Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 July 2022 , Sand acquired 80% of the equity share capital of Piper. The consideration was made by a share exchange of two

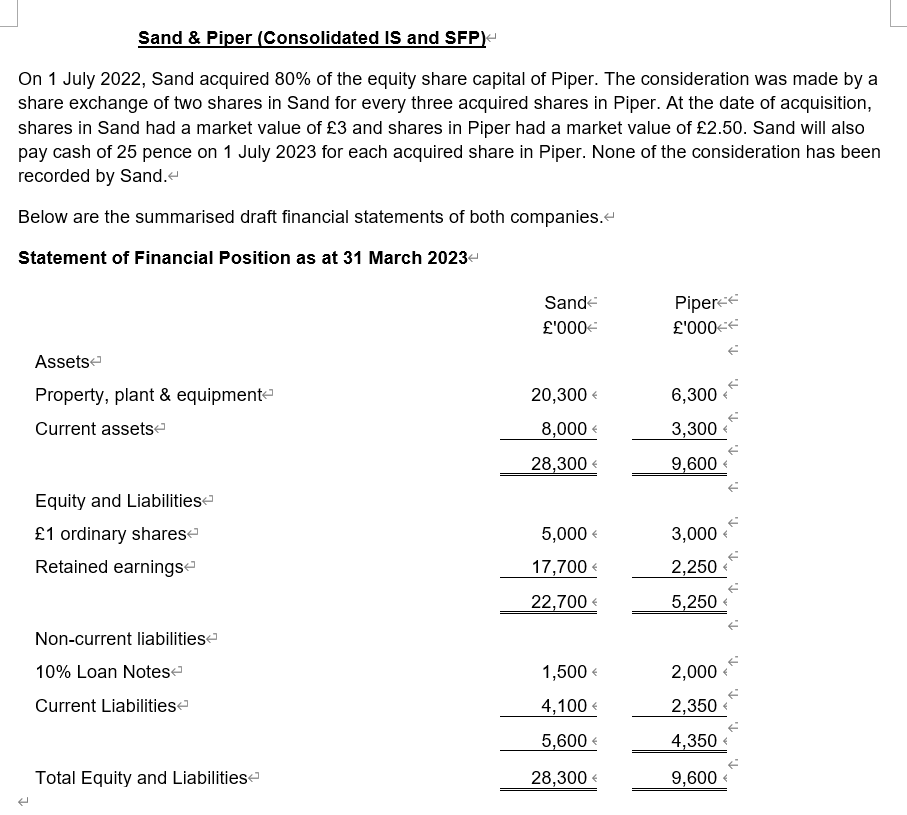

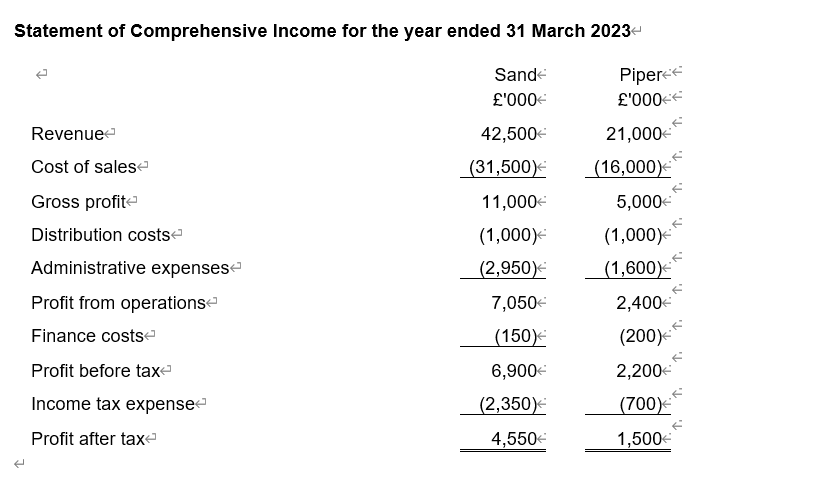

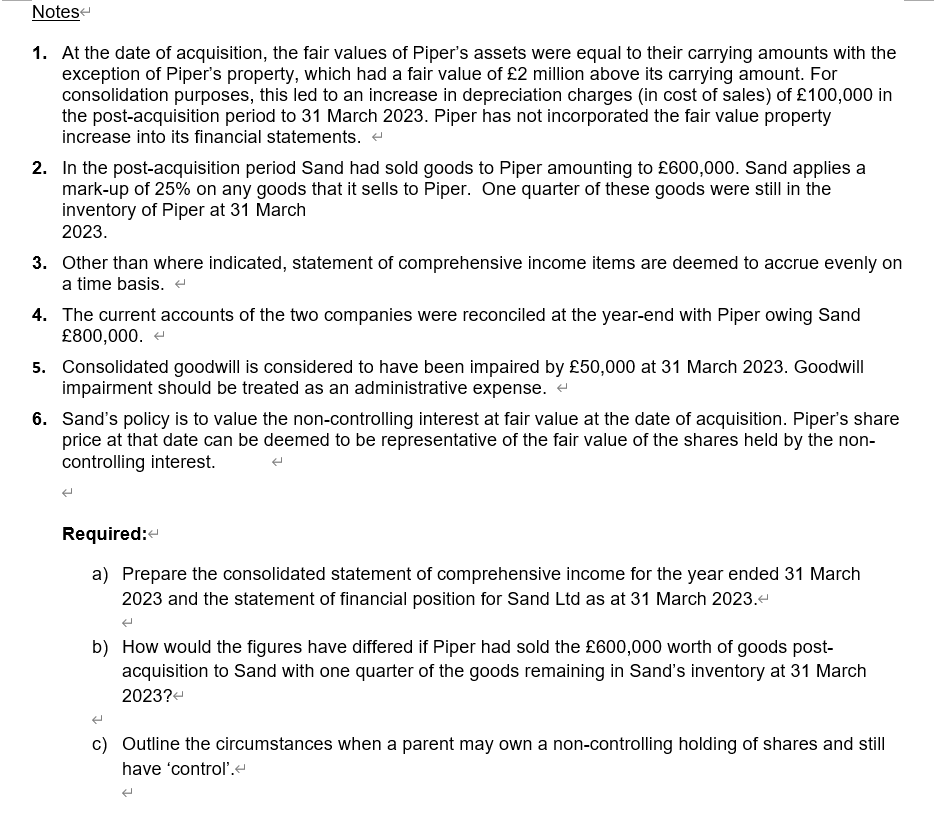

On 1 July 2022 , Sand acquired 80% of the equity share capital of Piper. The consideration was made by a share exchange of two shares in Sand for every three acquired shares in Piper. At the date of acquisition, shares in Sand had a market value of 3 and shares in Piper had a market value of 2.50. Sand will also pay cash of 25 pence on 1 July 2023 for each acquired share in Piper. None of the consideration has been recorded by Sand. Below are the summarised draft financial statements of both companies. Statement of Financial Position as at 31 March 2023 Statement of Comprehensive Income for the year ended 31 March 2023 1. At the date of acquisition, the fair values of Piper's assets were equal to their carrying amounts with the exception of Piper's property, which had a fair value of 2 million above its carrying amount. For consolidation purposes, this led to an increase in depreciation charges (in cost of sales) of 100,000 in the post-acquisition period to 31 March 2023. Piper has not incorporated the fair value property increase into its financial statements. 2. In the post-acquisition period Sand had sold goods to Piper amounting to 600,000. Sand applies a mark-up of 25% on any goods that it sells to Piper. One quarter of these goods were still in the inventory of Piper at 31 March 2023. 3. Other than where indicated, statement of comprehensive income items are deemed to accrue evenly on a time basis. 4. The current accounts of the two companies were reconciled at the year-end with Piper owing Sand 800,000. 5. Consolidated goodwill is considered to have been impaired by 50,000 at 31 March 2023. Goodwill impairment should be treated as an administrative expense. 6. Sand's policy is to value the non-controlling interest at fair value at the date of acquisition. Piper's share price at that date can be deemed to be representative of the fair value of the shares held by the noncontrolling interest. Required: a) Prepare the consolidated statement of comprehensive income for the year ended 31 March 2023 and the statement of financial position for Sand Ltd as at 31 March 2023. b) How would the figures have differed if Piper had sold the 600,000 worth of goods postacquisition to Sand with one quarter of the goods remaining in Sand's inventory at 31 March 2023 ? c) Outline the circumstances when a parent may own a non-controlling holding of shares and still have 'control

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started