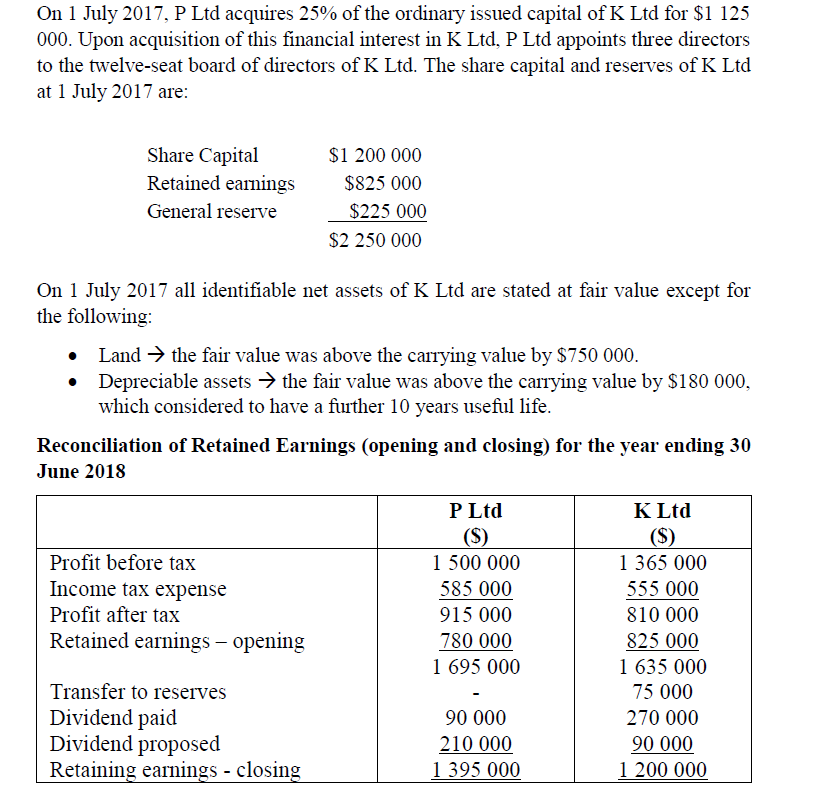

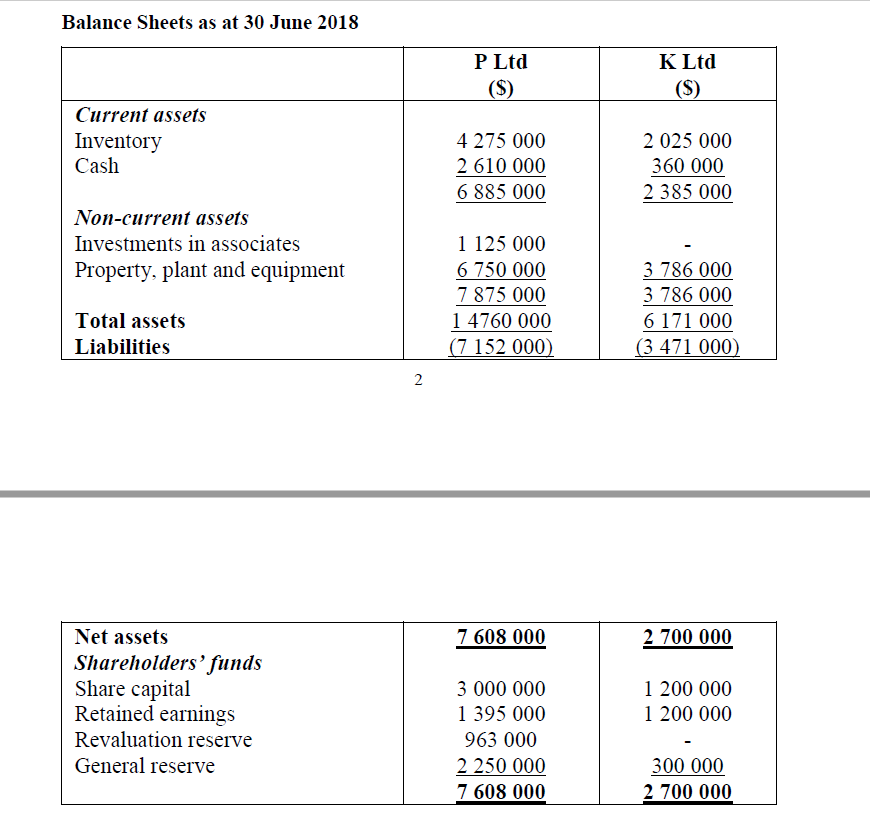

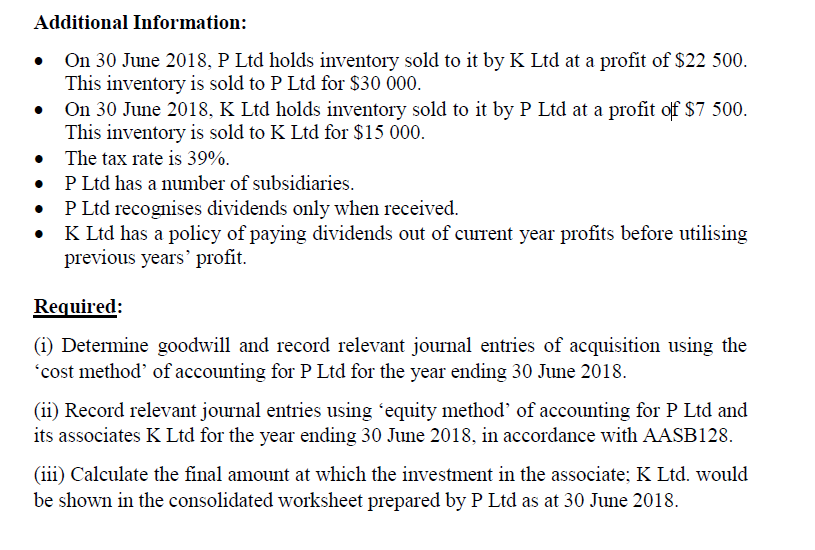

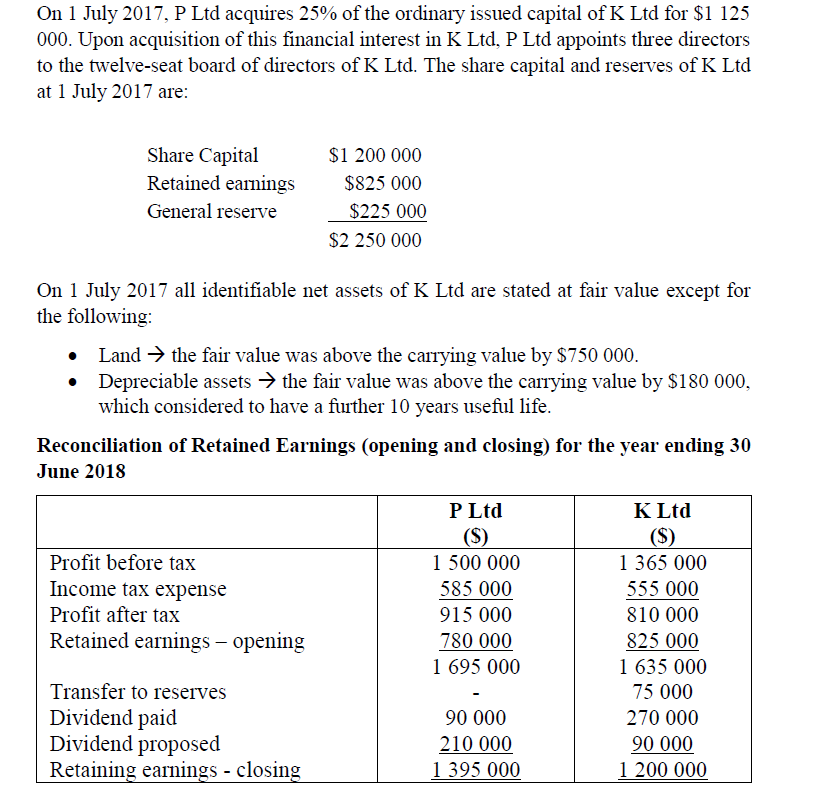

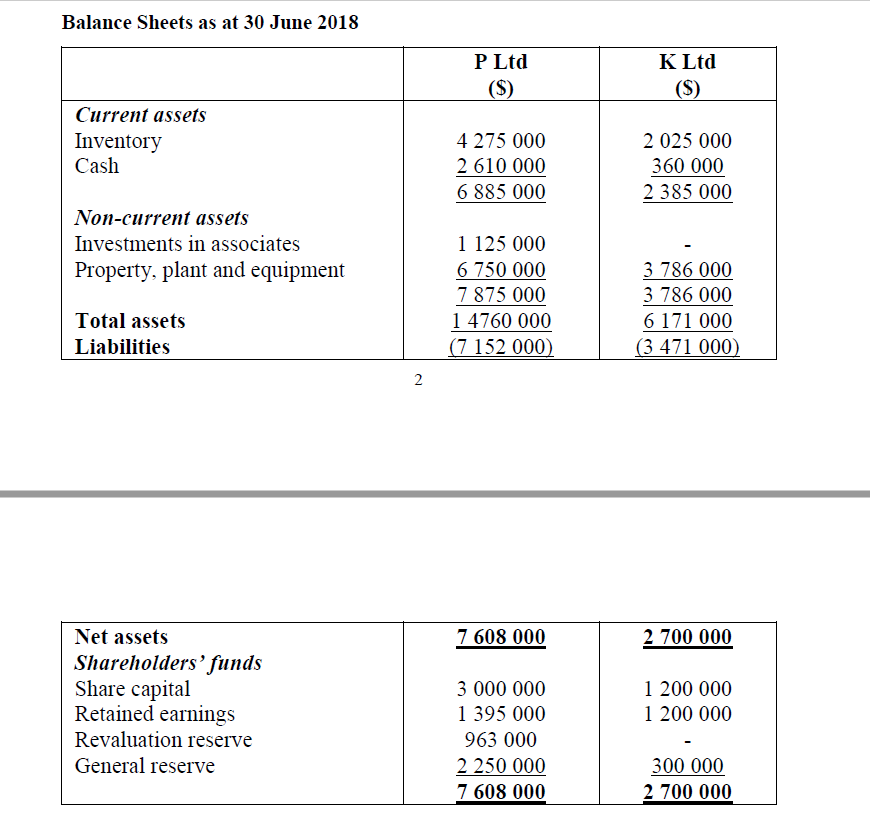

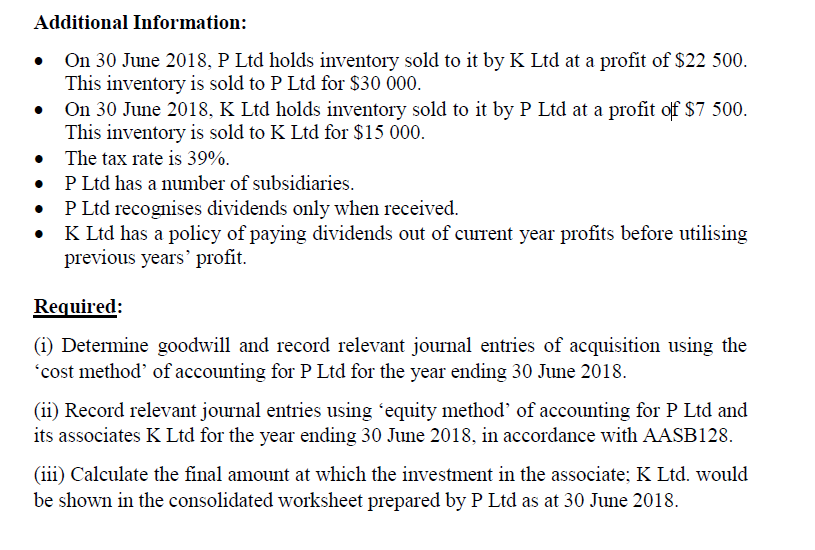

On 1 July 2017, P Ltd acquires 25% of the ordinary issued capital of K Ltd for $1 125 000. Upon acquisition of this financial interest in K Ltd, P Ltd appoints three directors to the twelve-seat board of directors of K Ltd. The share capital and reserves of K Ltd at 1 July 2017 are: Share Capital Retained earnings General reserve $1 200 000 $825 000 $225 000 $2 250 000 On 1 July 2017 all identifiable net assets of K Ltd are stated at fair value except for the following: Land the fair value was above the carrying value by $750 000. Depreciable assets the fair value was above the carrying value by $180 000, which considered to have a further 10 years useful life. Reconciliation of Retained Earnings (opening and closing) for the year ending 30 June 2018 Profit before tax Income tax expense Profit after tax Retained earnings - opening P Ltd (S) 1 500 000 585 000 915 000 780 000 1 695 000 K Ltd (S) 1 365 000 555 000 810 000 825 000 1 635 000 75 000 270 000 90 000 1 200 000 Transfer to reserves Dividend paid Dividend proposed Retaining earnings - closing 90 000 210 000 1 395 000 Balance Sheets as at 30 June 2018 P Ltd ($) K Ltd (S) Current assets Inventory Cash 4 275 000 2610 000 6 885 000 2 025 000 360 000 2 385 000 Non-current assets Investments in associates Property, plant and equipment 1 125 000 6 750 000 7 875 000 1 4760 000 (7 152 000) 3 786 000 3 786 000 6 171 000 (3 471 000 Total assets Liabilities 2 7 608 000 2 700 000 Net assets Shareholders'funds Share capital Retained earnings Revaluation reserve General reserve 1 200 000 1 200 000 3 000 000 1 395 000 963 000 2 250 000 7 608 000 300 000 2 700 000 Additional Information: On 30 June 2018, P Ltd holds inventory sold to it by K Ltd at a profit of $22 500. This inventory is sold to P Ltd for $30 000. On 30 June 2018, K Ltd holds inventory sold to it by P Ltd at a profit of $7 500. This inventory is sold to K Ltd for $15 000. The tax rate is 39%. P Ltd has a number of subsidiaries. P Ltd recognises dividends only when received. K Ltd has a policy of paying dividends out of current year profits before utilising previous years' profit. Required: (1) Determine goodwill and record relevant journal entries of acquisition using the cost method of accounting for P Ltd for the year ending 30 June 2018. (ii) Record relevant journal entries using equity method of accounting for P Ltd and its associates K Ltd for the year ending 30 June 2018, in accordance with AASB128. (iii) Calculate the final amount at which the investment in the associate; K Ltd. would be shown in the consolidated worksheet prepared by P Ltd as at 30 June 2018