Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 July 2021, Sheldon Ltd paid $350,000 to purchase 45% of the shares in Amy Ltd. The net assets (at fair value) of

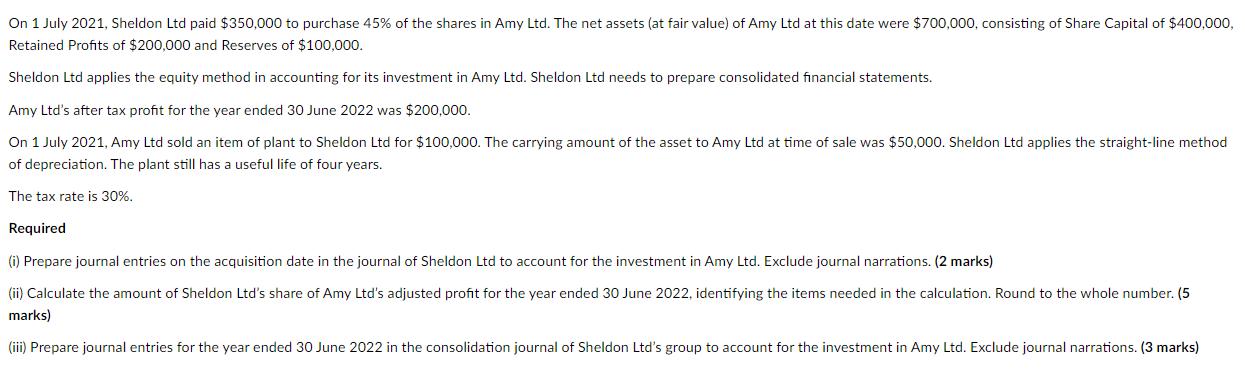

On 1 July 2021, Sheldon Ltd paid $350,000 to purchase 45% of the shares in Amy Ltd. The net assets (at fair value) of Amy Ltd at this date were $700,000, consisting of Share Capital of $400,000, Retained Profits of $200,000 and Reserves of $100,000. Sheldon Ltd applies the equity method in accounting for its investment in Amy Ltd. Sheldon Ltd needs to prepare consolidated financial statements. Amy Ltd's after tax profit for the year ended 30 June 2022 was $200,000. On 1 July 2021, Amy Ltd sold an item of plant to Sheldon Ltd for $100,000. The carrying amount of the asset to Amy Ltd at time of sale was $50,000. Sheldon Ltd applies the straight-line method of depreciation. The plant still has a useful life of four years. The tax rate is 30%. Required (i) Prepare journal entries on the acquisition date in the journal of Sheldon Ltd to account for the investment in Amy Ltd. Exclude journal narrations. (2 marks) (ii) Calculate the amount of Sheldon Ltd's share of Amy Ltd's adjusted profit for the year ended 30 June 2022, identifying the items needed in the calculation. Round to the whole number. (5 marks) (iii) Prepare journal entries for the year ended 30 June 2022 in the consolidation journal of Sheldon Ltd's group to account for the investment in Amy Ltd. Exclude journal narrations. (3 marks)

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

i Journal entries on the acquisition date in the journal of Sheldon Ltd to account for th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started