inventory in stock. During the year ended 30 June 2020, Doreen sold inventory to Milgate fodcash at a profit of $500. All of this inventory remained on hand at the 30 June 2020, and was sold to external parties during the period ended 30 June 2021. . During the year ended 30 June 2021, Doreen sold inventory to Milgate at a loss of $700. This inventory had cost Doreen $1,800. As of 30 June 2021, Milgate had all these inventories in stock. These goods had been paid for by the year end. During the year ended 30 June 2021, Milgate sold inventory to Doreen on credit at a price of $800. Milgate had recorded this inventory at cost of $600. None of this inventory had been sold outside the group, and all remained in inventory at 30 June 2021. These goods had not been paid for by the year end. $1900 Doreen bas During the year ended 30 June 2020, Milgate sold inventory to Doreen for cash at a price of $1,100. This inventory had cost Milgate $900. As of 30 June 2020, Doreen had 40% of the inventory in stock. . During the year ended 30 June 2020, Doreen sold inventory to Milgate for cash at a profit of $500. All of this inventory remained on hand at the 30 June 2020, and was sold to external parties during the period ended 30 June 2021. During the year ended 30 June 2021, Doreen sold inventory to Milgate at a loss of $700. This inventory had cost Doreen $1,800. As of 30 June 2021, Milgate had all these inventories in stock. These goods had been paid for by the year end. During the year ended 30 June 2021, Milgate sold inventory to Doreen on credit at a price of $800. Milgate had recorded this inventory at cost of $600. None of this inventory had been sold outside the group, and all remained in inventory at 30 June 2021. These goods had not been paid for by the year end. On 1 July 2018, Milgate sold an equipment to Doreen at a profit of $1,800. Doreen has since depreciated the equipment on a straight-line basis assuming a useful life of five years. During the year ended 30 June 2021, Milgate rented office space from Doreen at a cost of $1,080 for using the office space in the year ended 30 June 2021. As of 30 June 2021, Milgate still owed Doreen $180 of the rent for the year ended 30 June 2021. During the year ended 30 June 2021. Milgate declared and paid a dividend of $900. On 30 June 2021, the directors of Doreen valued goodwill at $900. Goodwill was deemed to be impaired by $500 in prior years. The corporate tax rate is 30%. Both companies have 30 June fiscal year end. . . . . . . . Separate income statements & balance sheets for year ended 30 June 2021 Revenue Cost of sales Gross profit Dividend Revenue Depreciation General & admin expenses Profit before tax Income tax expense Net profit after tax Profit attributable to NCI Profit attributable to the parent Retained earnings (O/B) Dividends paid Retained profits (C/B) Share capital Reserves Equity attributable to NCI Payables Deferred tax liabilities Loans Cash Total equities and liabilities Receivables Inventory Deferred tax assets Equipment (net) Land Shares in other entities Goodwill Total Assets Doreen 8,640 (5.328) 3,312 1.440 (1.080) 3,672 (1,102) 2,570 2,740 (1,260) 4,050 18,000 3,600 540 180 2,700 29,070 900 1,080 6,390 900 3,600 3,600 12,600 29,070 Milgate 3,600 (1.440) 2,160 (180) (1.078) 902 3.242 (900) (270) 632 2.974 6,750 2,520 360 90 13,234 540 13,234 544 540 3.600 180 4,860 3.510 13.2 5 3,64 18 Required: (a) Prepare all necessary consolidation journal entries for the year ended 30 June 2021 except the NCI entry. Round all journal entries to the nearest whole dollars. Narrations are not required. (15 marks) (b) Show all workings in the NCI schedule which helps to calculate the non-controlling interest's share of consolidated total shareholders' equity at 30 June 2021 and their share of consolidated net profit for the year. Note: Journal Entries are not required. Show all workings in the table below. (5 marks) NCI Schedule Milgate Ltd (S) NCI (S)

Step by Step Solution

★★★★★

3.63 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To prepare the necessary consolidation journal entries for the year ended 30 June 2021 we need to consider the following transactions and adj...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started