Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 July 2018, Mallee Ltd acquired all of the issued shares (cum div.) of Fowl Ltd. At this date, the equity of Fowl

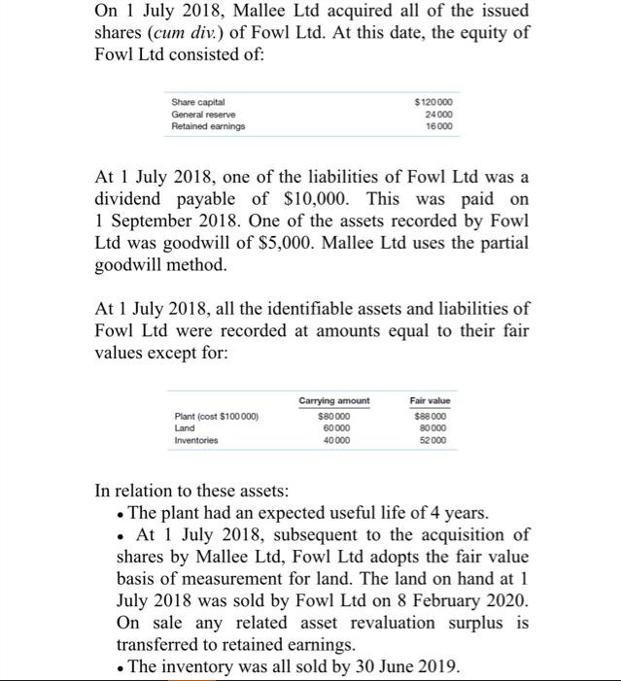

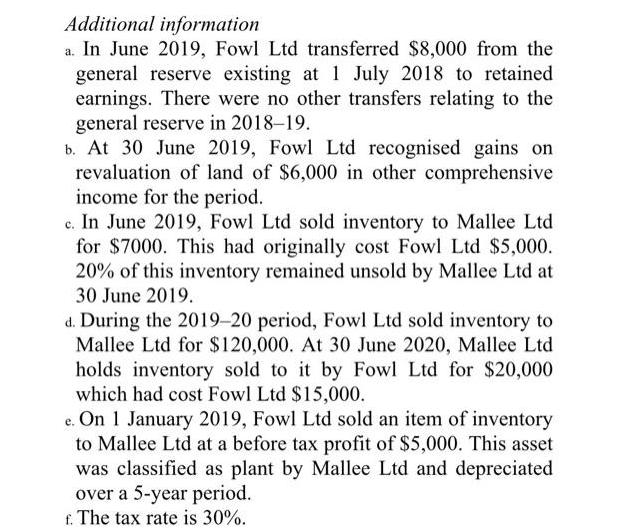

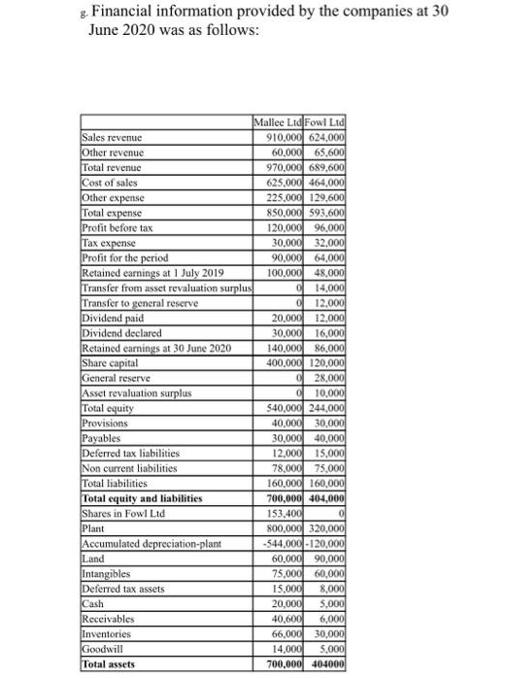

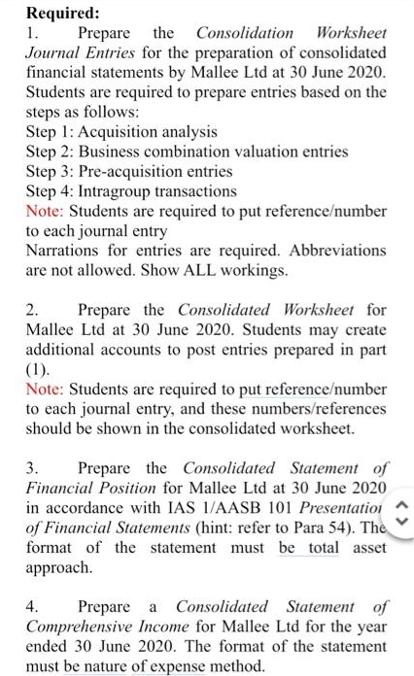

On 1 July 2018, Mallee Ltd acquired all of the issued shares (cum div.) of Fowl Ltd. At this date, the equity of Fowl Ltd consisted of: Share capital General reserve Retained earnings At 1 July 2018, one of the liabilities of Fowl Ltd was a dividend payable of $10,000. This was paid on 1 September 2018. One of the assets recorded by Fowl Ltd was goodwill of $5,000. Mallee Ltd uses the partial goodwill method. $120000 24000 16000 At 1 July 2018, all the identifiable assets and liabilities of Fowl Ltd were recorded at amounts equal to their fair values except for: Plant (cost $100.000) Land Inventories Carrying amount $80000 60000 40000 Fair value $88.000 80000 52000 In relation to these assets: The plant had an expected useful life of 4 years. . At 1 July 2018, subsequent to the acquisition of shares by Mallee Ltd, Fowl Ltd adopts the fair value basis of measurement for land. The land on hand at 1 July 2018 was sold by Fowl Ltd on 8 February 2020. On sale any related asset revaluation surplus is transferred to retained earnings. The inventory was all sold by 30 June 2019. Additional information a. In June 2019, Fowl Ltd transferred $8,000 from the general reserve existing at 1 July 2018 to retained earnings. There were no other transfers relating to the general reserve in 2018-19. b. At 30 June 2019, Fowl Ltd recognised gains on revaluation of land of $6,000 in other comprehensive income for the period. c. In June 2019, Fowl Ltd sold inventory to Mallee Ltd for $7000. This had originally cost Fowl Ltd $5,000. 20% of this inventory remained unsold by Mallee Ltd at 30 June 2019. d. During the 2019-20 period, Fowl Ltd sold inventory to Mallee Ltd for $120,000. At 30 June 2020, Mallee Ltd. holds inventory sold to it by Fowl Ltd for $20,000 which had cost Fowl Ltd $15,000. e. On 1 January 2019, Fowl Ltd sold an item of inventory to Mallee Ltd at a before tax profit of $5,000. This asset was classified as plant by Mallee Ltd and depreciated over a 5-year period. f. The tax rate is 30%. 8. Financial information provided by the companies at 30 June 2020 was as follows: Sales revenue Other revenue Total revenue Cost of sales Other expense Total expense Profit before tax Tax expense Profit for the period Retained earnings at 1 July 2019 Transfer from asset revaluation surplus Transfer to general reserve Dividend paid Dividend declared Retained earnings at 30 June 2020 Share capital General reserve Asset revaluation surplus Total equity Provisions Payables Deferred tax liabilities Non current liabilities Total liabilities Total equity and liabilities Shares in Fowl Ltd Plant Accumulated depreciation-plant Land Intangibles Deferred tax assets Cash Mallee Lid Fowl Ltd 910,000 624,000 60,000 65,600 970,000 689,600 625,000 464,000 225,000 129,600 850,000 593,600 Receivables Inventories Goodwill Total assets 120,000 96,000 30,000 32,000 90,000 64,000 100,000 48,000 0 0 14,000 12,000 20,000 12,000 30,000 16,000 140,000 86,000 400,000 120,000 28,000 0 0 10,000 540,000 244,000 40,000 30,000 30,000 40,000 12,000 15,000 78,000 75,000 160,000 160,000 700,000 404,000 153,400 0 800,000 320,000 -544,000-120,000 60,000 90,000 75,000 60,000 15,000 8,000 20,000 5,000 40,600 6,000 66,000 30,000 14,000 5,000 700,000 404000 Required: 1. Prepare the Consolidation Worksheet Journal Entries for the preparation of consolidated financial statements by Mallee Ltd at 30 June 2020. Students are required to prepare entries based on the steps as follows: Step 1: Acquisition analysis Step 2: Business combination valuation entries Step 3: Pre-acquisition entries Step 4: Intragroup transactions Note: Students are required to put reference/number to each journal entry Narrations for entries are required. Abbreviations are not allowed. Show ALL workings. 2. Prepare the Consolidated Worksheet for Mallee Ltd at 30 June 2020. Students may create additional accounts to post entries prepared in part (1). Note: Students are required to put reference/number to each journal entry, and these numbers/references should be shown in the consolidated worksheet. 3. Prepare the Consolidated Statement of Financial Position for Mallee Ltd at 30 June 2020 in accordance with IAS 1/AASB 101 Presentation of Financial Statements (hint: refer to Para 54). The format of the statement must be total asset approach. Prepare a Consolidated Statement of Comprehensive Income for Mallee Ltd for the year ended 30 June 2020. The format of the statement must be nature of expense method. 4.

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 Consolidation Worksheet Journal Entries Step 1 Acquisition Analysis Journal Entry JE 1 Record the Acquisition of Fowl Ltd by Mallee Ltd Account Debit DR Credit CR Investment in Fowl Ltd 400000 Cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started