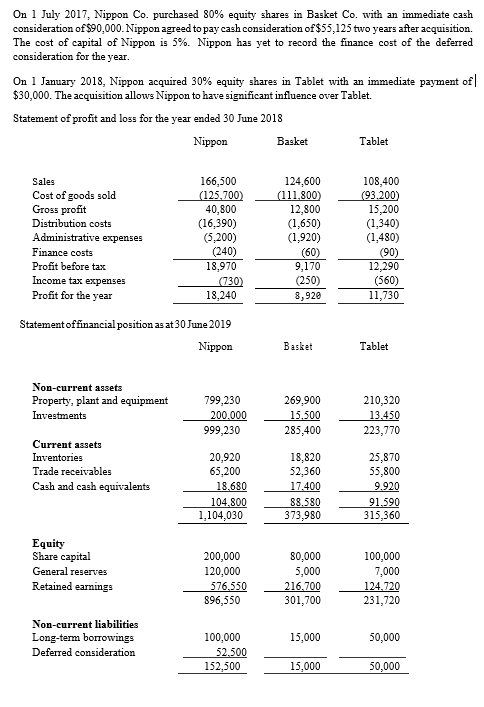

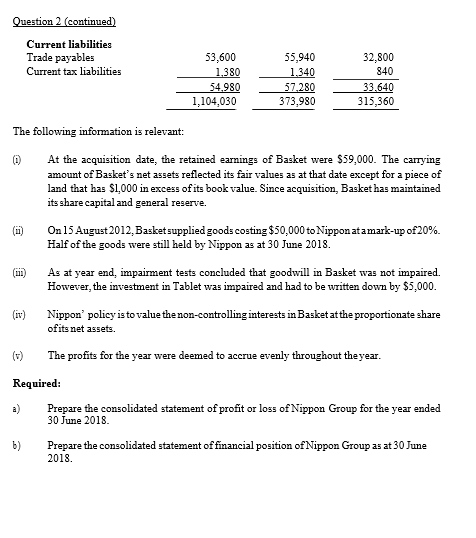

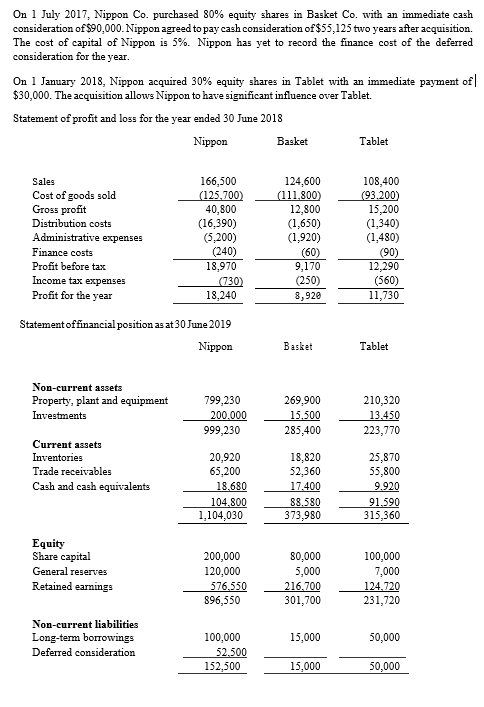

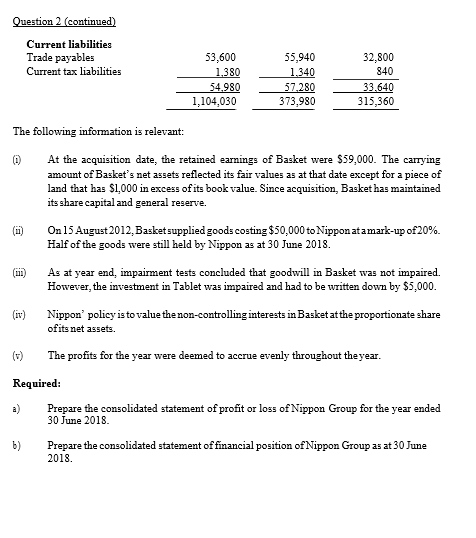

On 1 July 2017, Nippon Co. purchased 80% equity shares in Basket Co. with an immediate cash consideration of $90,000. Nippon agreed to pay cash consideration of$55,125 two years after acquisition. The cost of capital of Nippon is 5%. Nippon has yet to record the finance cost of the deferred consideration for the year. On 1 January 2018, Nippon acquired 30% equity shares in Tablet with an immediate payment of| $30,000. The acquisition allows Nippon to have significant influence over Tablet. Statement of profit and loss for the year ended 30 June 2018 Nippon Basket Tablet Sales Cost of goods sold Gross profit Distribution costs Administrative expenses Finance costs Profit before tax Income tax expenses Profit for the year 166,500 (125.700) 40,800 (16,390) (5,200) (240) 18,970 (730) 18,240 124,600 (111,800 12,800 (1,650) (1,920) (60) 9,170 (250) 8,92 108,400 (93.200 15,200 (1,340) (1,480) (90) 12,290 (560) 11,730 Statement offinancial position as at 30 June 2019 Nippon Basket Tablet Non-current assets Property, plant and equipment Investments 799,230 200.000 999,230 269,900 15.500 285,400 210,320 13,450 223,770 Current assets Inventories Trade receivables Cash and cash equivalents 20,920 65,200 18.680 104,800 1,104,030 18,820 52,360 17.400 88.580 373,980 25,870 55,800 9.920 91,590 315,360 Equity Share capital General reserves Retained earnings 200,000 120,000 576.550 896,550 80,000 5,000 216.700 301,700 100,000 7,000 124.720 231,720 Non-current liabilities Long-term borrowings Deferred consideration 15,000 50,000 100,000 52.500 152,500 15,000 50,000 Question 2 (continued) Current liabilities Trade payables Current tax liabilities 53,600 1.380 54.980 1,104,030 55,940 1.340 57,280 373,980 32,800 840 33.640 315,360 The following information is relevant: 1) At the acquisition date, the retained earnings of Basket were $59,000. The carrying amount of Basket's net assets reflected its fair values as at that date except for a piece of land that has $1,000 in excess of its book value. Since acquisition, Basket has maintained its share capital and general reserve. On 15 August 2012, Basket supplied goods costing $50,000 to Nippon atamark-up of 20%. Half of the goods were still held by Nippon as at 30 June 2018. As at year end, impairment tests concluded that goodwill in Basket was not impaired. However, the investment in Tablet was impaired and had to be written down by $5,000. (iv) Nippon policy is to value the non-controlling interests in Basket at the proportionate share ofits net assets. (v) The profits for the year were deemed to accrue evenly throughout the year. Required: Prepare the consolidated statement of profit or loss of Nippon Group for the year ended 30 June 2018 b) Prepare the consolidated statement of financial position of Nippon Group as at 30 June 2018