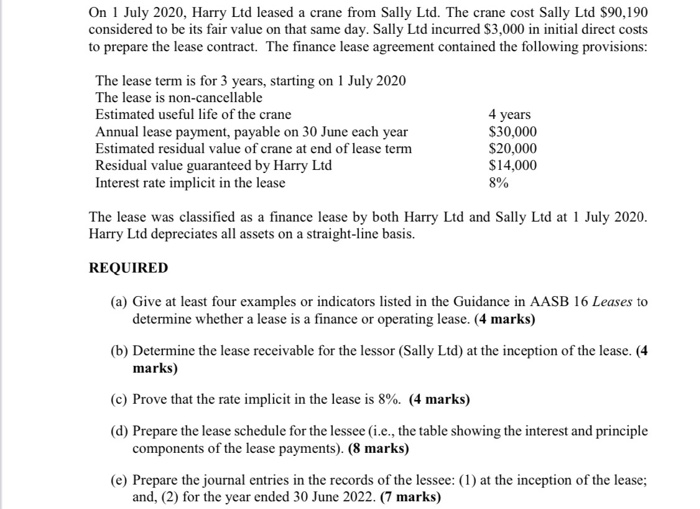

On 1 July 2020, Harry Ltd leased a crane from Sally Ltd. The crane cost Sally Ltd $90,190 considered to be its fair value on that same day. Sally Ltd incurred $3,000 in initial direct costs to prepare the lease contract. The finance lease agreement contained the following provisions: The lease term is for 3 years, starting on 1 July 2020 The lease is non-cancellable Estimated useful life of the crane 4 years Annual lease payment, payable on 30 June each year $30,000 Estimated residual value of crane at end of lease term $20,000 Residual value guaranteed by Harry Ltd $14,000 Interest rate implicit in the lease 8% The lease was classified as a finance lease by both Harry Ltd and Sally Ltd at 1 July 2020. Harry Ltd depreciates all assets on a straight-line basis. REQUIRED (a) Give at least four examples or indicators listed in the Guidance in AASB 16 Leases to determine whether a lease is a finance or operating lease. (4 marks) (b) Determine the lease receivable for the lessor (Sally Ltd) at the inception of the lease. (4 marks) (c) Prove that the rate implicit in the lease is 8%. (4 marks) (d) Prepare the lease schedule for the lessee (i.e., the table showing the interest and principle components of the lease payments). (8 marks) (e) Prepare the journal entries in the records of the lessee: (1) at the inception of the lease; and, (2) for the year ended 30 June 2022. (7 marks) On 1 July 2020, Harry Ltd leased a crane from Sally Ltd. The crane cost Sally Ltd $90,190 considered to be its fair value on that same day. Sally Ltd incurred $3,000 in initial direct costs to prepare the lease contract. The finance lease agreement contained the following provisions: The lease term is for 3 years, starting on 1 July 2020 The lease is non-cancellable Estimated useful life of the crane 4 years Annual lease payment, payable on 30 June each year $30,000 Estimated residual value of crane at end of lease term $20,000 Residual value guaranteed by Harry Ltd $14,000 Interest rate implicit in the lease 8% The lease was classified as a finance lease by both Harry Ltd and Sally Ltd at 1 July 2020. Harry Ltd depreciates all assets on a straight-line basis. REQUIRED (a) Give at least four examples or indicators listed in the Guidance in AASB 16 Leases to determine whether a lease is a finance or operating lease. (4 marks) (b) Determine the lease receivable for the lessor (Sally Ltd) at the inception of the lease. (4 marks) (c) Prove that the rate implicit in the lease is 8%. (4 marks) (d) Prepare the lease schedule for the lessee (i.e., the table showing the interest and principle components of the lease payments). (8 marks) (e) Prepare the journal entries in the records of the lessee: (1) at the inception of the lease; and, (2) for the year ended 30 June 2022. (7 marks)