Answered step by step

Verified Expert Solution

Question

1 Approved Answer

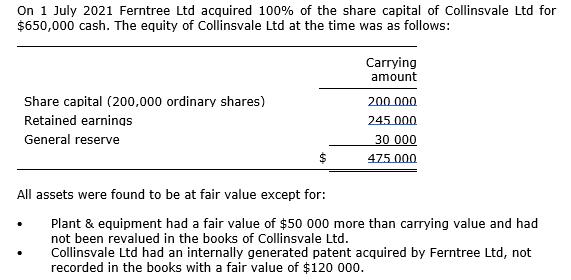

On 1 July 2021 Ferntree Ltd acquired 100% of the share capital of Collinsvale Ltd for $650,000 cash. The equity of Collinsvale Ltd at

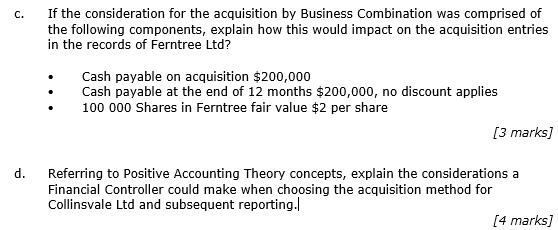

On 1 July 2021 Ferntree Ltd acquired 100% of the share capital of Collinsvale Ltd for $650,000 cash. The equity of Collinsvale Ltd at the time was as follows: Carrying amount Share capital (200,000 ordinary shares) 200.000 Retained earnings 245.000 General reserve 30 000 475.000 All assets were found to be at fair value except for: Plant & equipment had a fair value of $50 000 more than carrying value and had not been revalued in the books of Collinsvale Ltd. Collinsvale Ltd had an internally generated patent acquired by Ferntree Ltd, not recorded in the books with a fair value of $120 000. C. If the consideration for the acquisition by Business Combination was comprised of the following components, explain how this would impact on the acquisition entries in the records of Ferntree Ltd? Cash payable on acquisition $200,000 Cash payable at the end of 12 months $200,000, no discount applies 100 000 Shares in Ferntree fair value $2 per share [3 marks] d. Referring to Positive Accounting Theory concepts, explain the considerations a Financial Controller could make when choosing the acquisition method for Collinsvale Ltd and subsequent reporting. [4 marks]

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

c The acquisition of Collinsvale would be accounted for as follows Cash paid on acquisition 200000 C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started